June 23, 2023

With every passing month the Conference Board’s index of leading indicators continues to decline and economists become even more convinced that a recession is on the immediate horizon. The problem is that the economy is not cooperating. Businesses are still eagerly hiring workers. Hourly wages are rising. As a result, consumer income is climbing, which provides the fuel for further spending in the months ahead. Consumer spending remains solid for now but it will eventually decline. For an early hint of when consumer angst has risen to point that a recession is imminent we focus on the two biggest ticket items in a consumer’s budget – housing and autos. The housing market is hanging in there. Existing home sales are struggling because there is little available supply so potential home buyers have switched to new homes which are more readily available. Car and truck sales have risen in recent months as supply constraints have abated. If the economy were truly on the cusp of a recession, we would expect consumers to curtail spending on these two big ticket items but they have not done so. Why? Because interest rates are not high enough to cause employers to lay off workers. Once that happens, consumers worry about whether they will have a job six months from now and they will want to save some money. The resulting cutback in spending will begin with the two big ticket items and spread from there. But we are not at that point. Rates need to keep climbing.

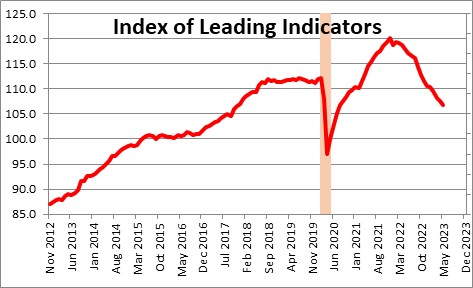

The index of leading indicators declined again in May. It has fallen for 15 consecutive months and has been signaling recession for a year. This index has never fallen so far for so long without the economy slipping into a recession. Having said that, the long-anticipated recession is far overdue and it does not appear to be on the immediate horizon. While many economists are forecasting a recession in the second half of this year, we are not amongst them. That does not mean we are not anticipating a recession at some point. We are. But for the expected recession to become reality we think the Fed needs to push rates higher than it or anybody else envisions at the moment. It will eventually get there, but it may take a while.

When the economy reaches the edge of the cliff and is about to slide into recession we will see home sales and car sales begin to decline. This makes sense because these are the two biggest ticket items in any consumer’s budget. We can save more money by postponing the purchase of a new home and/or extending the life of the current car for another year or two. For now these two harbingers of troubled times ahead are not flashing warning signs.

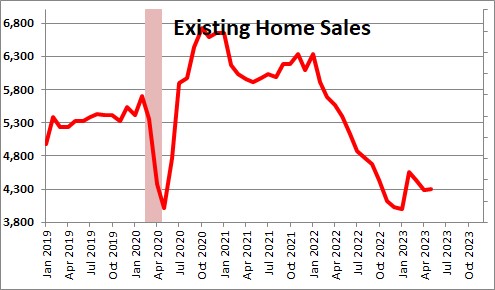

Existing home sales hit bottom in January but the subsequent rebound has been anemic. But the lack of vibrancy has not been caused by a shortfall in demand.

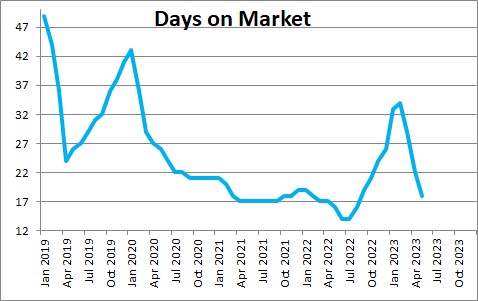

In fact, properties remained on the market for just 18 days in May which is one of the shortest lengths of time between listing and sale ever. Seventy-four percent of the homes sold in May were on the market for less than a month.

The anemic rebound in sales was caused by an acute shortage of homes available for sale. In May there was a 3.0-month supply of homes on the market, which is roughly one-half of the 6.0 month supply that is required to balance supply and demand. Someone may be prepared to buy but the realtor has few homes available to show them, some of which will not be the proper size, not close enough to a school, too expensive, or in need of repair. So, what do they do? They check out a new home.

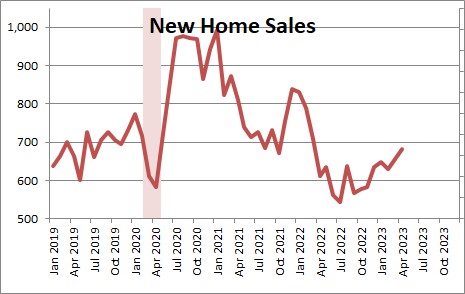

At 683 thousand new home sales are roughly in line with where they were prior to the recession. This is largely because there is a more substantial 7.6 month supply on the market. As we see it, the demand for housing has hit bottom and is beginning to climb slowly. By boosting the pace of construction builders are creating additional supply which has begun to boost the sales of both new and existing homes.

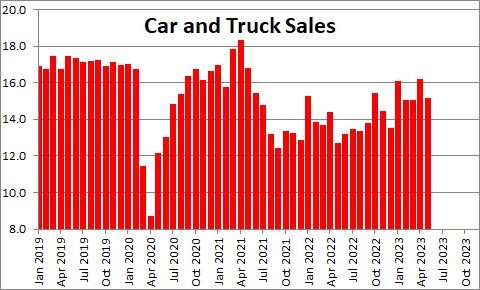

The other big ticket item, car sales, has risen in recent months as supply constraints that existed a year or so ago have disappeared. While somewhat lumpy from month to month, at 15.0 million units car sales are almost 20% higher than they were a year ago and seem to be climbing. The consumer is showing no reluctance to purchase a new vehicle – if he or she can find one in the dealer’s showroom.

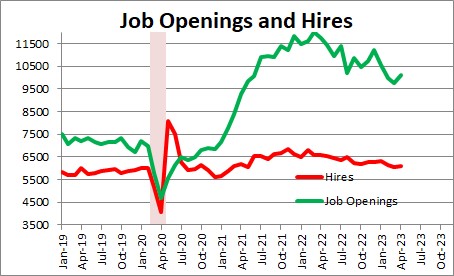

We suggest that the economy is unlikely to fall into recession until such time as consumers begin to worry about their jobs. Currently the economy is cranking out 283 thousand jobs per month.

Meanwhile, job openings at 10.1 million have slipped from their peak but are far higher than the 7.0 million pace that existed prior to the recession. Any way one slices it, the demand for labor continues to far outstrip supply.

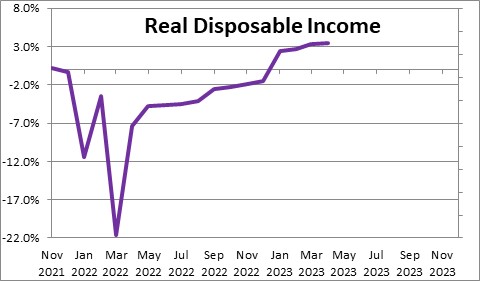

If firms continue to hire and hourly wages continue to climb, income will grow. After a long period of decline, real disposable income has risen 3.4% in the past year. Income growth may slow somewhat in the months ahead but as long as it keeps growing it will provide fuel for the consumer to keep spending.

While the economy is continuing to expand and is frustrating the naysayers, it is not bulletproof. The day of reckoning will come when interest rates have climbed to a level that business leaders decide that they need to reduce headcount, and when consumers wonder if they will have a job six months hence. At that point they will begin to curtail spending – with houses and cars leading the way.

We are guessing that the peak in the funds rate will be around the 6.0% mark by late fall which will boost the real funds rate to +1.4%. Currently with the funds rate at 5.25% and the core CPI at 5.3%, the real funds rate is 0% which is not high enough to induce fear in anyone. The Fed needs to keep going.

Stephen D. Slifer

NumberNomics

Charleston, S.C.

While of course there was some isolated examples of ‘demand pull’ triggers caused by the various Covid relief programs (basically giving a whole lot more people, a whole lot more disposable income and fewer places to spend it…) but that was transitory and has mostly flushed it’s way out of the system. Household savings is back to very low and household debt is back to very high.

No, this sticky inflation is ‘Cost Push’ driven; (Supply chain disruptions, higher energy costs, not enough willing workers, higher wages, etc.). AND a symptom of the massive surge in the M2 money supply.

The blunt instrument of raising interest rates more – won’t solve the problem. The Fed should focus more on continuing to reduce M2 – otherwise, the solutions need to come from FISCAL policies.

Congress should focus on more targeted solutions (reduce government spending, improve the supply side issues, ensure easy / cheap access to fuel, policies to encourage more labor participation, etc.).

Stephen, it is interesting times we live in. Maybe the recession rules of the road for so many years have changed. Thanks again for your analysis. I really appreciate it.

Darrel

Hi Nick. Thank you for your comments.

You are right that most of the stimulus money has disappeared. However, as I noted in the article, jobs are still rising and hourly wages are climbing which means that income is rising as well. In the past year real disposable income has risen 3.4%, As long as income keeps climbing consumer spending should rise as well. And you are right that the savings rate has fallen to an historically low level. But consumers have turned to credit card borrowing to allow them to keep spending. While not sustainable in the long run, it can keep consumers going for some length of time because their debt obligations as a percent of income are still very low. We can afford the additional debt payments.

I fully agree with your comments about the money supply. The Fed should continue to cause it to decline. But the recent declines still only partially offset the runup in M-2 during the recession and the year beyond. The recent declines have eliminated much of the surplus liquidity, but it will probably not disappear entirely until the end of this year.

And while Congress should do a lot of the things you suggest, I do not believe any of that is going to occur any time soon.

Thanks Darrel. Despite a widely anticipated recession, the data keep getting stronger. We are all scurrying to get a handle on the new normal.