February 15, 2019

Many economic statistics for December and January were delayed by the government shutdown. As those reports have become available, we discovered that the economy was considerably weaker at the end of last year than had been anticipated. But keep in mind that the stock market experienced a 20% selloff that began in October, the Fed raised rates in mid-December, and the government shutdown began on December 22. While economists expected some economic softness as a result of these factors, recent data indicate that the slowdown was far more pronounced than expected. However, the stock market has already reversed most of its earlier drop, the Fed has pledged to keep rates steady for the foreseeable future, and the government shutdown has now ended. Thus, it is a virtual certainty that the December/January economic slump will be largely reversed in the months ahead.

Without question the biggest surprise in recent statistics is that retail sales plunged 1.2% in December. That was the largest single-month decline since the end of the recession. Furthermore, the drop was widespread with virtually every category of sales contributing to the decline. Clearly, the stock drop, the expectation for further rate hikes, and the first few days of the government shutdown produced a much larger-than-expected drop-off in sales. But despite the surprisingly large December decline we believe that retail sales and the pace of economic activity in general will rebound in the months ahead for a variety of reasons.

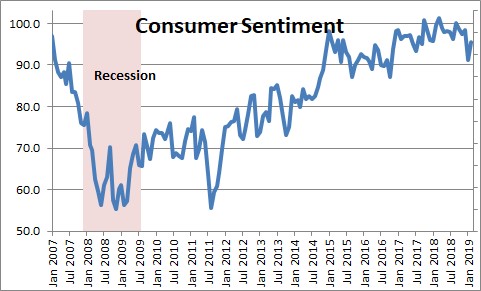

Consumer sentiment. Sentiment was hit hard in January. But the seven point drop in that month was partially offset by a 4.3-point increase in early February. Furthermore, the University of Michigan indicated that at the time of the most recent survey there was still a lingering threat of a second government shutdown which, of course, did not happen. Thus, sentiment should complete its recovery in March or April.

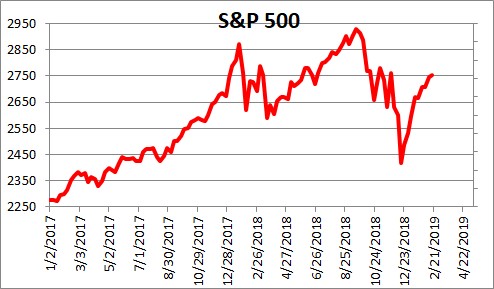

Stock market. The stock market selloff that began in October contributed significantly to the decline in confidence. The S&P 500 index fell 20% from its October high through mid-December as the prospect of further Fed rate hikes, a widening trade war, and a looming federal government shutdown frightened investors. That combo produced the biggest stock market selloff since the recession. While most economists believed the selloff would prove to be moderate, the magnitude of the decline and its extreme volatility raised concerns that a recession might be in the cards late this year or in 2020. Subsequent events have made it clear that those earlier fears were exaggerated and, as a result, the stock market has recovered two-thirds of its earlier losses and is now only about 6% below its prior peak. So, what changed?

The Fed. Perhaps the biggest change is with respect to the Fed. It raised the funds rate by one-quarter point at its meeting in mid-December and indicated that some further gradual increases in the target range for the federal funds rate would be required. Market participants feared that the Fed was ignoring reality, could raise rates too much, and perhaps trigger an unintended early end to the expansion. However, subsequent speeches by Fed Chair Powell have made it clear that while additional rate hikes could be necessary at some point, the Fed intends to leave rates unchanged for the foreseeable future. The tone of his recent remarks was completely different from the policy statement made in December and became the catalyst for the recent upswing in stock prices.

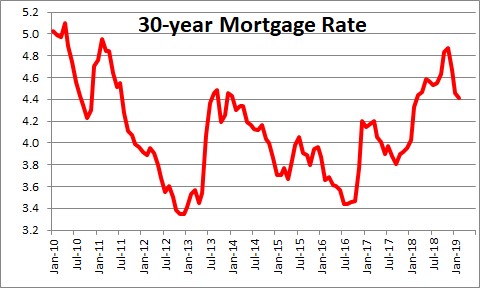

Mortgage rates. As the stock market fell in the fourth quarter economists began to fear a sharp slowdown in the pace of economic activity in the months ahead. Such a growth slowdown would eliminate upward pressure on the inflation rate and, as a result, long-term, interest rates began to decline. The 30-year mortgage rate, for example, has fallen 0.5% in the past six weeks from a peak of 4.9% to 4.4% which is where it was a year ago prior to much of the recent weakness in the housing market. That should re-invigorate home sales in the months ahead although the lack of supply will continue to curtail the rebound.

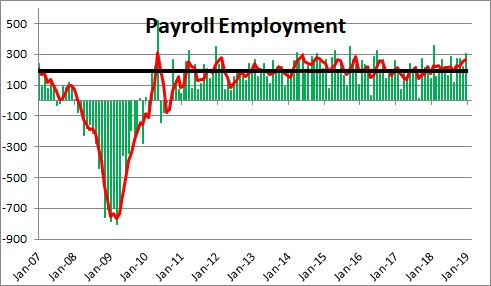

Jobs. Finally, keep in mind that monthly job gains are steady at a rate of 200 thousand per month. Continued increases in employment of that magnitude will generate income and provide the fuel to grease consumer spending in the months ahead.

The bottom line is that the lack of timely data shrouded the extent to which the economy took a hit late last year and in the early part of this year. But, given that all the factors contributing to the slide have been largely reversed, our sense is that the trend rate of economic activity has not changed much if at all. We continue to expect 2.7% GDP growth for this year although first quarter growth could slip to the 1.9% mark.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me