June 21, 2024

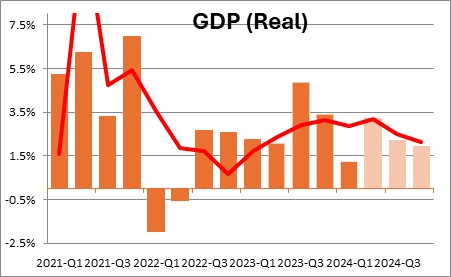

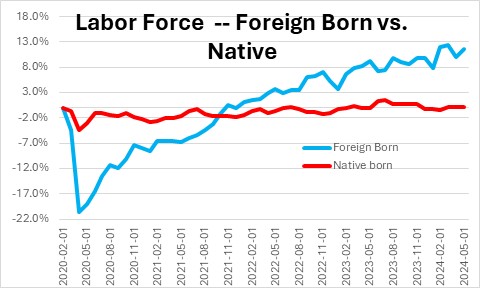

The economic expansion has defied expectations that it would slow markedly in the second half of last year. The Fed raised the funds rate from near 0% to its current level of 5.3% in an extremely short period of time. GDP growth should have slowed. It did not. One relatively simple explanation that has not received much attention is that GDP growth has been stimulated by the influx of illegal immigrants from Mexico. It is worth noting that all of the growth in the labor force since the 2020 recession has come from foreign-born individuals — i.e., immigrants. Without them GDP growth would have been significantly reduced late last year, and inflation would have slowed somewhat more rapidly than it has. President Biden’s executive order earlier this month to secure the border could reduce the flow of immigrants and curtail GDP growth in the second half of this year and help reduce inflation.

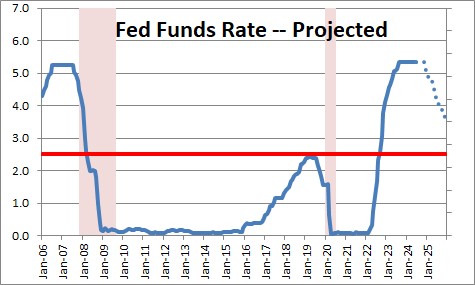

The Federal Reserve raised the funds rate from near 0% in March 2022 to its current level of 5.3% by July 2023. That is one of the most dramatic tightening initiatives ever. As a result, most economists expected significantly slower GDP growth in the second half of last year.

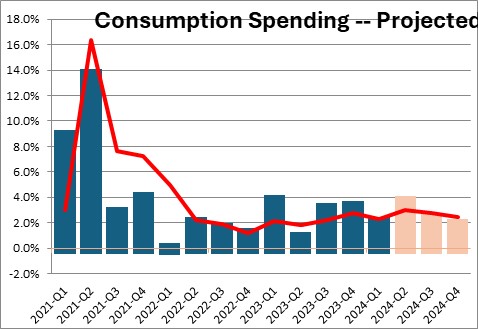

Instead, GDP growth accelerated from a 2.2% pace in the first half of 2023 to 4.9% in the third quarter and 3.4% in the fourth. Consumer spending growth exceeded 3.0% in both quarters. That should not have happened.

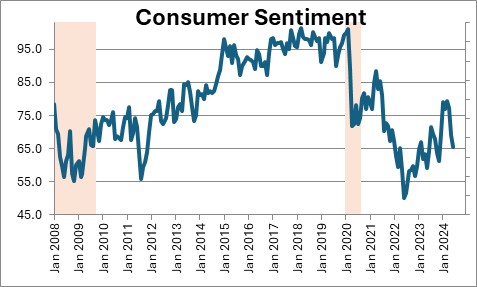

Sharply higher interest rates combined with a worrisome acceleration in inflation caused consumer sentiment to collapse. At one point sentiment fell to the lowest level on record. Even today at 65.6 it remains 30 points lower than it was prior to the 2020 recession. Those levels of sentiment are typically associated with recession. But yet the consumer keeps spending.

Personal consumption expenditures rose 3.1% in the third quarter of last year, 3.3% in the fourth quarter, 2.0% in the first quarter of this year, and are on track to climb at a 3.7% pace in the second quarter. Consumers feel terrible, but they continue to spend at a vigorous pace. This should not be happening. What gives?

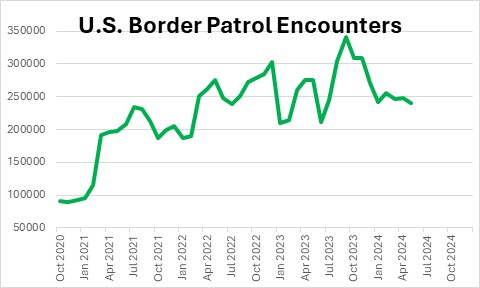

Amongst other variables, models of consumer spending rely heavily on the level and recent change in consumer sentiment and interest rates. They do not typically include any variable having to do with immigration. But in this case a dramatic increase in the number of immigrants crossing the border from Mexico appears to have been an important source of consumer spending and GDP growth. Monthly border patrol “encounters” have steadily increased in the past four years and reached a peak in the second half of last year with more than 300,000 illegal border crossers every month from August through November. It is not clear exactly who these people are, but they almost certainly include criminals, drug dealers, people involved in the sex trade, and spies from Russia and China. But that is a different story.

One thing we do know is that many of them have begun to seek — and find — employment in the United States. Since the 2020 recession all of the growth in the labor force has come from foreign-born individuals. During that period of time the labor force expanded by 3.3 million individuals. Of them 3.2 million have been foreign born, 0.1 million were born in the U.S. Thus, the foreign born labor force has risen 11.5% since 2020, the native born labor force has grown by 0.1%. These statistics are collected by the Bureau of Labor Statistics from the same survey used to calculate the unemployment rate. That is known as the Current Population Survey and the data are obtained by government workers knocking on doors and asking questions about the employment status of whoever answers the door. They almost certainly received some less-than-truthful responses which means that the official statistics understate the extent to which immigrants may have entered into and are working in the U.S..

Presumably, if they are working they are producing something, hence they are boosting consumer spending and, in turn, stimulating GDP growth. They need some place to live which is boosting the demand for housing further supplementing GDP growth and putting upward pressure on rents and the consumer price index. Not only have these individuals entered the labor force and been looking for work, for the most part they have been finding jobs. The unemployment rate was 3.5% prior to the recession. It remained at 3.5% until August of last year. That happens to coincide with the beginning of the surge in illegal immigration. The unemployment rate has since climbed to 4.0% as the job market was presumably unable to provide jobs for the tidal wave of recent immigrants.

The surge in immigration may be about to end. On June 4 President Biden announced an executive order to secure the border. It will suspend entry of noncitizens who cross the southern border into the U.S. unlawfully, and will restrict asylum for these noncitizens. If this action is successful the pace of illegal immigration will slow and GDP growth in the second half of the year will be curtailed. The long-awaited slowdown in consumer spending and GDP growth may soon arrive,

In fact, suddenly, signs of slower growth are emerging. Consumer sentiment is once again falling, retail sales have become anemic, homebuilder sentiment and housing starts are declining. Consumer spending surged in February and March which will lift second quarter GDP to 2.8%. But growth in the second half of the year should slow to something in the 1.5-2.0% range. We have heard this story before, but if the government can restrict the flow of illegal migration it might actually happen this time.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me