August 20, 2021

Each passing week economists and investors find something else to worry about. COVID concerns have been pushed to the forefront as the number of new cases has climbed. That spawns a fear that a renewed lockdown could negatively impact the pace of economic activity. The inflation statistics continue to point towards a much faster than anticipated jump in inflation, but the Fed clings to a belief that the recent run-up largely reflects supply constraints that will eventually disappear. Then there is the issue of the Fed “tapering” its asset purchases. Fed minutes of the July 27-28 meeting suggest that some members would like a gradual reduction in its pace of asset purchases to begin prior to yearend, but that should not be regarded as a foregone conclusion. Other FOMC members fear that the spread of the Delta variant of COVID could slow the pace of economic activity sufficiently that the Fed should not hastily withdraw its financial support. Despite a long list of potential worries, the weekly economic data keep rolling in and highlight the fact that this combination of fears has not yet significantly impacted the pace of economic activity. Is it just a matter of time before that happens? We doubt it.

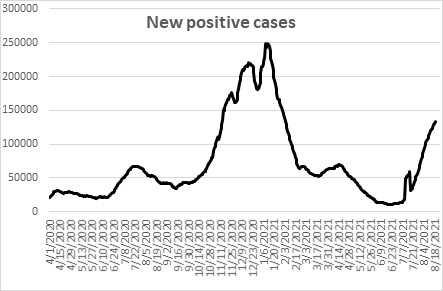

The number of new cases has climbed to about 125 thousand per day and many of them are finding their way into hospitals. But 90% of these hospitalized patients are unvaccinated. There is an obvious solution to that problem.

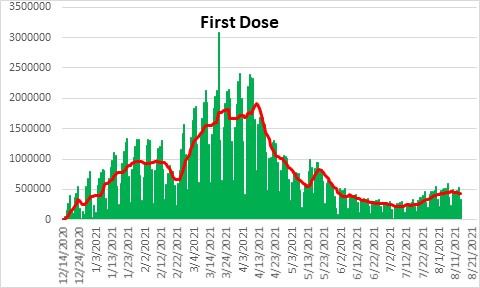

Unfortunately, the number of people receiving their first dose of a vaccine has picked up only slightly. The latest spread statistics have not yet convinced many unvaccinated Americans to change their minds.

Despite these disturbing statistics the flow of weekly data suggest little economic impact through mid-August. The number of people processing through TSA checkpoints has edged lower in the past couple of weeks but that appears to be a normal seasonal event. The number of passengers remains about 80% of its 2019, pre-pandemic, pace and that has changed very little. The missing 20% are, presumably, business travelers who are unlikely to return any time soon.

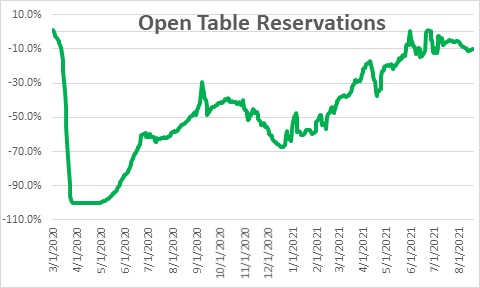

Restaurant reservations through Open Table has edged lower, but is not significantly different from what it was in mid-July before COVID fears began to spread.

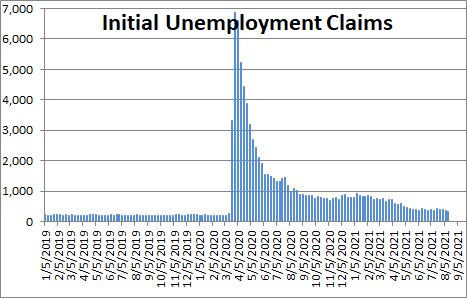

Meanwhile, initial unemployment claims and the number of people receiving unemployment benefits continue to decline, which suggests that the labor shortage is so acute that business leaders are still hiring all qualified applicants.

Given all of the above, we continue to anticipate 8.9% GDP growth in the third quarter. The consensus appears to be for about 7.0% growth. And if some of these supply constraints can be eliminated, we look for GDP growth to quicken to 10.5% in the fourth quarter. So while COVID fears are widespread, consumers and business leaders have not changed their behavior despite having had ample time to do so.

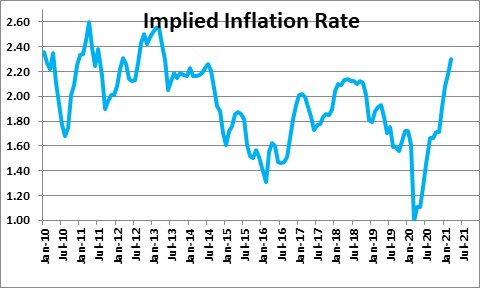

The latest topic of discussion is the Fed’s desire to begin “tapering” its asset purchases. According to the minutes of the July 27-28 meeting the Fed believes it has met its inflation goal of bringing inflation expectations back to or slightly beyond its 2.0% target. The inflation rate implied by the difference between the nominal 10-year U.S. Treasury note rate and its inflation-adjusted counterpart has climbed to 2.3%. A year or so ago it had dipped to 1.0%. The Fed is now claiming it has met its inflation goal.

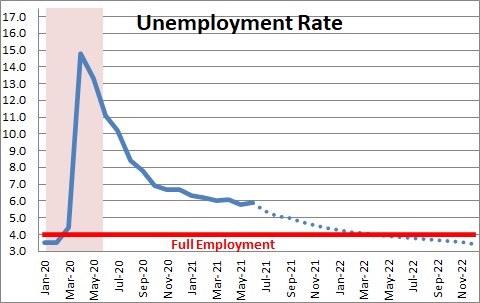

But its second goal of full employment remains elusive. The unemployment rate currently is 5.3%. The Fed believes that its full employment level is about 4.0%. By December we expect the unemployment rate to reach the 4.4% mark. While not yet at the full employment threshold it will be getting close. However the Fed fears that COVID could reduce GDP growth later in the year and, as a result, achieving the full employment goal could be pushed farther into the future. So, will the Fed begin to reduce its asset purchases later this year or wait until early 2022 to begin? It could go either way, but we will bet on a January 2022 start date.

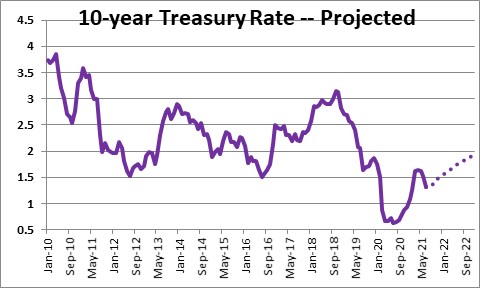

Once the “tapering” begins will the markets experience a “taper tantrum” in the form of a sharp rise in long-term yields? That is what happened in 2013 when the Fed announced its intention to slowly eliminate its quantitative easing program. We doubt that will happen. Indeed, we would argue that the markets have already had a taper reaction during the past year when Treasury yields rose from about 0.75% to its current level of about 1.25%. Having said that, rates will climb further once the Fed makes its intentions official. We anticipate the yield on the 10-year to climb from 1.3% currently to 1.5% by the end of this year and 1.9% by the end of 2022. As the economy continues to expand at a reasonably rapid pace and inflation rises by more than is generally expected at the moment, it makes sense that long-term interest rates should climb.

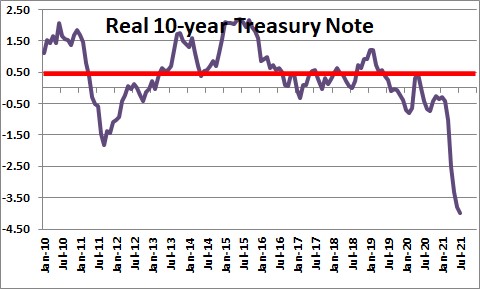

It is important to keep in mind that the “real” or inflation-adjusted yield on the 10-year is -4.0% with a nominal yield of 1.3% more than offset by a 5.3% increase in the CPI. This means that investors may receive a 1.3% interest rate return, but that is more than offset by a sharp 5.3% reduction in their purchasing power. Since 2010 the “real” 10-year has averaged 0.5%. To us, purchasing Treasury yields at a negative real rate of return makes no sense. The stock market offers a far more attractive alternative.

Investors and economists always find something to worry about. But on many occasions their concerns are unwarranted. We are convinced that is the case this time.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me