February 9, 2018

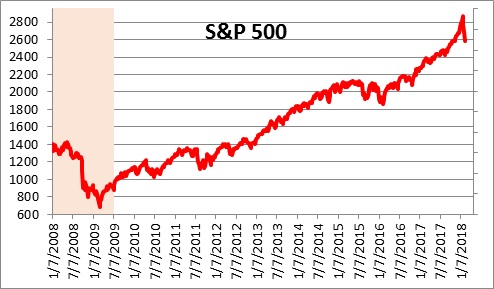

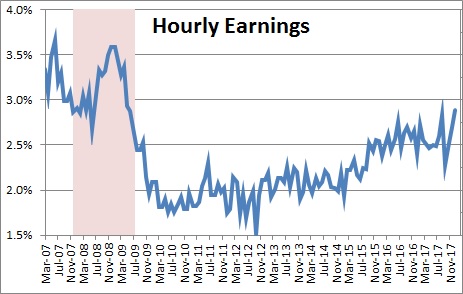

The S&P 500 index has now retreated 10% from its record high level which means that it has officially experienced a “correction”. The decline was triggered by a report that wages have risen 2.7% in the past year which suggested to some market participants that the economy is overheating, inflation is about to accelerate, and the Fed could raise interest rates more quickly than anticipated. News that the budget deal will increase the deficit by $300 billion over the next two years further spooked the bond market and exacerbated the stock market drop.

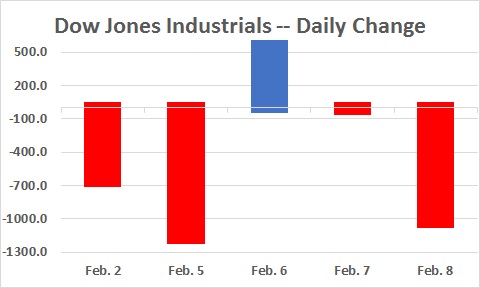

From an investor’s viewpoint perhaps more troubling than the magnitude of the drop, was the volatility that occurred during the week. The Dow Jones Industrial Index declined 665 points on Friday, plunged an additional 1,175 points the following Monday, rebounded 567 points on Tuesday, only to resume its slide with a 1,033-point drop on Thursday.

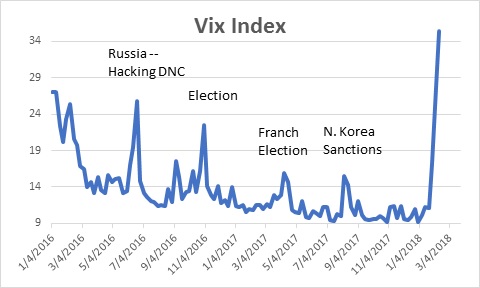

As a result, the Vix Index of volatility soared. Our sense is that with the steady ascent of the stock market over the past year, some investors had a risk profile that was probably acceptable in the low volatility environment that has existed for the past two years, but their positions became intolerable once volatility surged and they panicked.

Interestingly, economists have not changed their view about the economy. They continue to expect GDP growth to pick up to some degree this year, they believe inflation will also climb but only slightly, and they continue to anticipate three or perhaps four rate hikes by the Fed. With tax cuts on the way, a pickup in investment spending already positively impacting growth, and still low interest rates, that view seems well-justified. We believe that the recent stock market selloff is a speed bump that will have little discernable impact on either economic growth or inflation.

Having said that we respect the market and, given this hiccough, we should pay close attention to the data going forward. Is there any hint that the economy is overheating? Is inflation headed higher than we expect? Is the Fed under the leadership of a new chairman likely to change its game plan and accelerate the pace of interest rate hikes?

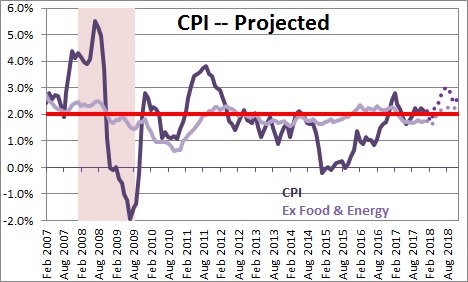

The next potentially market-moving piece of information will be the CPI report for January which will be released on Wednesday morning, February 14. The market is expecting the so-called “core CPI”, which excludes the volatile food and energy components, to increase 0.2% in January. If so, the year-over-year increase will slip from 1.8% currently to 1.6% and perhaps eliminate some of the fear of higher inflation.

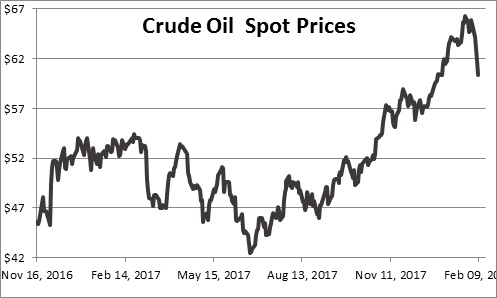

The increase in the overall CPI index will also get some attention but, regardless of the outcome for January, keep in mind that crude oil prices plunged this past week as U.S. production soared and crude inventories began to build. If sustained, which seems likely, this will keep the inflation rate in check for months to come.

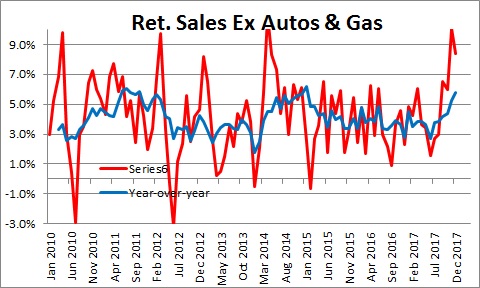

On Wednesday we will get a look at retail sales for January. This is important because it is the first month of the quarter and determines the goods portion of consumption spending for that month. Since consumer spending is two-thirds of GDP it will help economists refine their estimates of first quarter GDP growth. Like the CPI, economists strip out the volatile categories, like autos and gasoline, to derive “core retail sales”. This series has been strong for the past six months with an average monthly increase of 0.6% some of which undoubtedly reflects post-hurricane rebuilding which should soon begin to taper off.

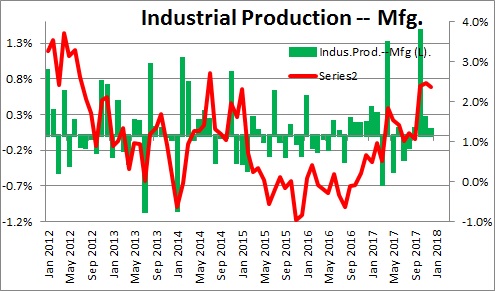

On Thursday the Federal Reserve will release industrial production data for January. The focus will be on the change in production in the manufacturing sector. (The mining category largely reflects changes in oil prices, and the utility component is whipsawed by unusually cold or snowy weather which is subsequently reversed.) The manufacturing sector has been gathering momentum. Orders have been steadily climbing, and production has risen 2.5% in the past year or 0.2% per month.

Then, there is the all-important employment report for February which will be released on March 2. The markets will anticipate an increase in employment of 180 thousand and no change in the 4.1% unemployment rate. But the focus will undoubtedly be on the change in average hourly earnings. It has been increasing 0.3% per month since October. Another 0.3% increase will boost the year-over-year increase from 2.7% to 2.9%. The pickup to 2.7% a month ago is what triggered the initial market drop on Friday morning, February 2. While the year-over-year increase might climb to 2.9%, a steady diet of monthly increases of 0.3% will eventually boost the annual increase to 3.6%. While fatter paychecks are a good thing, the market may not see it that way. As we have pointed out on numerous occasions, more rapid wage growth can be partially or entirely offset by a commensurate increase in productivity and that is what we expect. But that is a story for another day. We will not see productivity and unit labor cost data for the first quarter until the end of April.

The bottom line is that markets have become nervous about the possibility of the economy overheating, inflation on the rise, and an expedited pace of Fed tightening. We think market fears are overblown. However, turn downs in the economy are always foreshadowed by declines in the stock market. Consumers and businesses are seemingly unaffected by the recent 10% drop. But what if stock prices fall by an additional 10% and we experience a full-blown bear market? Will consumers and the business community continue to maintain the faith? Such a scenario could be more problematic. We do not expect that to happen. But for our moderate growth/ moderate inflation/slow Fed tightening scenario to be accurate, we need confirmation from the data. We think we will ultimately get that reassurance, but it is important to constantly monitor the tea leaves.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me