February 8, 2019

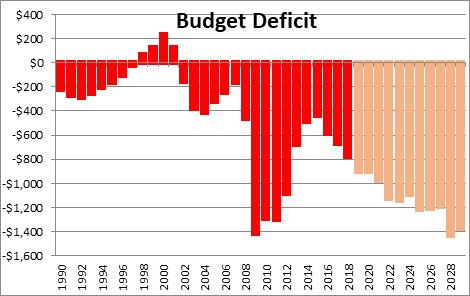

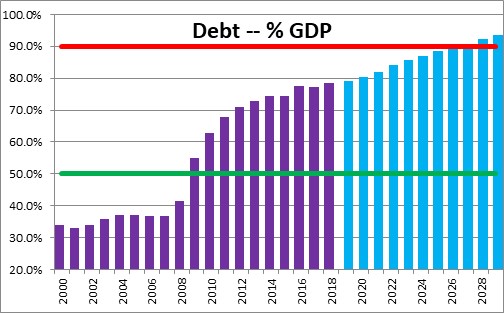

The Congressional Budget Office (CBO) recently released its annual budget forecasts for the next decade. While marginally smaller than projections made in the spring of last year, it anticipates deficits that grow steadily and exceed $1.0 trillion each year beginning in 2022. Given this string of consecutive deficits, Treasury debt outstanding is projected to climb and reach 93% of GDP in 2029 which would be its highest level since just after World War II. Budget forecasts are always tricky because of both economic uncertainty and future legislative action, but it is hard to imagine anything other than a steadily deteriorating fiscal situation for years to come.

The CBO anticipates a budget deficit of roughly $900 billion for 2019 and 2020 but the deficits then exceed $1.0 trillion each year beginning in 2021.

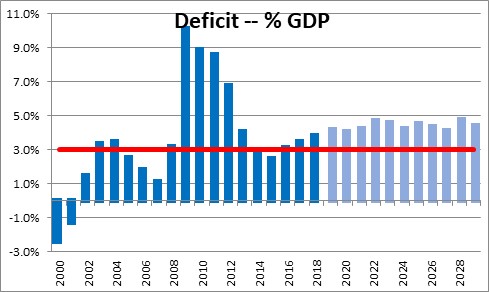

Economists typically look at budget deficits as a percent of GDP. Over the forecast period the projected deficits average about 4.5% of GDP. The only other times the deficit has been so large were immediately after World War II and in the wake of the 2007-2009 recession. Over the past 50 years the budget deficit has averaged 3.0% of GDP which most economists regard as being sustainable. Unfortunately, 4.5% is not 3.0%.

Whenever the federal government incurs a deficit, the U.S. Treasury must issue an equivalent amount of debt to finance that shortfall. This means that over the next decade Treasury debt outstanding will increase by roughly $1.0 trillion every single year. As a result, debt as a percent of GDP will climb from 78% today to 93% of GDP by 2029 which is its highest level since just after World War II. Worse yet, with the aging of the population the debt to GDP ratio could easily reach 150% of GDP by 2049 — far higher than it has ever been. Economists suggest that a debt to GDP ratio above 90% is dangerous because foreign and domestic investors will become reluctant to purchase Treasury debt without a significant increase in interest rates to guard against the possibility of default. To further put this number in perspective, consider the fact that Greece’s debt/GDP ratio is currently 175% of GDP. It is abundantly clear that the U.S. fiscal position is headed in the wrong direction for the foreseeable future.

What is causing these outsized deficits? Too little revenue? Or too much spending?

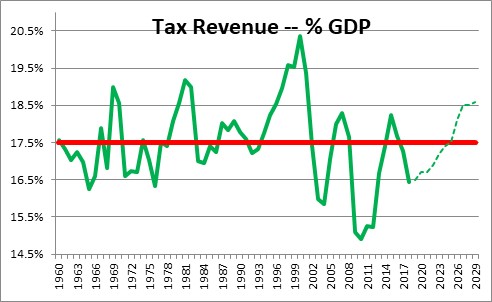

On the revenue side, the steady growth in projected federal tax revenues is fueled by continued economic growth. Growth generates income which, in turn, boosts individual income tax receipts. The CBO anticipates that tax revenue will climb from 16.5% of GDP this year to 17.5% by 2025 which is roughly in line with its 50-year average. The projected growth in revenues beyond 2025 to 18.5% is largely attributable to the expiration of nearly all the individual income tax provisions included in the 2017 tax act. If Congress chooses to extend those tax cuts the revenue projections would be reduced, and the anticipated budget deficits would be even larger. Thus, the projected deficits are not attributable to a shortfall of tax revenue.

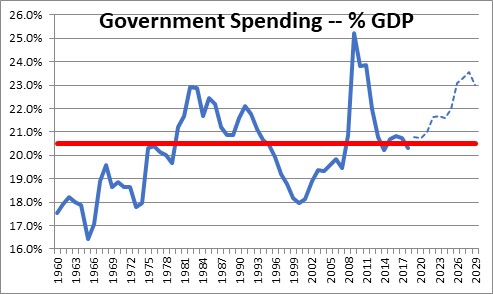

Government expenditures are projected to rise over the coming decade. Specifically, outlays are expected to rise from 20.8% in 2019 (which is roughly in line with its historical average) to 23.0% by 2029. Most of this increase can be attributed to the aging of the population. As our population grows an increasing number of older adults will retire and begin to receive Social Security. At the same time they become eligible for Medicare benefits. Meanwhile, interest rates are likely to rise to more normal levels, which will boost the interest expense on the public debt. Because this increase in expenditures is largely driven by demographics it is inescapable.

In our view, this situation described above is unsustainable. Furthermore, because the problem is on the spending side any serious budget improvement can be achieved only by trimming expenditures, entitlement spending in particular – Social Security, Medicare, Medicaid, welfare benefits, and veterans’ benefits – because such expenditures now comprise two-thirds of all government spending.

Spending cuts will not be on the agenda under this president which means that nothing will happen for at least two years and perhaps as many as six years.

If Democrats should win the election in 2020 with its “Green New Deal” as a platform, the budget will spiral out of control by the end of the next decade. The sponsors want to achieve 100% clean energy by 2030, upgrade all existing buildings in the U.S. to maximal energy efficiency, expand high-speed rail so broadly that air travel would almost become obsolete, guarantee a job at a living wage for every American, and provide all people of the United States with high-quality health care. They propose to pay for this via a higher estate tax on the wealthiest Americans and by raising the tax rate on the top 1% of wage earners. That is not going to happen. The moment those taxes are raised wealthy Americans will exploit loopholes to shrink their tax liability and simultaneously shift their wealth offshore.

In our view, the Republicans lack of attention to the budget situation is unacceptable. The Democrats alternative is worse. Our sense is that budget issues will not be addressed until a crisis arises — perhaps triggered by the next recession.

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve,

Do you have a contact at the WSJ or Bloomberg to get this published?

Maybe we can hack into the government and force everyone to read this!

Miss you,

Jerry

Hi Jerry,

Nice to hear from you. From what I hear from Peter you all seem to be doing good things up there. Glad to hear it — but not really a big surprise!

I would not h old my breath waiting for Congress/the President to switch gears. But then again, what’s new? I think they missed their chance when Obama scuttled the Simpson/Bowles bipartisan agreement in 2010.