May 21, 2021

The extreme shortage of available housing is causing home prices to soar. The housing market is seriously overheated. People are knocking on homeowners’ doors asking if they would be interested in selling. Some current homeowners are listing their houses at ridiculously high prices just to test the water and see if they can entice a potential buyer to bite. Speculators are offering prices 10% or more above the asking price. The number of all cash buyers is increasing which is shutting out younger, first time buyers. Purchasers no longer feel comfortable asking for a home inspection for fear of losing the house to someone else. The problem in the housing market is a reflection of current monetary and fiscal policy. Through a series of stimulus checks the federal government has shoved money into consumers hands which they can use to purchase houses or anything else. The Fed keeps buying U.S. Treasury and mortgage-backed securities and continues to pump more money into the economy every month. Throughout its history the Fed has been forced to counter asset bubbles by raising rates, and such occasions do not have a happy ending. Think back to the dot.com bubble in 2000. Then there was the housing bubble in 2008-09. Today, between the housing market and stock market. it is abundantly clear there is an asset bubble in the U.S. housing market. How long does this last? And what will it take to stop it?

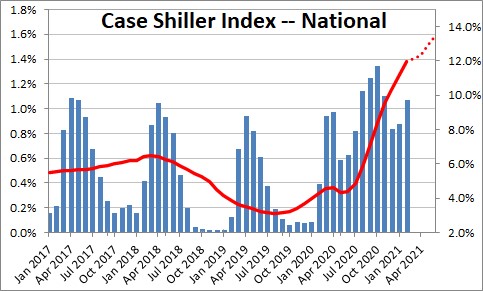

Home prices are rising by any measure. The Case Shiller index has risen 12.0% in the past twelve months and recent data suggest that the pace is climbing towards the 15.0% mark. Existing home prices have risen 19% in the past year.

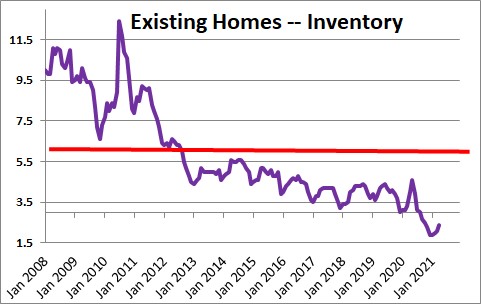

Prices are rising so rapidly because housing is in short supply. The number of months of existing homes available for sale is 2.4 months which is near a record low level and well below the 6.0 million level that realtors believe is required to balance supply and demand.

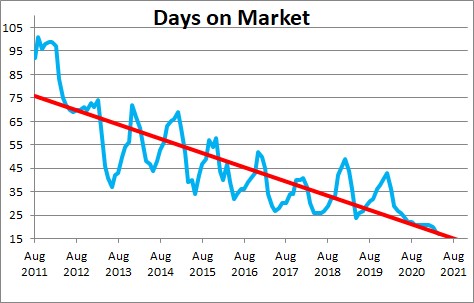

As further evidence of the robust demand for houses, the average home sits on the market for just 17 days. That is the shortest length of time between listing and sale on record. In fact, 88% of the homes sold in April were on the market for less than a month.

Lawrence Yun, the Chief Economist for the National Association of Realtors noted that, “First-time buyers in particular are having trouble securing that first home for a multitude of reasons, including not enough affordable properties, competition with cash buyers and properties leaving the market at such a rapid pace,” Of the homes sold in April, 17% were cash sales which is up from 10% in April 2020.

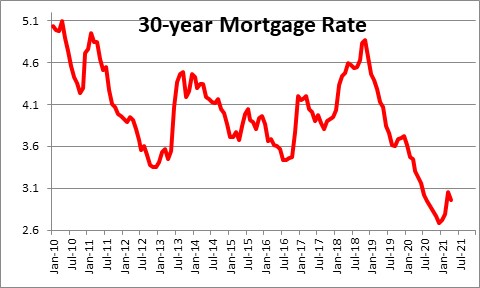

The housing shortage is the result of a number of factors. First, mortgage rates remain at the 3.0% mark which is close to a record low level.

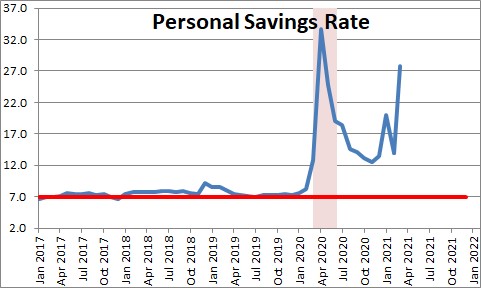

Second, through a series of stimulus checks the federal government has put so much money into consumers hands that the savings rate has soared to 27%. Those funds are in liquid form and available to consumers to spend on houses or anything else that they want to buy.

Third, during the pandemic workers began to work from home. That means that renters in pricey metropolitan areas could do their jobs just as easily from a less costly home in the suburbs or in a place like Texas and Florida. At the same time, potential home sellers were reluctant to put their homes on the market because they did not want a stream of potential COVID carriers tromping through their homes.

As the number of COVID cases continues to shrink some of those previously-fearful potential home sellers may now be tempted to put their homes on the market. But that does not solve the problem. They may sell their home quickly, but they now have to find a home elsewhere. One home gets listed and sold, but that creates the demand for a home somewhere else.

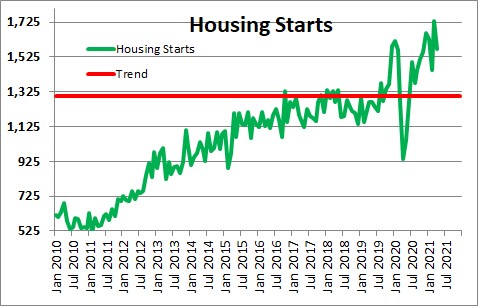

The solution to the housing shortage is to get builders to step up the pace of new construction. They are trying. But the skilled labor they require is in short supply. Prices of raw materials like wood and timber have risen 35% in the past year which makes building an affordable home challenging. The number of lots available to builders anywhere close to a city is hard to find. Builders could perhaps get more workers if they were willing to pay higher wages, but that will cause home prices to rise even faster. If the federal government allows its generous unemployment benefits to expire after Labor Day, perhaps the number of workers available will increase dramatically. But Labor Day is still four months away. It is difficult to see the situation changing much between now and then.

There is a bubble in the housing market today. The same is true in some parts of the stock market as evidenced by the GameStop problem a few months ago and the wild swings in the Bitcoin market. The Fed’s easy money policy is a major source of the problem. Investors are no longer happy with a 1.6% nominal yield on a 10-year note. In real terms the 10-year yield is -0.8%. Who wants a negative real rate? To get a decent return investors are turning to riskier investments. That includes the stock market. Some are throwing caution to the wind and getting involved in GameStop options and Bitcoin. Others believe that they can become real estate flippers. In short, there is simply too much money chasing too few goods.

It is time for the Fed to become slightly less friendly. But that is not going to happen. There may be some chatter amongst Fed officials about making that shift, but it is likely to be just talk for a long time to come for a couple of reasons. First, the Fed wants to see the unemployment rate fall back at least to the 4.0% mark it regards as full employment or, perhaps, even to the 3.5% rate that existed prior to the recession. Second, the federal government’s generous employment benefits are making it for difficult for firms to hire enough workers to satisfy demand. That, in turn, retards the ability of the unemployment rate to fall quickly. Third, inflation in the near-term will climb with the core CPI expected to rise gradually to the 3.4% mark by the end of the year. But the Fed will, first of all, welcome a pickup in the inflation rate which has fallen about 0.5% short of its 2.0% inflation target a for a decade. And then, even if inflation gets to 3.4%, the Fed will continue to believe that the pickup is temporary until such time as it is proven wrong. That process is going to take months.

With 24% growth in the money supply the inflation rate is headed higher. But how quickly it rises and the extent of the runup will be unclear for a long time to come. We are optimistic that the core CPI will rise by only 3.4% this year and in 2021. We count on productivity gains to keep rising wages in check. But this is uncharted territory. The money supply has never risen this rapidly and no one, us included, can be sure exactly how that plays out.

Stay tuned. Inflation is headed higher. Long rates will rise. But short interest rates are not going anywhere – even if they should. If the Fed delays, is this the asset bubble that the Fed will eventually be forced to break? If so, the seeds of the next recession are getting planted today.

Stephen Slifer

NumberNomics

Charleston, S.C.

To borrow from Senator Lloyd Bentsen who was running for Vice President a few decades ago: Joe Biden is no Ronald Reagan and Jerome Powell is no Paul Volcker.

This thing is going to get out of control much faster than this bunch will be able or willing to comprehend it and once it sinks they won’t have courage to fix it.

Hi Walter,

I agree that leadership in Washington appears to be distinctly lacking these days. It breaks my heart to see Powell surrendering the Fed’s independence. I spent a decade there at the very beginning of my career and have always been proud of the people that worked in the Fed system. I have never worked with a smarter, more dedicated group of people in my life. Throughout my entire career I was convinced that the Fed truly valued its independence and had people like Volcker who had the courage to do something that was the right thing to do even though it was politically unacceptable. That no longer seems to be the case with the current Fed leadership. As you point out, there do not seem to be any Paul Volcker’s on the horizon if we need them.

Best.

Steve

Hi,

We just moved to the Dallas area and you have to be 10%+ to get a home here. Also home sellers are getting 30-60 free lease backs so they can look for a home after they sell theirs. No one will talk to you with a contingency offer. Once you get in your home, good luck finding a washer, dryer, and refrigerator. Due to shipment back logs, nothing is available.

Dennis

HI Dennis,

I hope you all enjoy Dallas.

A friend of mine just sent me the MLS listing for Daniel Island. There are 13 listings in total (typically 50-60). There is one home listed <$1 million. There are 2 listings between $1-2 million. 3 between $2-3 million. And 7 properties >$3 million. This is absolutely nuts.

Tempted to sell, but then we have to go some place. Where sure exactly where that would be.

Best.

Steve

HI Dennis.

Hope you enjoy Dallas.

A friend just sent me the MLS listing for Daniel Island. There are 13 properties listed in total (typically 50-60). There is 1 property listed for less than $1 million, two properties between $1-2 million,

3 between $2-3 million, and 7 greater than $3 million. This is crazy. Tempted to sell, but where do we go?

Best.

Steve