September 13, 2024

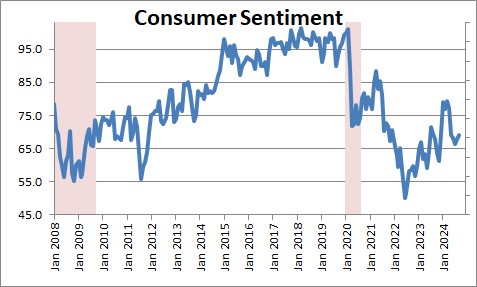

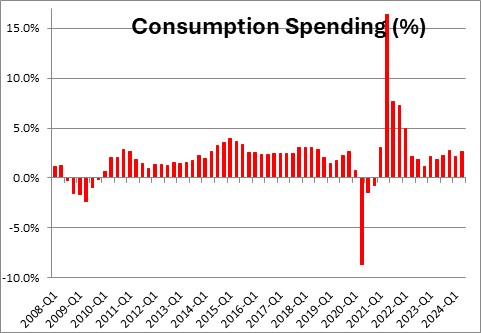

One of the mysteries of the current expansion has been the contrast between consumer confidence – which is terrible – and consumer spending – which is not. All of the various consumer confidence surveys are close to the low point reached in the 2020 recession and not far from the nadir of the 2008-2009 recession. Typically when consumer attitudes are depressed they cut back on spending. Not this time. There is little evidence of any pullback in spending thus far. To maintain their lifestyle consumers are dipping into savings and running up credit card balances. Can consumers hang in there? We think so.

Consumer sentiment plunged during the pandemic in 2020. When the recession ended two months later and the economy re-opened, consumer spirits began to climb only to sink again when the Fed began to raise interest rates. Consumers eventually became even more discouraged than they were at the low point in 2008-2009. That particular downtown was dubbed “The Great Recession” because it was the longest and deepest recession since the depression in the 1930’s. Sentiment has rebounded somewhat, but at 69.0 currently it is roughly 30 points lower than it was prior to the 2020 recession. When asked, consumers seem particularly concerned about inflation. But inflation has retreated to the 2.5% mark. Why all the worry?

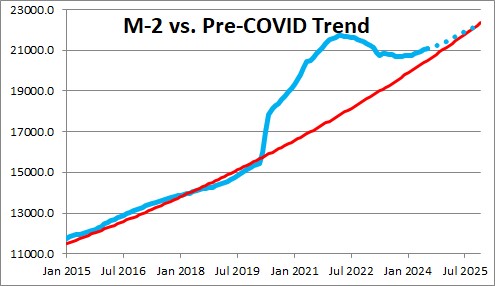

The run-up in inflation was caused by the Federal Reserve. Between March 2020 and March 2022 the Fed purchased $4.0 trillion of U.S. Treasury securities. Growth in the money supply surged. The U.S. economy was awash in surplus liquidity. No wonder we had an inflation problem! Since then the Fed has been shrinking its balance sheet and most surplus liquidity has been eliminated.

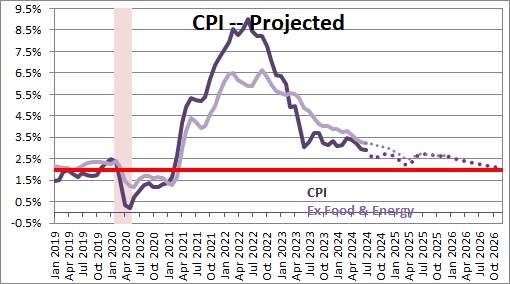

As the money supply soared and then contracted, inflation followed suit. After peaking at 9.0% in June 2022 it has retreated to 2.6%. Virtually every economist agrees that it is on a slow march to the 2.0% target. The problem is that while the rate of growth of prices may have slowed from 9.0% to 2.6%, prices never declined. That is the source of consumer angst.

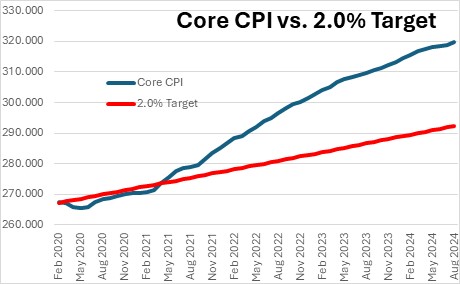

The level of the CPI today is 9.5% higher than it would have been if inflation had risen at a steady 2.0% pace since the end of 2019. The inflation run-up has significantly eroded consumer purchasing power.

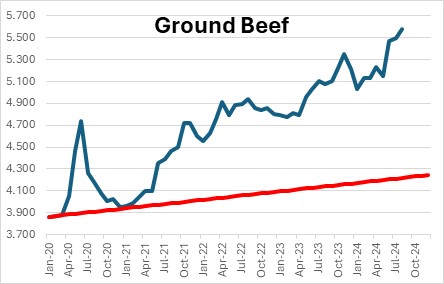

A few examples are in order. One pound of ground beef has risen 45% in four years from $3.86 to $5.58. A dozen eggs have climbed 110% from $1.53 to $3.20. Rent has risen 25%. Car insurance has climbed 50%. Car repairs 48%. All of these items are necessities. We have to eat. We have to pay the rent. We have to keep the car going so we can get to work, which means we have to fill the tank with gas and pay for insurance and repairs. It is hard to find substitutes for these items. Because spending on necessities constitutes about two-thirds of a family’s total spending, when those prices rise there is less money left over for savings, debt repayment, or a family vacation. That hurts. And the impact is greatest on those families at the low end of the income scale. Many of them now have to choose which bills to pay each month. No wonder consumers are concerned.

Typically when consumers get nervous they cut back on spending. They worry whether they will have a job in the months ahead. Caution is warranted. Spending declined in 2008-2009 and again in 2020. But there is no evidence yet that consumers are getting nervous about spending. They seem intent on maintaining their lifestyle.

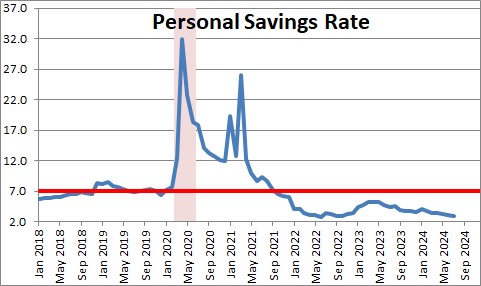

To do so they have slashed the savings rate from an historical average of 7.0% to 2.9%.

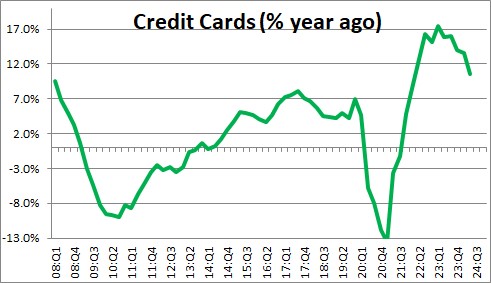

They have chosen to run up credit card debt. Card growth is zipping along at a speedy 10.6% pace. Such borrowing is extremely expensive with interest rates of 20-25% applied to the outstanding balance.

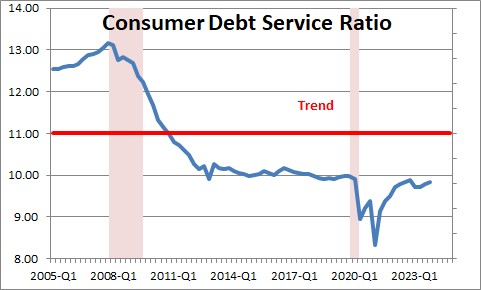

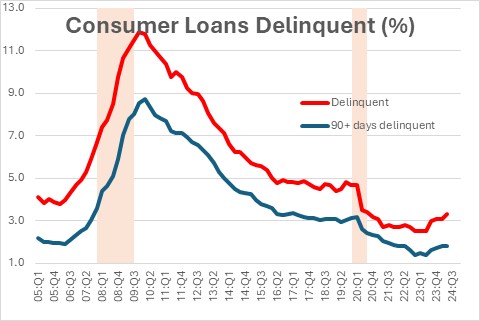

One reason consumers are not struggling is that they have little debt. When the government sent out stimulus checks in 2020 and 2021, consumers apparently used a significant chunk to pay down debt. Debt in relation to income fell to a record low level. The rapid run-up in credit card debt has caused the debt service ratio to climb, but it started at a record low level.

Thus far, consumers are having little difficulty making their monthly payments. Delinquency rates have risen slightly but remain below where they were prior to the recession.

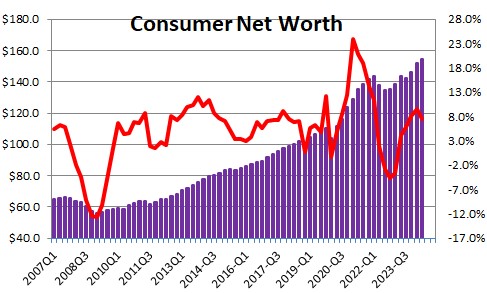

Another factor allowing consumers to keep spending is that their net worth is at a record high level. The increase in net worth has been fueled by the surging stock market and steady increases in home prices. If a family member gets laid off, he or she has a significant cash cushion to ease the pain.

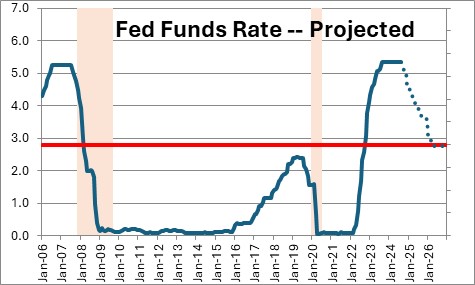

Looking forward, a series of rate cuts by the Fed will buoy consumer spirits and spending. The funds rate is currently 5.3%. We expect a series of 0.25% rate reductions by the Fed beginning next week and continuing until the funds rate reaches 2.8% sometime in the first half of 2026. That will provide a steady source of stimulus for the U.S. economy.

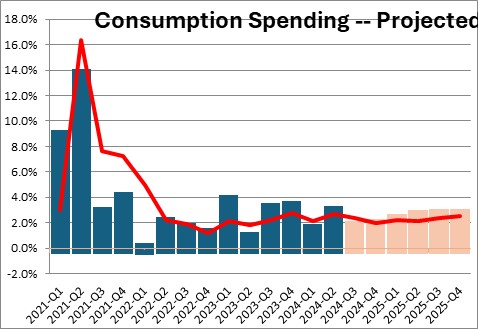

Against this background we believe that consumer spending will continue at roughly a 2.5% pace. That should allow GDP growth to expand at a roughly comparable 2.5% rate through the end of next year and 2026.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me