January 19, 2018

The economy is in its ninth year of expansion. The stock market is on a powerful upswing. It is inevitable that between now and yearend it will hit a speed bump and correct by 10% or more. People will get nervous. There will be talk of a recession. How can you tell whether the downturn is a signal that the expansion is coming to an end? Or merely the latest hiccough? Here is what we are watching.

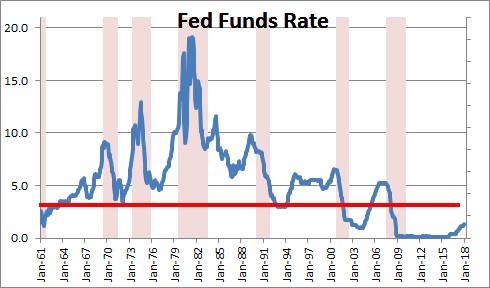

Federal Funds Rate. The Fed is gradually raising the federal funds rate. It is currently at 1.25%. With three more one-quarter point moves later this year it will reach the 2.0% mark by yearend. But it will remain well below the so-called “neutral” level of about 3.0%. We have repeatedly highlighted the fact that the U.S. economy has never, ever gone into recession without the Fed first pushing the funds rate above the neutral rate. Going into the last recession the funds rate reached the 5.0% mark before the economy went over the edge. Regardless of what happens to the stock market this year, this necessary pre-condition for a recession will not be met any time soon.

Inflation on the Rise. The CPI excluding the volatile food and energy components rose 1.8% last year. The Fed has a 2.0% target. The Fed has indicated that it will be willing to tolerate an above-target inflation rate for a while because it has been below its target for so long. What is that acceptable upper limit? Nobody knows. 3.0% perhaps? Once inflation surpasses 3.0% or so the Fed will feel compelled to raise the funds rate significantly above the neutral rate of 3.0%, and actively shift into “tightening” mode. At that point we should be hyper-alert, but we are not even close.

Stock Market Drop. Once the two conditions above have been met, a stock market swoon will be an important leading indicator. A 10% drop this year will mean nothing because rates are not even close to a level that might trigger a recession. But a 10% drop once rates have climbed above the neutral rate of 3.0% — on their way to 4.0% or 5.0% — will almost certainly be a harbinger that the good times will soon end.

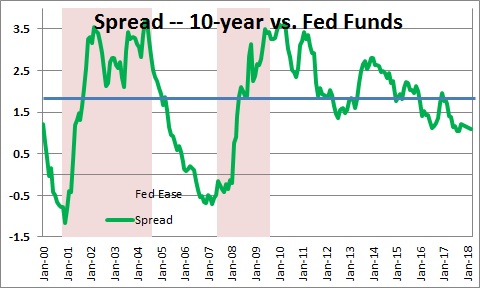

Yield Curve Inverts. This means that short-term interest rates have risen above long-term rates. It is an indicator that the Fed is aggressively trying to slow the economy by raising short rates significantly. It is a relatively reliable indicator that the economy will soon enter a recession. Some fear the yield curve might invert this year. That is not going to happen. It has flattened a lot in the past year. In December 2016 long rates were almost 2.0% higher than short rates. In December of last year that spread had narrowed to 1.2%. Between now and yearend we expect short rates to rise 0.75% to 2.0%, while long rates rise by 0.5% to 2.9%. The curve will get flatter still, but remain positive at 0.9%.

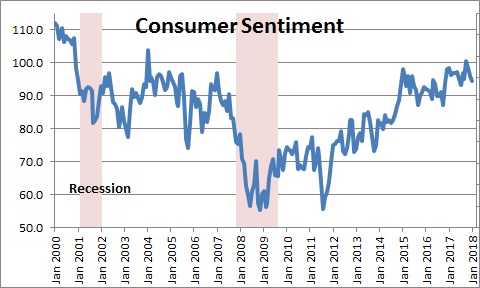

Consumer confidence. At some point we will begin to get nervous and all measures of consumer confidence will turn downwards. Most confidence measures split the overall index into a “current conditions” component and an “expectations” component. When we get nervous the expectations component will be the first to turn fall.

Housing. Once the bad times arrive housing and autos will turn downwards first. Why? Because they are the two biggest ticket items in our budget. Realtors and builders are the canaries in the coal mine for the rest of the economy. Pay attention to building permits. They will turn downward before builders cut back on the construction of new houses.

Car sales. Same as above. This is a big-ticket item. It will get hit quickly. Car sales are reported on the first business day of the month for the month that has just ended. Thus, they are one of the timeliest economic indicators.

Factory orders. The orders component of the ISM (Institute Supply Management) survey will fall sharply. This is another very timely indicator. It is reported on the first business day of the month for the month that just ended.

Factory workweek. The factory workweek will decline. Rather than lay off workers at the first sign of emerging weakness, manufacturers first cut back on the hours worked of existing employees. This is part of the employment report which is released on the first Friday of the month for the previous month which means it is also very timely.

If these indicators all begin to turn downwards, you can be sure we are in the soup.

How will we know when the recession has actually begun? Industrial production. The National Bureau of Economic Research (NBER) is the official arbiter of the beginning and ending dates of business cycles. In the most recent cycle industrial production registered its first decline in January 2008. The NBER said that the expansion ended in December 2007. On the flip side, industrial production first turned upwards in July 2009. The NBER said the recession ended in June 2009.

We mention all of this not because we expect a recession any time soon. We don’t. We think the expansion has at least 3 to 5 years to go. But once the stock market swoon begins you can be assured that many economists will significantly boost the odds of a recession later this year. We want to assure you that will not happen.

Maintain the faith. When the stock market begins to fall it will be a correction, not a harbinger of recession.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me