January 15, 2021

The virus continues to spread rapidly. Both the labor market and the economy softened somewhat in November and December. But that hardly seems consistent with the economic crisis described by President-elect Joe Biden in his speech on Thursday. We understand that he is trying to enlist support for an additional $1.9 trillion fiscal stimulus/corona virus relief package, but he is grossly exaggerating the degree of economic weakness. The economy may have to endure a couple more months of sloppy-looking data, but GDP growth for the year seems likely to be 5.5% and the unemployment rate could fall towards the 4.5% mark by yearend because a vaccine is on its way. The economy is simply not in a dire economic crisis.

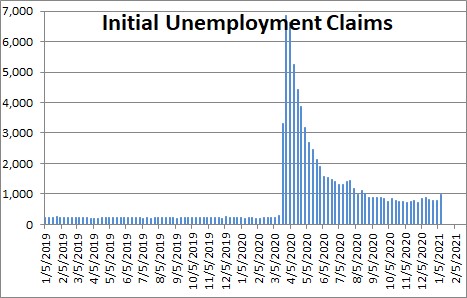

Initial unemployment claims rose at yearend which suggests that the labor market has weakened somewhat. But people are taking what is, thus far, a single-week’s increase and extrapolating that into a leading indicator of significant weakness in the weeks and months ahead. We doubt that will happen.

In addition, retail sales have declined in the last couple of months as consumers cut back on Christmas spending. But much of that softness will be reversed as the vaccine becomes more widely distributed in the spring.

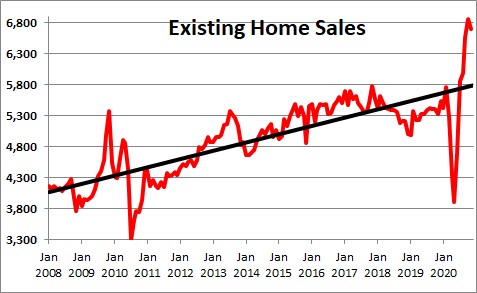

The doomsayers seem to ignore the fact that, spurred by record-low 2.7% mortgage rates, the housing sector is on fire with existing home sales at the fastest pace since 2006.

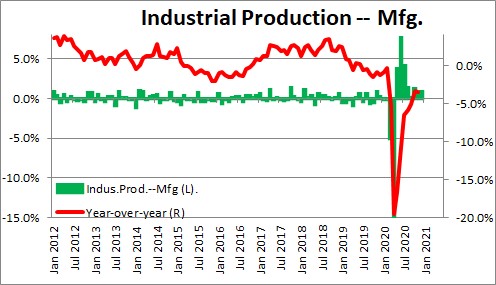

Also, driven by rapid growth in orders the manufacturing sector continues to climb. Industrial production rose sharply in each of the last three months of the year as orders surged and forced manufacturers to step on the gas. Furthermore, production would have been even faster if their suppliers had been able to keep pace.

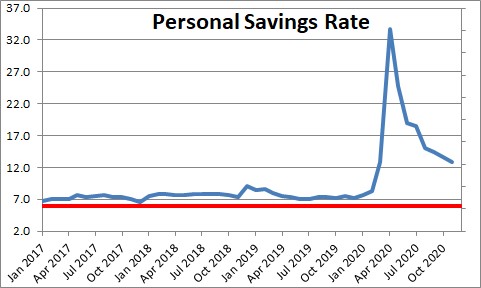

In addition, consumers have plenty of cash on the sidelines in the form of an elevated savings rate to allow them to spend at a reasonable pace for at least the rest of this year.

Finally, if the economy were on the brink of an economic slowdown the stock market would be one of the first places where such fear would become evident. Instead, the stock market is at a record high level.

Fed Chair Powell is one of the cheerleaders for the significant economic weakness: theme. But that seems odd since in December the Federal Reserve predicted 4.2% GDP growth in 2021 and indicated that the unemployment rate would decline to 5.0% by the end of the year (versus 6.7% currently). So where exactly is this economic crisis that he is describing?

Our sense is that our leaders in Washington – from president-elect Biden, to the Democrats in charge of both the House and the Senate, and even the Chair of the Federal Reserve – are describing an economy that is in dire need of assistance. If a second economic stimulus/corona virus relief bill had not been passed late last year, and a vaccine had not yet been developed, we might have more sympathy for that view. But just two weeks ago Congress passed such a bill and a vaccine is already being distributed. For that reason, everybody – including the pessimists – anticipate a quick upswing in growth that will lead to respectable GDP growth for the year and a further decline in the unemployment rate. We find it hard to believe that a scientific community that shortened the normal vaccine development cycle from 10 years to 1 year cannot quickly find a way to accelerate the production of that vaccine and improve its method of distribution.

The proposal for still more government spending seems to reflect a notion that policy makers cannot overstimulate the economy. In the very near term that may be true. But there are consequences in terms of far larger-than-expected budget deficits in the years ahead. In September, the Congressional Budget Office anticipated a budget deficit of $1.8 trillion this fiscal year, but that was before the recently-enacted $900 billion spending package. It now seems likely that we will see a second consecutive budget deficit of at least $3.0 trillion and a debt to GDP ratio that surpasses the post-World War II high of 106% and climbs to a record-breaking 110% of GDP. While Congress should boost spending to help the economy when it dips into recession (like it did last year), it should also cut back on spending when the economy returns to normal. We have absolutely zero confidence that will happen.

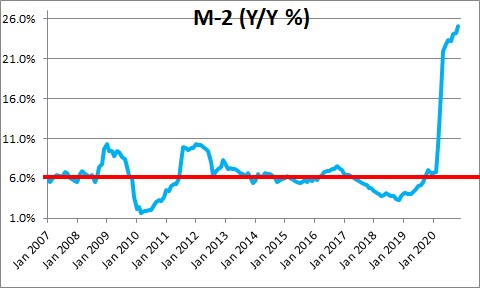

Then there is the almost inevitable acceleration in the inflation rate. Growth in the money supply of 25% in the past year almost guarantees that inflation will soon begin to rise. And, indeed, signs of a higher inflation rate are becoming increasingly evident. Commodity prices have risen sharply in recent months. The dollar has been falling which will boost the prices of imported goods. Crude oil prices have climbed to $53 per barrel and OPEC is cutting production in an effort to push them higher. Prices at restaurants, bars, hotels, and airfares were all cut last year in the midst of the recession. But once the vaccine becomes more widely distributed and we all feel more comfortable going out to eat and travel, those prices are also going to climb.

Our leaders in Washington completely dismiss these longer-term consequences and/or feel comfortable they can control them once they begin to emerge. While we hope they are right, but we remain unconvinced.

Stephen Slifer

NumberNomics

Charleston, S.C.

I believe that President-elect Joe Biden is just as clueless about the effect of a huge increase in the money supply in 2020 as President Lyndon Johnson was in 1966 and that most of the people that will be reporting to Biden are too young to know what it was like from the late 1960s, through the 1970s and into the early 1980s with rampant inflation that know one was able or willing to deal with.

A continuing 25% increase in the money supply should give us just what we deserve and it won’t be pretty. Also, as in the past, no one will take responsibility for dealing with it and reigning it in.

Thanks for your informative and well explained blog. Despite the enormous increase in the money supply, the Velocity of Money (VOM) of M2 is at the lowest level since 1960 by far.

See https://fred.stlouisfed.org/series/M2V

If VOM is so low, doesn’t this tell us that this new money is bound up in investments and is not finding its way into the consumer economy? It certainly does not appear to be making its way into CapEx projects as these type projects have generally been slashed and were weak pre-coronavirus. Why would inflation increase if the new money is not moving into the consumer economy?

Hi Walter,

Things are a bit different today with all of us shopping on-line. Because we can find the lowest price anywhere in the country (or the world), get free shipping, and next day delivery, goods-producing firms today have virtually no pricing power. Raise prices and we take our business elsewhere. And goods represent 35-40% of everything that we buy. Thus, we have a 0% (or close to it) inflation rate for all consumer prices. Kind of changes the game from the 1970’s. But I still think we are about to put that to the test with all this money growth.

If it does get out of hand, I do not see many Paul Volcker’s around who have the guts to do whatever is necessary to get it back in check.

Steve

Hi Blake,

You are absolutely right that the velocity of M-2 has declined. But the problem is we do not measure “velocity”. We measure nominal GDP. We measure M-2. Divide the former by the latter and you will get the V-2 measure presented by the St. Louis Fed. For example,

GDP M-2 Velocity

Q2 21561/139 15613 1.380973

Q2 19520.114 17684.3 1.10381

Q3 21170.252 18458.3 1.46923

But what does that really mean? All it says is that in Q2, for example, GDP dropped a lot while money growth surged. Hence, velocity dropped like a stone in that quarter. There was a small bounceback in Q3 but it still stays way below its average which, over the past 50 years was 1.8. But I have always felt very uncomfortable drawing big conclusions based on something I cannot measure. But other economists talk about velocity doing this or that. Maybe, but I have a tough time with the logic.

Think also what M-2 is. It starts with M-1 (Checking account deposits and currency), and then adds into it savings deposits, money market funds, time deposits, and CD’s. Those are funds that you and I can tap at any time to spend. If we choose to take some of those funds sitting around in cash form and invest it, they disappear from the money supply. So the way I see it, M-2 money is a powder keg just waiting to get spent. We are spending some of it today on houses and cars and taking advantage of really low interest rates. Given that cars and houses are the two biggest ticket items in our budget Ww must not feel too uncomfortable about the economy going forward or whether we will have a job six months down the road. At the moment we see COVID all around us and are wondering when it will finally get contained. Hence, we may remain just a bit cautious. My bet is that during the spring when it seems clear (at last) that COVID is getting under control, we will start to spend on other things as well and inflation will begin to climb.

Steve