November 12, 2010

Last week we talked a lot about how the larger-than-expected increase in payroll employment, combined with a further increase in the nonfarm workweek indicted that firms ramped up production in October which, in turn, suggests that fourth quarter GDP growth will show significant acceleration. Indeed, we currently anticipate Q4 growth of 3.5% versus a 2.0% gain in Q2. So far, so good.

But it is possible that firms are producing more goods, but not really selling them. In that event the additional production gets stuck in inventories, faster fourth quarter GDP growth will prove to be an aberration, and at some point firms will need to slow production. To see whether or not this is the case, we need to look at the demand side of the equation.

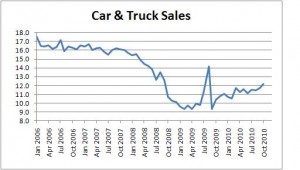

That takes us to this week. On Monday we get retail sales for October which will give us some hint about whether these newly-produced goods are actually getting sold. We already know a few things about October sales. For example, we know that car sales continued to climb to a 12.2 million pace versus 11.7 in September. With the exception of the summer of 2009 when cash-for-clunkers was in place, that is the fastest pace of car sales we have seen since September 2008 – about the time that Lehman collapsed. That is encouraging. We also know that chain store sales for the monthly were fairly robust. For both of these reasons the market is anticipating an increase of 0.7% overall and 0.4% excluding autos.

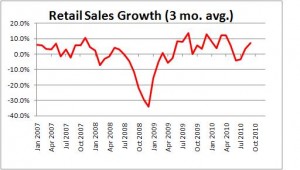

If we were to see an increase of that magnitude it would mean that in the past three months overall sales have been rising at about an 8% pace. If inflation is rising by 2%, then we are suggesting that in the past three months that “real” sales of goods have been climbing at a 6% pace. That is steamy! Now, admittedly, we have only seen data through October and know nothing about November or December. We also know nothing about the sales of services which have been rising fairly slowly in the past several months (and which represent about two-thirds of all consumer spending). Having said all that, it appears that consumer spending is off to a good start this quarter, which makes us comfortable with a GDP growth rate for the fourth quarter of 3.5%.

On a different note, we will get some inflation news this week that might be interesting. On Tuesday the PPI for October is projected rise 0.8% overall and 0.4% excluding the volatile food and energy components. If those consensus gains are correct here is what the PPI chart will look like:

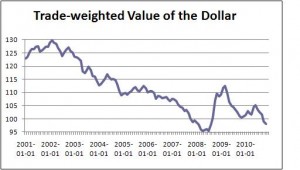

The black lines represent the addition of the October data. Suddenly there is a bit of upward pressure on producer prices for the first time in a couple of years. That pressure has been evident at the crude and intermediate goods stages of productions for several months, so it is not surprising that it has finally worked its way into the finished goods series. Without a doubt this reflects the dollar weakness that has emerged since midyear caused first by the expectation, and now the reality, of further Fed ease. The dollar has fallen about 7% in the past five months. When the dollar declines in value, the owners of commodities that are paid in dollars, like oil, are effectively receiving less money, so they raise prices. It is tempting to get worried about this higher rate of inflation at the wholesale level, but that concern is premature. Read on.

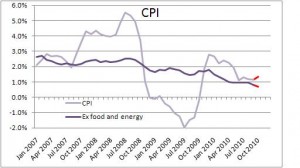

On Wednesday we will get CPI data for October. At the consumer level there is, as shown below, no evidence of a pickup in inflation. The consensus expects the CPI to rise 0.4% overall, but just 0.1% ex food and energy. This stability in the so-called core rate of inflation is attributable to the fact that currently rising wages are more than offset by increased productivity. This means that labor costs adjusted for those gains in productivity, what economists call “unit labor costs”, are still declining. This is important because labor costs reflect about two-thirds of the cost of a product. As productivity growth slows this situation may change, but for now we should expect consumer price inflation to remain in check for some time to come.

If all this is right, then this week should confirm that we are getting faster GDP growth without a pickup in inflation. Let’s enjoy that favorable combo while we can.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me