July 5, 2024

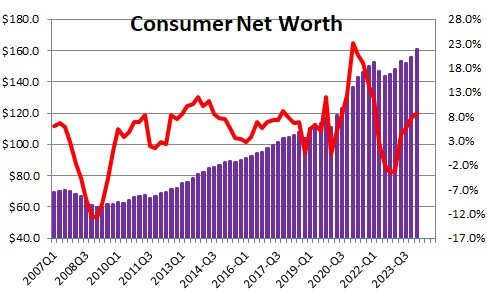

The employment report for June was weaker than expected and bolstered the markets’ belief that Fed rate cuts could happen as soon as September. In our opinion the markets are once again getting ahead of the Fed. GDP growth is showing some signs of slowing down. But slowing from what to what? We expect GDP growth of 2.0% in the second quarter and 1.7% growth in the second half of the year. But those growth rates are roughly in line with the economy’s potential growth rate. If that is the case, why ease? Furthermore, inflation remains stubbornly high and is likely to show little improvement between now and yearend. A Fed easing move would likely re-ignite the housing market and push home prices higher. Ditto for car sales. That would make it more difficult for the inflation rate to subside which is the last thing the Fed would like to have happen. With the stock market and consumer net worth at record high levels policy makers have the luxury of taking their time. Rate cuts are coming, but a premature rate reduction would make the inflation situation worse. Be patient.

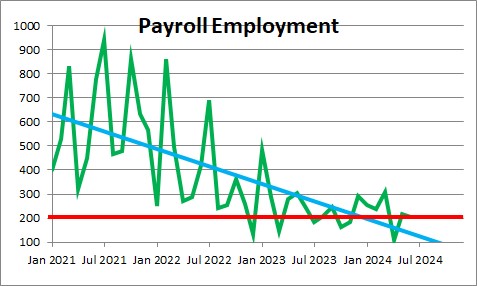

Payroll employment showed a 206 thousand increase in June which was combined with reduced employment gains in April and May. Payroll employment has risen on average 177 thousand in the past three months. Clearly, the labor market is cooling off. In the past year the labor force has risen roughly 100 thousand per month. Thus, the demand for labor today is roughly in line with supply. The labor market has lost its sizzle but is hardly weak. But to feel comfortable cutting interest rates the Fed would like to see the unemployment rate edge upwards to perhaps 4.5% at the same time that the inflation rate resumes its decline toward the 2.0% mark. Neither of those two things is likely to happen between now and yearend.

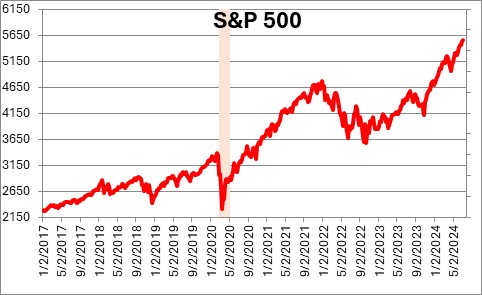

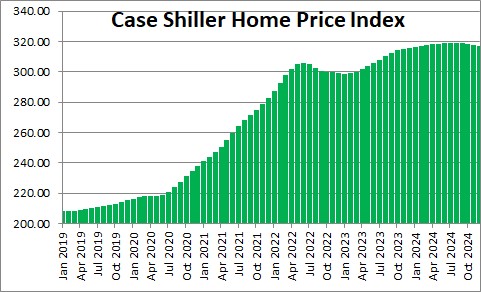

At the end of this month we will get our first look at second quarter GDP which we peg at 2.0%. A month or two ago the expected growth rate for that quarter was much higher at 3.0% or even higher. But downward revisions to earlier data and a slower pace of consumer spending in April and May has reduced the expected growth rate for the quarter. Some may argue that the economy today is still adjusting to the Fed’s final rate hike to the 5.25-5.5% mark in July 2023 and, hence, even slower growth is likely in the second half of the year. Maybe. But if the labor market remains fairly steady we expect GDP growth of 1.7% in the final two quarters of the year. Jobs are still being created. Wages are rising slowly. The stock market is at a record high level. Home prices are at a record high level. The stock market and home price combo has boosted consumer net worth to a record high level. So exactly how much of a slowdown are we likely to get?

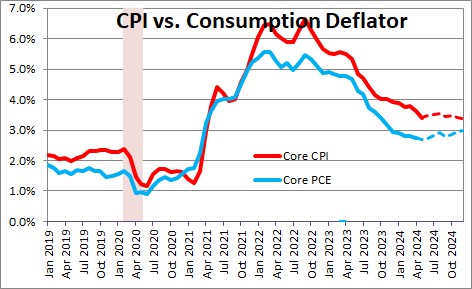

On the inflation from the core CPI has risen 3.4% in the past year. The Fed’s targeted inflation measure, the core personal consumption expenditures deflator has increased 2.6%. But in the second half of 2023 both inflation measures registered very small gains every month between July and December. As a result, neither measure is likely to register any improvement between now and yearend. We expect the core CPI for the year to be 3.4% (the same as it is currently) and the core PCE deflator to be 2.9% (higher than it is today). How in the world can the Fed justify a rate cut if those two forecasts are accurate? In the first half of 2025 the year ago comparisons will be more friendly and the inflation rate should renew its downtrend.

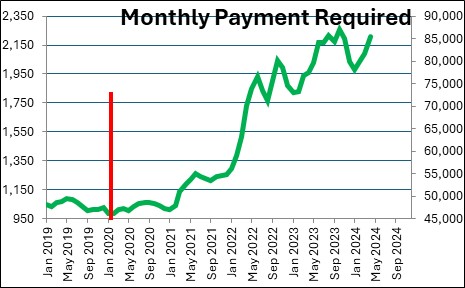

The most rate sensitive sectors of the economy, automobiles and housing, need lower interest rates to re-ignite growth. Home prices are at a record high level. Mortgage rates have climbed from 3.0% a couple of years ago to 7.0% mark. As a result, mortgage payments have more than doubled from $1,000 per month prior to the recession to $2,200 currently.

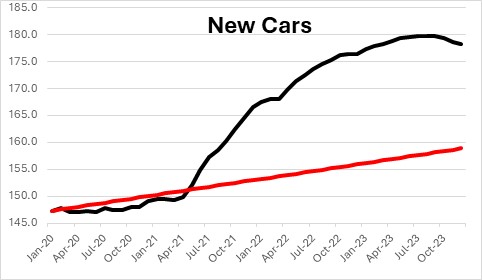

Car prices have edged lower thus far in 2024 but are 22% higher than they were prior to the pandemic. Like mortgage rates, monthly car payments have soared for exactly the same reasons.

With home prices, rent, car prices, automobile insurance, and car repairs having risen so rapidly in the past four years younger workers, in particular, are getting squeezed. The American dream of purchasing a new home and/or a new car is becoming increasingly a pipe dream.

Lower rates would help, but with inflation still higher than desired, the Fed needs to steer away from a premature rate cut. Re-igniting the housing and automotive sectors of the economy, at the least, will make it more difficult for the inflation rate to drop to the desired 2.0% pace.

If early next year the economy is chugging along at a 1.7% pace and the inflation rate resumes its downtrend, then the Fed can begin its long-awaited rate cut initiative. Jumping the gun would be counterproductive.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me