June 28, 2024

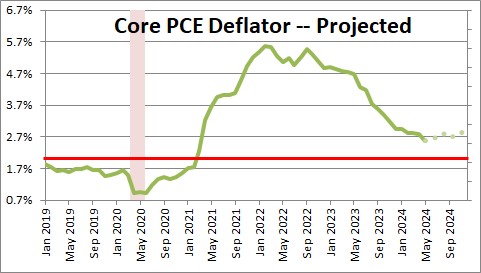

Recent data suggest that the economy has downshifted from its relatively rapid pace in the first half of the year. However, the political outlook has gotten even more uncertain in the wake of the presidential debate. This clouds the economic outlook for 2025 and beyond. Longer-term growth aside, the outlook for the second half of this year has become clearer. Income growth has slowed in the first five months of this year to about the 1.0% mark. Anxious to maintain their lifestyle consumers relied heavily on their credit cards in the early part of the year but, finally, spending appears to be less exuberant. This suggests that second half GDP growth will be less robust than it was earlier in the year. At the same time the Fed’s targeted inflation measure, the core personal consumption expenditures deflator, rose less than expected in May. Not surprisingly, the markets now believe that the Fed will cut the funds rate at least once or perhaps twice between now and yearend. But before going too far down the road it is important to keep in mind that the stock market is at a record high level which is bolstering consumer net worth. It is hard to imagine a dramatic growth slowdown under those circumstances. For what it is worth we anticipate GDP growth of 1.8% in the second half of the year with a single rate cut in the funds rate in December to 5.0-5.25%. A modest slowdown in GDP growth, a gradual tapering off of the inflation rate, and a slow but steady reduction in the funds rate over the next couple of years is hardly exciting, but it should lead to sustainable growth for the foreseeable future.

By now everybody has digested the outcome of the presidential debate. It seems likely that leaders of the Democratic Party will increase the pressure on President Biden to step aside. While that may be the desired outcome, there are significant logistical challenges in making that happen unless President Biden cooperates. Thus, the debate significantly clouds the economic outlook for 2025 and beyond.

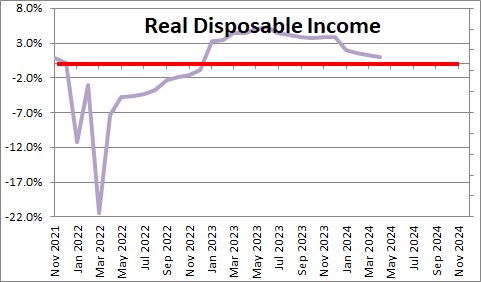

Between now and yearend the economy seems to be slowing down to a more sustainable pace. In the past several months real disposable income growth, which provides the fuel for consumer spending, appears to have slipped from a solid 3.8% pace in 2023 to 1.1%.

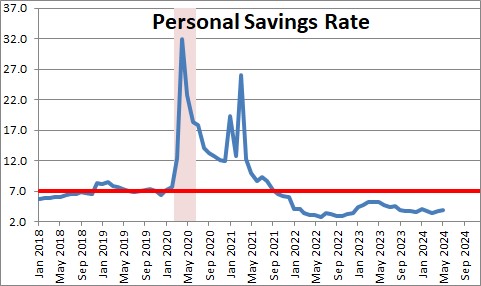

Consumers initially did not want to curtail their pace of spending so they opted to save less of their paycheck. The savings rate has dropped from an average of 7.0% in the past 20 years to 3.9%.

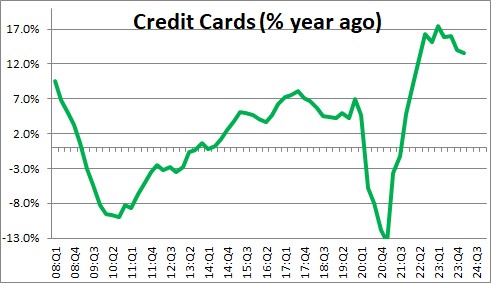

Consumers also ratcheted up credit card borrowing to maintain their pace of spending. But dipping into savings and running up credit card debt are not sustainable solutions over the long haul. Eventually, spending will have to downshift to a pace more consistent with the growth in income.

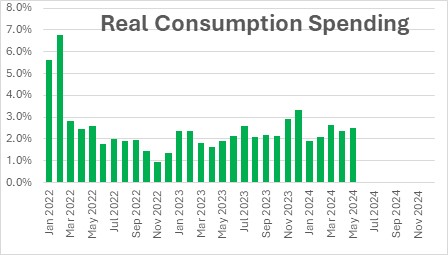

In the past year real consumer spending has been fairly steady with growth of 2.4%. But in the past three months that growth rate has dropped down to 1.8%. Reality seems to be setting in and consumer spending is finally taking a modest hit.

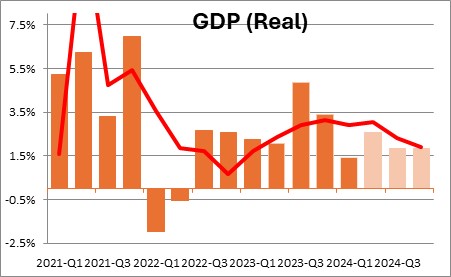

All of this is setting the stage for slower GDP growth in the final two quarters of this year. For what it is worth we anticipate 2.6% GDP growth in the second quarter followed by roughly 1.8% growth in the second half of the year.

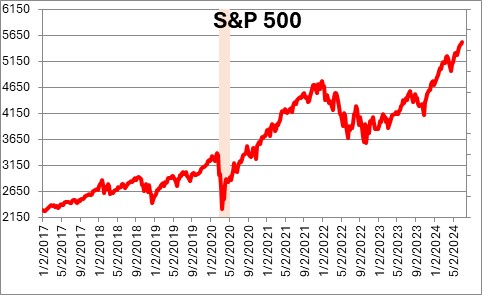

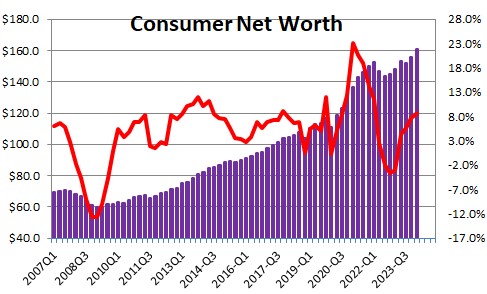

Some economists fear that this is the beginning of a more substantial downshift in growth. But the stock market is at a record high level having risen 25% in the past year.

Driven by the combination of rising stock prices and still climbing home prices, consumer net worth is also at a record high level having risen nearly 9% in the past year. It is hard to envision a meaningful pullback in consumer spending under these circumstances.

Meanwhile, the Fed’s preferred inflation gauge, the core personal consumption expenditures deflator, rose 0.1% in May which was less than expected. The year-over-year growth rate slowed to 2.6% compared to the Fed’s 2.0% target. This has fueled speculation of significant Fed easing by the end of the year. But be careful. In the second half of last year the core CPI registered a series of 0.1% gains each month. For the year-over-year growth in the core PCE to slow farther between now and December, the monthly increases will have to average less than 0.1%. This seems unlikely. As a result, we expect the core CPI to actually increase to 2.9% in 2024. A slight increase in the year-over-year growth rate between now and yearend will make it difficult for the Fed to ease significantly.

In short, GDP growth seems to be slowing to a more sustainable 1.8% pace. The inflation rate continues to edge its way lower — although less quickly than hoped for. And the Fed should be able to initiate what will probably be a protracted period of rate cuts in December with the funds rate eventually dropping from 5.3% currently to 3.0% or so by mid-2026. If that is the case, this expansion still has legs.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me