July 26, 2019

Second quarter GDP growth came in about as advertised at 2.1% after having risen 3.1% in the first quarter. While various categories of GDP growth swung widely in the first two quarters they basically evened out if the two quarters are combined. Thus, GDP growth in the first half of the year of 2.6% seems to be a relatively accurate assessment. Having said that, Fed officials remain concerned about a GDP slowdown later this year in both the U.S. and globally. They seem to anticipate growth slipping to just 2.0% in the final two quarters of the year. That seems far too pessimistic. We are looking for GDP growth to remain robust at 2.8% in the final two quarters of the year. This article is being written prior to the July 30-31 Federal Open Market Committee meeting. The Fed is widely expected to cut rates 0.25% at that meeting and perhaps again later in the year.

While we see no justification for lower rates, the Fed is no longer being guided by incoming data. The rules of the monetary policy game have changed and it is not clear exactly what the new rules are. The Fed has an expectation of slower growth ahead and is willing to cut rates based on that forecast despite a lack of evidence that the slowdown is underway. It has bought into the notion that in the world of very low interest rates it can no longer wait for signs of a slowdown to emerge. It is convinced that it must act preemptively and cut rates before the slowdown begins. It hopes that lower rates will prevent the slowdown from actually materializing. Thus, it is taking out an “insurance policy” to guarantee that the expansion continues at a respectable pace.

If growth slows later this year, the Fed will score high marks for having taken preemptive action. But what if we are right and growth does not slow? Has any harm been done? Probably not, but the jury is probably still out.

We are not going to raise our estimate of GDP growth for the final two quarters of this year given the expectation of lower interest rates. The reason is that we believe the economy is at full employment and business leaders will be no better able to find qualified workers in the wake of the rate cuts than they are today. The Fed may can cut interest rates, but it cannot create jobs. As noted earlier, we expect GDP growth of 2.8% in the final two quarters of the year.

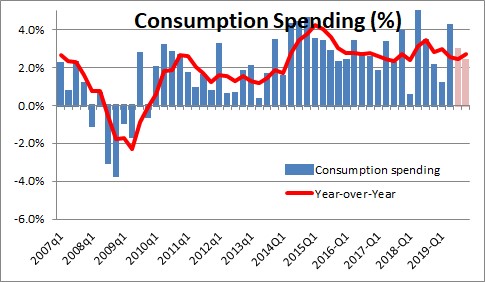

Most economists who expect slower growth typically do not talk about the consumer. That is because consumer spending climbed at a solid 2.7% pace in the first half of the year. With rates low and likely to decline somewhat between now and yearend, little debt, the stock market at a record high level, and jobs continuing to climb by 180 thousand per month, there is no reason to expect consumer spending to slow in the second half of the year. That is important because consumer spending accounts for two thirds of GDP.

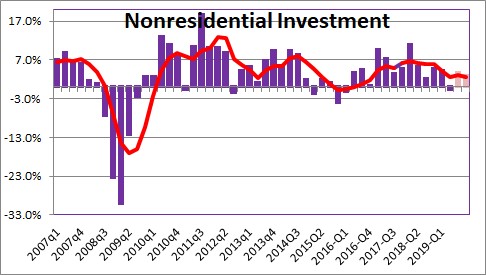

The Fed could produce faster GDP growth if it could entice business leaders to boost the pace of investment spending. But in the current environment that seems unlikely to happen any time soon. There is a widespread belief that both the U.S. economy and global growth are going to slow in the second half of this year. As a result investment spending declined 0.6% in the second quarter as corporate executives became more tentative and many expect a further decline in investment spending in the second half of this year. But be cautious. Spending on intellectual property products which include software and research and development spending, and which accounts for about one-third of all investment spending, has risen at an 8.0% pace in the past year. If businesses cannot find an adequate number of qualified workers, they are likely to spend money on technology to boost output. This is the kind of investment spending that will also tend to boost productivity growth in the quarters ahead and cause potential GDP growth to quicken from 2.0% or so a few years ago to 2.8% by the end of this decade. Having said all that, the notion of slower growth in the economy later this year is so firmly entrenched, it will take several quarters of solid GDP growth for corporate leaders to change their minds. Perhaps investment spending will accelerate in 2020, but it will probably remain sluggish with growth of only about 3.5% — largely on intellectual property — in the final two quarters of the year.

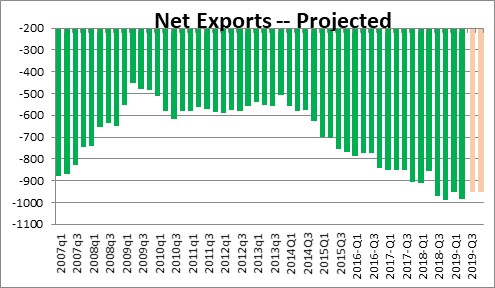

The other sector of the economy that the naysayers cite is trade. But the deficit for net exports is volatile from one quarter to the next. The economists who support the notion that growth outside the U.S. is slowing will undoubtedly point to a 5.2% drop in exports in the second quarter. As a result, the trade sector subtracted 0.5% from GDP growth in that quarter. But exports also rose 4.4% in the first quarter and the trade sector added 0.7% to GDP growth in that quarter. We expect no growth in exports between now and yearend, and expect the trade component to subtract only about 0.2% from GDP growth in 2019.

Thus, we had — and continue to have — a relatively positive view of the economy for the foreseeable future. We do not think that rate cuts by the Fed in the second half of this year are likely to alter that forecast in any significant way.

However, lower rates will boost the stock market by lowering the cost of corporate borrowing which will enhance earnings. But, given the widely expected view that the U.S. and global economies are going to slow down in the second half of the year stock prices may rise, but corporate leaders will remain cautious about a faster pace of investment spending.

We feared that an unexpected rate cut by the Fed might be viewed as a sign that the Fed had caved in to President Trump’s wishes and therefore be viewed negatively. But the notion of slower growth ahead is so well-entrenched, most economists and market participants welcome the rate cuts. We have not heard anyone suggest a political motive for the Fed’s action. That is good news.

The bottom line is that we do not expect much if any growth pickup as a result of the Fed’s almost certain rate cuts, but it also seems unlikely to hurt anything. And even, perhaps, it has extended the life of the expansion for a while longer. We never believed the end of the expansion was in sight. Lower rates are likely to push the end date even farther into the future.

Stephen Slifer

NumberNomics

Charleston, S.C.

You do not mention WHY you think 44+1 and his cronies have not influenced the FED. I’m bettin’ they are pushing behind the scenes.

Stephen, your interpretation is fascinating. You are right on the money most of the time. I am betting on you this time too. Thanks for your thoughts. Darrel