December 4, 2020

Private sector employment rose 344 thousand in November which was a disappointment to us. We had expected an increase of 700 thousand. However, layoffs and the number of people receiving unemployment benefits are declining steadily which means that the labor market continues to improve. But the perception that the labor market is softening has given renewed incentive to our lawmakers in Washington to reach an agreement on some sort of a virus relief/stimulus package. While the details of the package remain uncertain it appears to be about $900 billion and will probably extend Federal unemployment benefits of $300 per week, provide protection from evictions for renters, and an extension of the payroll protection program for small businesses. We currently expect fourth quarter GDP growth to climb by 9.0%. We also expect growth of 5.5% growth in the first quarter, but it is likely to be even faster if the additional government spending is approved. Many in Congress believe this will simply be an interim bill until a larger package can be enacted early next year

The November softness in employment was experienced largely in the food services and drinking places category which fell 17 thousand in November after a sizable 192 thousand gain in the prior month. Clearly, the rapidly spreading virus took a toll on that industry. The other soft sector was retail employment which declined by 35 thousand in November as retailers hired fewer workers than normal at the beginning of the holiday season which compares to an increase of 95 thousand in the prior month.

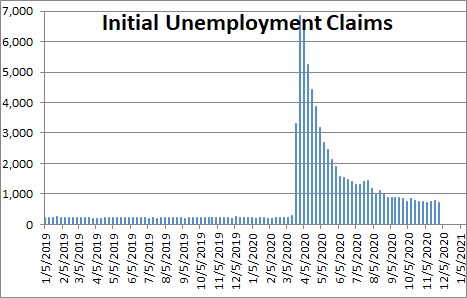

But the labor market continues to improve. In the week ending November 28 layoffs fell 75 thousand to 712 thousand. The trend in layoffs is still downward although, admittedly, the rate of decline has slowed in the past month or so.

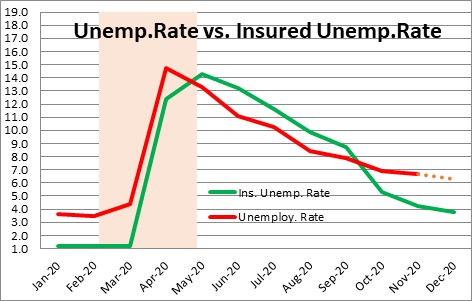

While some workers can be laid off in any given month, other workers are hired. If hiring exceeds firing, then the number of people unemployed declines. The Bureau of Labor Statistics each week publishes what it calls the “Insured Unemployment Rate” which calculates the number of people receiving unemployment benefits as a percent of the labor force. It closely tracks the official unemployment rate. That rate fell 0.4% in the week ending November 28 and has declined on average 0.3% per week for the past four weeks. Given that the labor market continues to improve, we expect the unemployment rate to fall 0.5% in December to 6.2%.

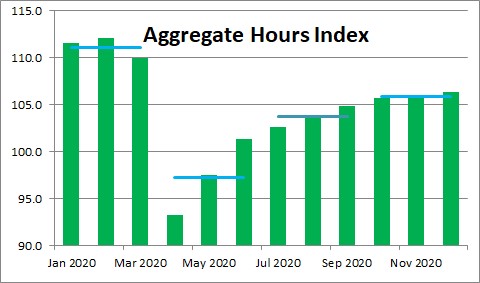

Each month employers can hire more workers and/or increase the number of hours that their existing employees work. The “Aggregate Hours Index” is the product of those two numbers. If we know how many people are working and how many hours they worked, we can estimate how many goods and services they produced which is what GDP is all about. Thus, the aggregate hours index can be regarded as a rough monthly proxy for GDP. Given the level of this index in October and November and an estimate of employment and hours worked for December, it appears that this index rose 9.0% in the fourth quarter. Hence, we expect GDP growth in that quarter of 9.0%. Following a 33.1% rebound in the third quarter, continuation of GDP growth at a 9.0% pace in the fourth quarter suggests that despite the faster rate of spread of the virus, businesses are still hiring and consumers are still spending.

Even before the release of the November employment report Republicans and Democrats in both the House and Senate were trying to reach agreement on further government spending. It is best characterized as a virus relief bill because the intention is to assist both those workers who remain unemployed and those small businesses that continue to struggle. That additional $900 billion of government spending will also provide a boost to GDP growth in the early part of the year. We currently expect GDP growth of 5.5% in the first quarter, but it could even be more rapid than that if additional spending is approved.

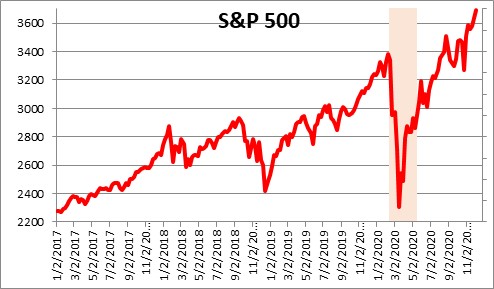

We continue to fret over the increase in the size of the budget deficit for fiscal 2021 and the further increase in U.S. Treasury debt outstanding. We still believe that debt matters and hope that our leaders in Washington will soon make an effort to shrink the projected budget deficits. But that is not going to happen. President-elect Biden, Fed Chair Jerome Powell, and incoming Treasury Secretary Yellen are all in favor of additional spending to support the economy — even spending far beyond the “interim” package currently being discussed. That is fine in the short time. It will, hopefully, assist those folks who remain in need, and simultaneously stimulate GDP growth. No wonder the stock market loves the idea! But it may soon boost the inflation rate beyond what the Fed would like to see, and simultaneously push long-term interest rates higher. But, for now, full speed ahead. We will deal with those potential problems when and if they occur.

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve, I tried to mention this yesterday when you said you hoped for Georgia to provide a divided Congress by electing a Republican majority to the Senate. My remark was a statement and not a question so your “Alex Trebek” disqualified it. It was already past time given the lateness of the hour.

My Statement was that every Democratic Administration has reduced the Deficit since Carter. Why Democratic Administrations are associated with deficits goes to FDR and the New Deal, and to Republicans laying the blame of the effect of their Tax Cuts and Defense Spending at the hands of the following administrations. Had George Bush not cut the Surplus and then start the war with Iraq, we would be in a very different place. You fell in the same Partisan trap of blaming one party for the deficit and another trying to use it responsibly for effective stimulus.

We both paid 50% taxes in the 80’s which was wasteful. But the taxes to build the Interstate Highway System of Eisenhower were needed for domestic defense. The reduction in taxes has let the support of that infrastructure go to ruin and a huge loss of jobs. You think that the economy is going to come roaring back, but I think the loss of jobs in certain sectors is permanent. You yourself said we saw a huge pick up in productivity, so doesn’t that preclude that certain jobs are not coming back and the tax dollars from them along with them?

You said towards the end of the Call, “I don’t know “, about variables that could happen. First, I’d say Economist “don’t know”, so it doesn’t reflect on you personally. Secondly, I’d make the point of what has created the deficits, like tax cuts, increased Defense Spending for Wars, and lest we forget the huge Entitlement of Social Security and Medicare are all part of the bill we have to pay.

Your call was great and I love your down to earth style, but I do think you might be missing a dramatic shift in how we work and how we are going to pay for the deficits going forward. How does that impact the economy and how does it impact future generations?

Your friend forever,

Ray

Steve, I sat through you presentation and question/answer session on December 3rd. It was inspiring. I really liked the way you used facts to support your comments and also let it be known that you could be wrong. That to me is the sign of a ethical man who is searching for the truth. Your insight is phenomenal and I accept it with very few questions. Thank you so much.

Darrel

Hi Ray,

I am glad you were able to join me on Thursday. I hope you got something out of it — despite your concern about my budget comments.

Harry was not trying to “disqualify” your question. In all other years I cut off the Q&A promptly at 9:00. I want to be respectful of people’s time. They have jobs and need to get back to them. I let it go somewhat beyond that this time because it is much easier for somebody who has to leave to just drop off a Zoom call then it is to walk out of a room full of people who can notice your departure.

I notice that your question is all about budget deficits. In depth answers to all the questions you raise would require a discussion of another hour or more. Please understand that my primary goal on Thursday was to provide some blueprint for what might happen to the economy in the coming year or so and most of my comments were directed towards that. But I did note that because of our action earlier in the year the budget deficit exploded and, as a result, Treasury debt skyrocketed. That was intended to be a small part of the discussion. And did not try to blame any particular party for what happened. The economy was going into the tank in the spring and the government did what it was supposed to do in a crisis — come to the rescue. In fact, I specifically stated that I approved of that action back in the spring. Furthermore, I think the government did the right thing back in 2008-09 with that stimulus package. Both packages were bipartisan. The economy needed help. They had to do it.

But my issue is what happens after that. I believe that once the good times return, government is supposed to come up with some plan to shrink the deficit and pay down some of the outstanding debt. And that is what seems to be lacking. Nobody — Republicans, Democrats, or the Fed — seems to care any more. I believe deficits and debt matter. Perhaps the Modern Monetary Theory people do not believe that to be the case, but I do. Perhaps they are right. Maybe deficits do not matter. But that is not what I believe.

I did say in response to a question that the left wing of the Democrat party concerns me because they support some extremely large spending programs like the Green New Deal, free college education, Medicare for all, eliminating student debt, etc. And that does concern me. If they are going to support those programs there needs to be — in my opinion — a plan for how they are going to be financed. The supporters seem to think that debt does not matter and, therefore, they can spend whatever is required. I am not in that camp. I believe that debt matters.

And, finally, my views are just that — my views. I can not speak for other economists. Besides, most of them probably disagree with my relatively optimistic view of the world anyway. What you get is my view of the world. Sometimes it is right. Sometimes it is not. I own it, right or wrong.

Best.

Steve

Hi Darrel.

Thanks for your kind words. Coming from you that is high praise. This has been a challenging year for all of us and what lies next is not clear at all. As I mentioned, my goal was for people to walk away with one or two things to think about that they had not heard from others. Maybe that additional information will help them make more intelligent decisions about how to run their own business or, perhaps, manage their own portfolio. This is all about information. The more of it the better. I know that some of my best ideas over the years have come from others — clients, other economists, friends. We get to talking about something that strikes me as being an interesting perspective. I check it out a bit and, if it makes sense, I incorporate it into my forecasts. There is no question that discussions such as those have made me a better economist.

Best to you and your family during the upcoming holiday season. Talk soon.

Steve