September 20, 2023

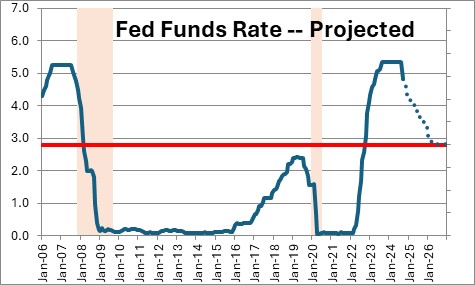

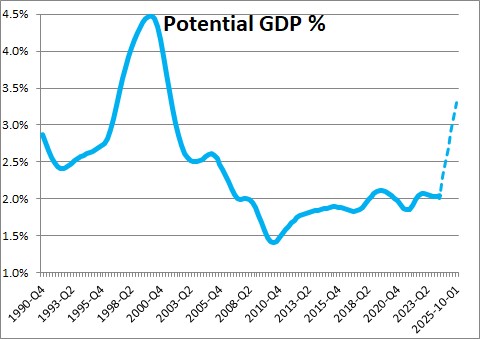

The financial press has been filled with analysis (and over analysis) of the Fed’s decision to the cut federal funds rate by 0.5% to 4.75-5.0%. Some economic experts suggest that the economy must be far weaker than the Fed is suggesting publicly to warrant the outsized rate reduction. Others suggest pollical motives with the election just 46 days away. Our explanation is far simpler. The funds rate had been 5.3%. The ultimately objective is to reduce it to 2.9%. Whether rates were chopped by 0.25% or 0.5% in September is irrelevant. The funds rate will remain far above where it is supposed to be for another year. Fed policy remains restrictive, but somewhat less restrictive than it was a few days ago. One other fear we have heard is that by reducing the funds rate quickly when the economy is still chugging along at a reasonably rapid rate, the risk is that the faster growth induced by the rate reductions could trigger a resurgence of inflation. We do not buy that either. It is our belief that productivity growth has accelerated and that the economic speed limit (otherwise known as its potential growth rate) has been raised from 1.9% to perhaps 3.3%. The economy can grow more quickly without risking a re-emergence of inflation.

We were surprised by the 0.5% reduction in the funds rate. We were in the 0.25% camp. But we believe it really does not matter very much. Many more rate reductions are required for the funds rate to get into the vicinity where it is supposedly “neutral” and thereby neither stimulating nor restricting growth. The Fed believes that when inflation is at its 2.0% target, the funds rate should be 2.9%. The funds rate has been stuck at 5.3%% for a year. The funds rate needs to fall by 2.4% to get close to that so-called neutral rate. The recent 0.5% reduction is a drop in the bucket relative to what the Fed eventually needs to do. All this discussion strikes us as much ado about nothing.

Then there is the political argument that the 0.5% rate cut was designed to elect Kamala Harris and keep the presidency in the hands of Democrats. In our view that is rubbish. The rate cut was not politically motivated. With monetary policy affecting the economy with so-called “long and variable lags” whatever the Fed chose to do on September 18 would have virtually no economic impact prior to the November 5 election. It is true that the Fed usually (but not always) tries to stay out of the political discussion by not changing rates in last couple of months prior to an election. With the economy seemingly on a respectable growth path of about 2.0% in the third quarter the Fed did not need to do anything at its meeting in September. The economy would not fall apart if it waited another 46 days. It needlessly injected itself into the election debate. From an economic standpoint whether it cut rates by 0.25%, 0.5%, or even chose to do nothing in September would not impact the economy between now and November 5. From a political viewpoint the decisive Fed action put it on the defensive.

But let’s look at the final argument. Is the economy strong enough currently that aggressive Fed easing runs the risk of re-igniting a currently benign inflation outlook? We do not share this fear. In the past four quarters GDP growth has averaged 3.1%. We do not yet know the third quarter GDP growth but it appears to be roughly 2.0%. The Fed believes that the economic speed limit is currently 1.9%. If prior to any rate reductions the economy was chugging along at a 3.0% rate, doesn’t aggressive rate cutting run the risk of re-igniting inflation? Our answer is no.

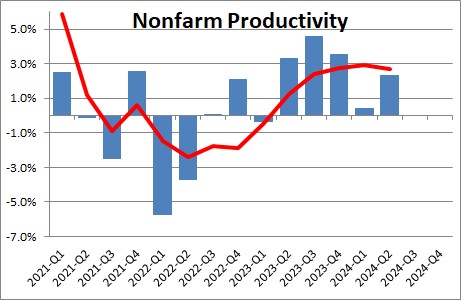

Think about it. The economy has been zooming along at a 3.0% pace for the past year. It is at full employment but yet the inflation rate has slowed. The core CPI has slipped from 4.4% in August 2023 to 3.3% in August 2024. If the economy’s potential growth rate were 1.9% that should not have happened. Inflation should have risen. We think that the reason for that is that potential growth is no longer 1.9% but more likely 3.0-3.5%.

The economy’s potential growth rate (or economic speed limit) is currently believed to be 1.9% consisting of 0.9% growth in the labor force combined with 1.0% growth in productivity. But in the past year productivity growth has accelerated to 2.7%. We would suggest that when the labor market is very tight, workers are hard to find, and the economy is still expanding, business leaders should spend money on technology to boost the productivity of those workers already on the payroll. Increasing output without boosting headcount translates into faster growth in productivity. Overlay that with AI which is expanding rapidly. Every firm in America is testing AI to see what benefits it can bring. That suggests to us that rapid productivity growth will continue for years to come.

If productivity growth is going to remain rapid then potential growth must also have accelerated. If we change the equation and add 0.8% growth in the labor force plus 2.5% growth in productivity, potential growth jumps to 3.3%. Is that implausible? We do not think so. Productivity surged to 4.5% or so in the 1990’s when the economy was first adjusting to the internet. Can AI do the same thing to the economy in the 2020’s. We think it can.

The Fed acted more aggressively than we thought last week. But given the gap between where the funds rate was (5.3%) and where it needs to be (2.9%), we believe that a 0.5% cut was not unwarranted even thought that was not what we expected. We also do not believe that aggressive Fed easing is going to re-ignite inflation. The economy can sustain GDP growth of 3.3% or so and not risk a renewed run-up in inflation.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me