September 16, 2022

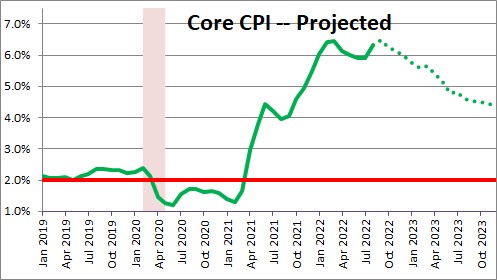

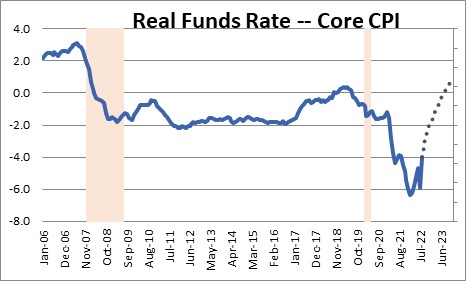

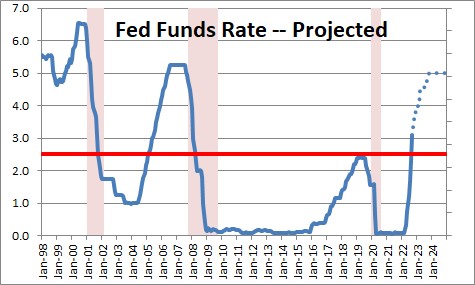

The economy is showing hints of slowing down, but inflation remains stubbornly high. Given that the Fed’s goal is to bring inflation back to the 2.0% mark, nothing that happened last week is enough to convince it that the end of its tightening is in sight. The Fed meets this week and is expected to raise the funds rate by 0.75% which would bring it to 3.0-3.25%. But, unfortunately, that still leaves the real funds rate negative. We learned this past week that the core CPI has risen by 6.3% in the past year which means that even with the new, higher funds rate the real funds rate would be -3.2%. But negative real interest rates are not going to slow the economy enough to shrink inflation to the desired 2.0% pace. As the markets wake up to the fact that the Fed still has work to do, neither stock market nor bond market investors are going to be happy.

The shocker this past week was the unexpectedly big 0.6% jump in the core CPI in August which brings the 12-month increase to 6.3%. It is simply not showing any sign of slowing down.

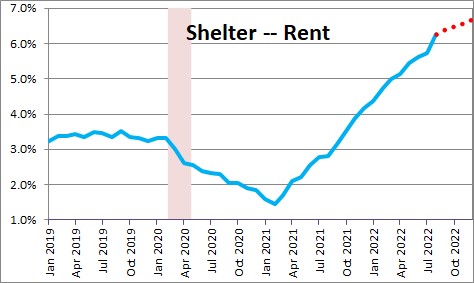

The biggest problem with the CPI is the “shelter” component (or rent) which is accelerating. It has risen 6.3% in the past year, but in the past three months the pace has climbed to 7.4%. It seems to be accelerating rather than slowing down. This is a big deal because the shelter component makes up one-third of the entire CPI index. If one-third of the CPI is going to grow at a 6.3% (or faster) pace for the foreseeable future, how in the world is the overall index going to slow to the 2.0% mark?

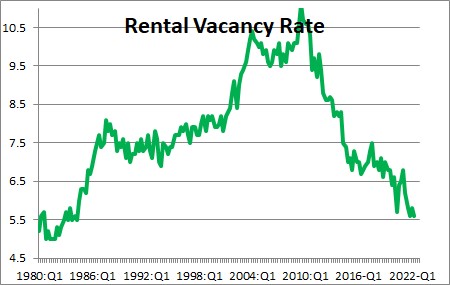

Keep in mind that the vacancy rate amongst rental properties is the lowest it has been since the early 1980’s. We simply do not have enough rental properties available. When demand far exceeds supply, rents rise.

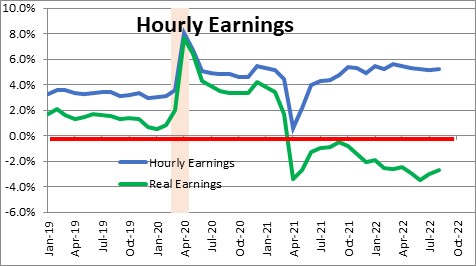

The other big problem with inflation is that real wages are declining. Given the labor shortage, firms are having to find ways to attract workers. To do that they are boosting wages which in the past year have risen 5.2%. But inflation has risen even faster and, as a result, real wages have fallen 2.7%. The purchasing power of a workers paycheck is less than it was a year ago. When that happens individual workers and unions press for even bigger wage hikes. Look what happened with rail workers this past week. They got an immediate wage increase of 14%, 24% over the next five years, and an annual lump sum bonus of $5,000. We got lucky this time and averted a debilitating rail strike, but next time we may not be so fortunate. Do you think other unions haven’t noticed? Wage hikes and bonuses are such a big deal because labor costs represent about two-thirds of any company’s spending. If they go up, the company will try to pass them through to their customers and, right now, they are finding little resistance. They can claim their labor costs have gone up and supply chain problems are boosting their costs of materials. We sympathize with their plight but continue to buy that product despite higher prices.

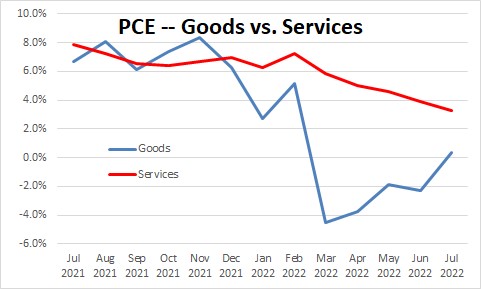

This past week we also learned that retail sales rose 0.3% in August and has risen 9.4% in the past year. But inflation is curtailing consumer purchasing power. In real terms goods spending has risen only 0.4%. But also remember that real consumer spending on goods is only one-third of all consumer spending. Spending on services – the remaining two-thirds of consumer spending – has been zipping along at a steamy 3.3% rate. Consumer spending may be slowing for some products, but it is hardly collapsing.

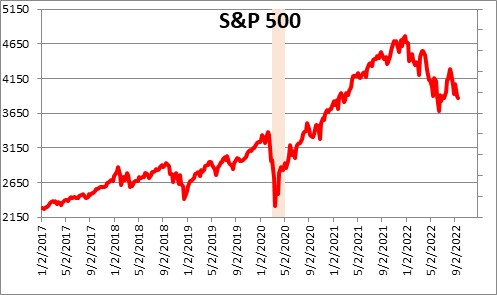

All of the above has made investors nervous. The S&P 500 index has been volatile in recent months as investors ponder the extent to which the economy has slowed and whether inflation might be slowing down. Right now they are not happy and the S&P has fallen 19% from its end of year record high level. Stock investors have reached the conclusion that the Fed still has more work to do. They are right.

We keep focusing on the real funds rate. We think it matters and so does the Fed. In its quarterly forecasts the Fed believes that when inflation is 2.0% a neutral funds rate is 2.5%. Thus, it is seeking a positive real funds rate of +0.5% — a funds rate of 2.5% less 2.0% inflation. If the Fed raises the funds rate by 0.75% this week to 3.1% the real funds rate will be -3.2% (3.1% funds rate less 6.3% core CPI). The funds rate is not yet close to where the Fed thinks it needs to be. This is why the Fed is sounding so tough. The Fed is hoping that the inflation rate slows quickly but, given all the factors noted above, that seems unlikely.

If inflation does not slow quickly, the funds rate may have to climb to a level that nobody seems to be contemplating currently. For what it is worth, we are expecting the funds rate to be 4.0% at the end of this year and 5.0% by the end of 2023.

In our opinion, the current problems were caused by the combination of excessive stimulus ($10.0 trillion when only $2.0 trillion was necessary), and the Fed which misdiagnosed the cause of the run-up in inflation and was, therefore, at least a year late in starting to reverse the direction of its policy. We are now paying the price.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me