April 1, 2024

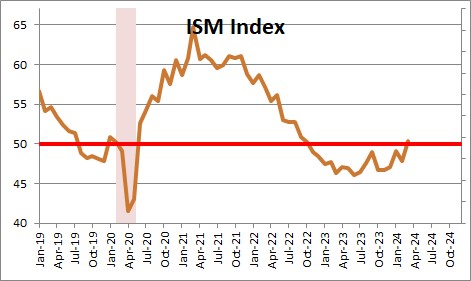

The Institute for Supply Management’s index of conditions in the manufacturing sector rose 2.5 points in March to 50.3 after having fallen 1.3 points in February. This is the first time that this index has been above the breakeven point of 50.0 since September 2022. The manufacturing sector edged upwards in March. While 50.0 is the breakeven point for the manufacturing sector, a level of 42,5 is generally regarded as the breakeven point for the economy as a whole. A level of 50.3 is associated with a GDP increase of 2.2%.

The ISM organization does a similar survey for the services sector. The ISM index of conditions in the service sector for February will be released on Wednesday, April 3.

The Institute for Supply Management Chair for the Survey Committee Timothy Fiore said, “The U.S. manufacturing sector moved into expansion for the first time since September 2022. Demand was positive, output strengthened and inputs remained accommodative. Demand improvement was reflected by the (1) New Orders Index back in expansion and fewer comments regarding ‘softening,’ (2) New Export Orders Index expanding again, supported by panelists’ stronger optimism (3) Backlog of Orders Index remaining in moderate contraction territory, the same as in February and (4) Customers’ Inventories Index contracting for the fourth consecutive month, remaining at a level accommodative for future production. Output (measured by the Production and Employment indexes) surged, with a combined 7.7-percentage point upward impact on the Manufacturing PMI® calculation. Panelists’ companies notably increased their production levels month over month. Head-count reductions continued in March, with sizable layoff activity reported. Inputs — defined as supplier deliveries, inventories, prices and imports — continued to accommodate future demand growth and showed signs of stiffening. The Supplier Deliveries Index dropped marginally, moving into ‘faster’ territory, and the Inventories Index improved but remained in slight contraction territory. The Prices Index moved further upward in moderate expansion (or ‘increasing’) territory as commodity driven costs remain unstable.”

Comments from respondents include the following:

- “Performance continues to defy projections of a downturn in activity. Demand remains strong, and the pipeline for orders is robust.” [Chemical Products]

- “Expecting to see orders and production pick up for the second quarter. Suppliers are working with us to help drive costs down, which will help improve the margin for the rest of the year and deliver growth in 2025.” [Transportation Equipment]

- “Commodity prices continue to hold steady.” [Food, Beverage & Tobacco Products]

- “Demand remains soft, but optimism is high that orders are ‘just on the horizon.’ Expectations are for a strong second quarter. Supply chain issues are minimal, with only semiconductors and select electronic parts being an issue.” [Computer & Electronic Products]

- “Noticing an increase in suppliers’ selectiveness regarding orders they quote and take. Additionally, there’s been a noticeable increase in manufacturing companies targeted for acquisition by larger entities (established companies, investment firms and the like).” [Machinery]

- “Business is still strong — we are meeting and exceeding our forecasts. So far, we’re not hearing anything negative with our customers as far as ongoing business is concerned — it’s the same for raw material suppliers, nothing negative.” [Fabricated Metal Products]

- “As an energy-intensive manufacturer, energy pricing continues to be a concern for our business. The move to electrification has increased demand, and supply is not stable because we’re not in an ideal geography for wind and solar power.” [Paper Products]

- “The potential aftermaths of the presidential election are beginning to impact conversations and negotiations of long-term agreements/contracts.” [Petroleum & Coal Products]

- “Continue to experience a softness in the industrial sector. There is optimism that order activity will increase in the late second quarter, leading to improvement in this segment for the second half of the year. The aerospace and defense market is continuing to ramp up, and demand is outpacing supply in our supply chain.” [Primary Metals]

- “Business activity is up. Many manufacturers are anticipating better business in the second quarter and much better in the third quarter. They are reporting that second-quarter bookings are just starting to ramp up.” [Wood Products]

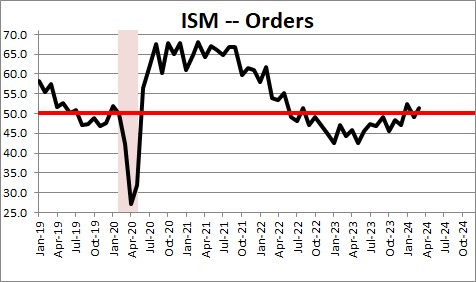

The orders component rose 2.2 points in March after declining 3.3 points in February, Basically, they are bouncing around close to the breakeven level of 50.0. . Fiore noted that “Of the six largest manufacturing sectors, four (Computer & Electronic Products; Fabricated Metal Products; Food, Beverage & Tobacco Products; and Chemical Products) reported increased new orders. Panelists’ comments reflected continuing improvement in demand, a trend that began in December 2023,”

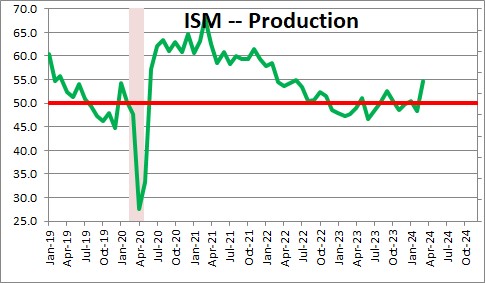

The production component jumped 6.2 points in March to 54.6 after having fallen 2.0 points in February. This is the fastest pace of production since the summer of 2022. Fiore noted that,“Panelists’ companies improved output levels compared to February. The index posted its highest reading since June 2022, when it registered 54.7 percent,” An index level of 52.2 is generally consistent with an increase in industrial production. Thus, industrial production is likely to increase in February.

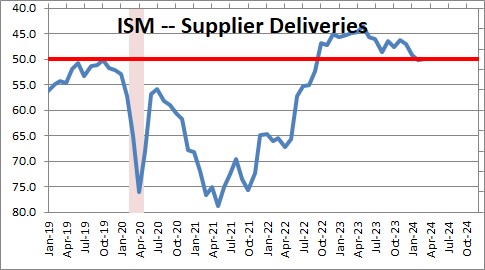

The delivery performance of suppliers to manufacturing organizations fell 0.2 point in March to 49.9 after having risen 1.0 point in February. This means that supplier deliveries were essentially unchanged in March. Fiore noted that “Panelists’ comments continue to indicate that supplier performance is improving; delivery promises are more stable as inputs transition to a more demand-driven environment. For the third month, supplier responsiveness appears to be ‘stiffer,’ meaning some suppliers are struggling to keep up,”

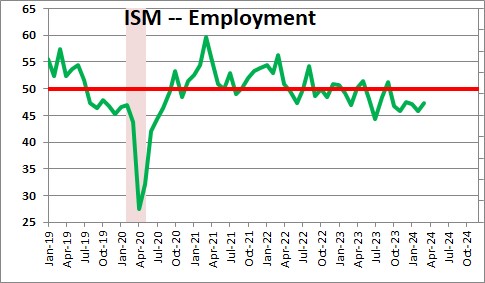

The employment index rose 1.5 points in March to 47.4 after having fallen 1.2 points in February. Fiore noted that, “The index indicated employment contracted for the sixth month in a row (but at a slower rate in March) after one month of expansion and three months of contraction before that. Of the six big manufacturing sectors, three (Transportation Equipment; Machinery; and Food, Beverage & Tobacco Products) expanded employment in March. Many Business Survey Committee respondents’ companies are continuing to reduce head counts through layoffs (which account for 76 percent of reduction activity, up from 50 percent in February), attrition and hiring freezes. Panelists’ comments in March were again equally split between companies adding and reducing head counts. This approximately 1-to-1 ratio has been consistent since October 2023,” An index reading above 50.4 is generally consistent with an increase in the BLS data on manufacturing employment. Thus, factory employment is likely to decline in March.

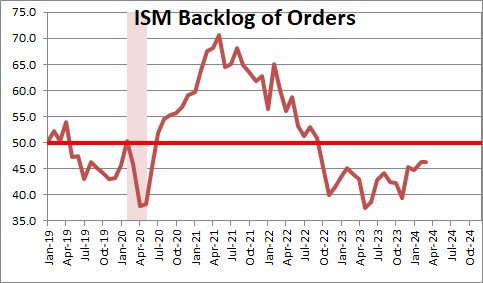

The backlog of orders was unchanged in March at 46.3 after having risen 1.6 points in February Fiore noted that, “The index remained in contraction in March, as production rates and new order levels continue to not be conducive to expansion in backlogs,”

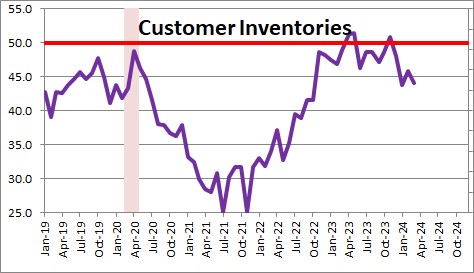

Customer inventory levels declined 1.8 points in March to 44.0 after having risen 2.1 points in February Fiore said that, “Customers’ inventory levels decreased at a faster rate in March, with the index retreating a bit more into ‘too low’ territory. Panelists report their companies’ customers continue to have a shortage of their products in inventory, which is considered positive for future new orders and production,”

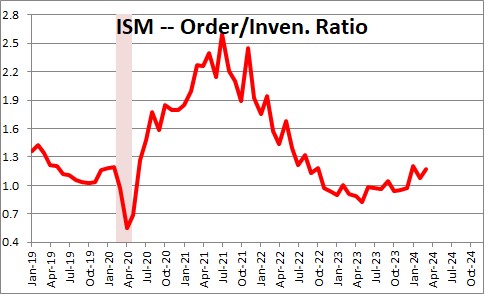

With the increase in the orders index and a drop in customer inventories the ratio of orders to inventories rose 0.1 point in March to 1.2 after having fallen 0.1 in February. The 1.2 level for this index suggests that production could continue to climb slowly in the months ahead.

increase

increase

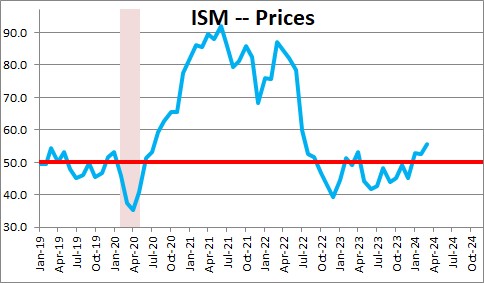

The prices paid component rose 3.3 points in March to 55.8 after having fallen 0.4 points in February, Fiore noted that, “The Prices Index indicated moderate expansion in March, recording its highest level since July 2022 (60 percent). Commodity prices continue to be volatile, especially crude oil, aluminum and plastics. Twenty-four percent of companies reported higher prices, compared to 18 percent in February,” A price index above 52.8 is generally consistent with the Bureau of Labor Statistics PPI index for Intermediate Materials.

We expect GDP to climb at roughly a 2.2% pace in the first two quarters of this year.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me