May 13, 2016

The markets have largely written off the possibility of an increase in the funds rate in June. But a rate hike by the Fed at its June 14-15 meeting is increasingly likely. First, GDP growth in the U.S. is rebounding nicely from its winter slump. Second, the economic situation overseas is relatively upbeat. The timing is right for the Fed to act.

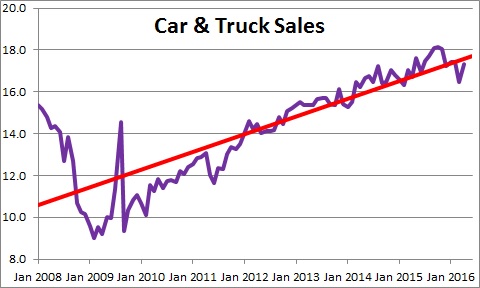

Retail sales rose 1.3% in April which was the biggest increase in more than a year. Part of the increase came from auto sales which rose 3.2% last month. Auto sales are always volatile. Nevertheless, they are basically the fastest they have been in a decade. People do not buy cars (and houses) unless they feel confident about the pace of economic activity in the months ahead.

Rising gasoline prices also contributed to the April increase. But that reflects an increase in prices and not an increase in the amount of gasoline sold. Apart from autos and gasoline, sales rose 0.6% in April, 4.4% in the past year, and 6.0% in the past three months. The consumer is on a roll.

Then there was the dramatic increase in consumer sentiment for May. The University of Michigan index jumped 6.8 points in May to 95.8 with the bulk of the increase in the expectations component. One should never overreact to a single month of data, but this is a much larger than usual increase.

When we add up the bits and pieces we conclude that second quarter GDP will come in at about 2.3% after sluggish growth in each of the two previous quarters. The Atlanta Fed’s reasonably accurate tracking model places second quarter growth at 2.8%, so the risk is that GDP growth is stronger than expected.

But what about economic conditions outside of the U.S.? They caused the Fed to postpone its initial rate hike from October to December last year. They also prevented the Fed from a second rate hike at its meetings in March and April. But now they seem favorable.

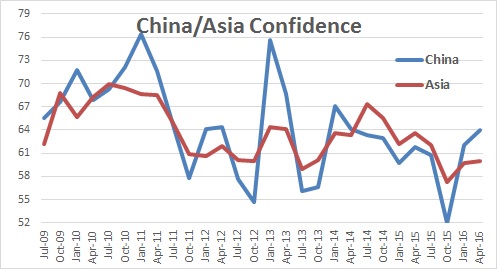

First of all, the fear that GDP data for China are significantly overstated appears to have subsided. After a long slide late last year and into the early part of this year, the Shanghai Composite Index has traded sideways for the past four months.

In addition, the Young Presidents’ Organization’s (YPO) survey of CEO confidence in both Asia as a whole and in China has risen in each of the past two quarters. This suggests that business leaders in that end of the world expect growth to continue at a reasonable pace.

Finally, the IMF kept its GDP growth forecast for China at 6.5% for this year which is unchanged from its earlier projection.

From the stock market, to a survey of CEO confidence, to the IMF’s economic forecast it appears that the pace of economic expansion in China – and Asia — appears to be stabilizing.

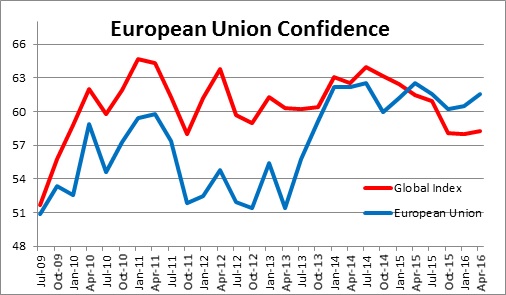

What about Europe? Economic conditions in the E.U. actually seem to be getting better. First, like the Shanghai Composite Index, the Euro Stoxx 50 stock market index has been steady for the past several months.

Second, YPO executives in the E.U. remain extremely confident. The confidence index for the E.U. rose in both January and April. This is the fifth consecutive quarter that the E.U. confidence index has been higher than the global reading, and the third consecutive quarter when E.U. confidence has been the highest of the nine regions surveyed. That stands in stark contrast to the dark days of 2011-2013 when the continent was suffering through a continuing series of financial crises.

Europeans are upbeat because the Euro area is currently receiving considerable stimulus from a number of sources. Oil prices have fallen precipitously in the past eighteen months. The dollar has fallen dramatically against the dollar since the spring of 2014 which makes European goods cheaper for Americans to buy which should stimulate growth in European exports. Finally, the European Central Bank lowered rates again in March and is prepared to provide additional stimulus if necessary. No wonder the European Community is upbeat.

Given these stimulative factors the IMF expects GDP growth for the E.U. this year of 1.8% after a 2.0% gain in 2015. These are the fastest growth rates for Europe since 2007.

From the Fed’s viewpoint, clear evidence that the U.S. economy is back on track should be reassuring, and it appears that global economic conditions are encouraging. That is in stark contrast to the sharp stock market declines and general concern about global growth that existed late last year and the early part of this year. The Fed needs to raise rates by several percentage points and it should take advantage of opportunities to gradually increase them. While the next recession is still several years down the road, the Fed needs room to lower rates once it arrives.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me