October 26, 2013

GDP growth in the third quarter rose 2.0% which was roughly in line with expectations. The most interesting part of this report is the divergent behavior between consumers and businesses. The former is growing at a respectable pace. The latter has taken a hit as firms worry about the impact of the “fiscal cliff”.

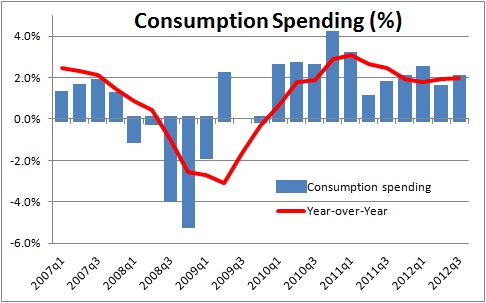

Consumer spending in the third quarter rose 2.0% which is roughly in line with other recent quarters. While certainly not robust, the consumer does not seem unduly concerned about what might happen in the first half of next year if Congress does not address the tax increases and cuts in government spending that are scheduled to go into effect at yearend.

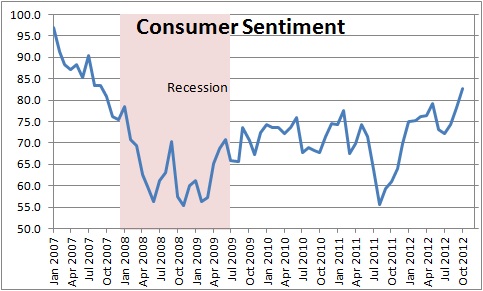

Indeed, consumer sentiment has jumped 8.3 points in the past two months to 82.6 which is its highest level since September 2007.

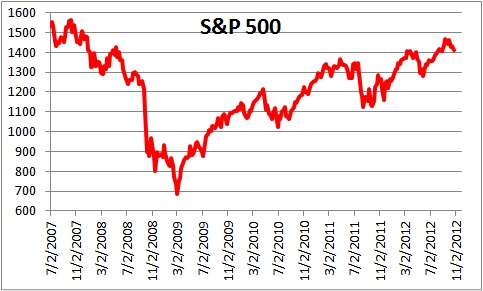

Part of the consumers’ enthusiasm is related to the stock market which has been rising steadily. The stock market has tailed off in recent weeks as third quarter earnings have tended to disappoint, but it remains near its highest level for the cycle. Following the election there is likely to be a relief trade regardless of who wins which would propel stock prices higher.

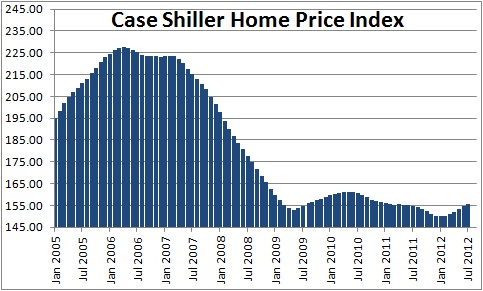

Another reason why consumers are feeling frisky is that the housing market suddenly looks attractive. Home prices have fallen more than 30%. Mortgage rates have declined to a record low level of 3.5% and seem headed towards the 3.0% mark as the Fed continues to purchase mortgage-backed securities. As a result, home sales have begun to climb and home prices have turned upwards. Home prices hit bottom in January, and have been climbing at an impressive7.5% pace since. This is important for two reasons. First, rising home prices means that some current homeowners who are upside down and owe more than their property is worth, may now be able to sell without coming up with cash out of their own pocket.

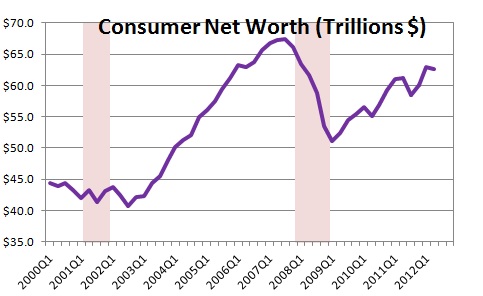

Second, as home prices climb consumer net worth increases. Consumer net worth fell 25% during the recession as both home prices and the stock market collapsed. It has since rebounded, but the gain has been attributable solely to the stock market. If home prices now also turn upwards, the consumer will soon have recovered everything that was lost during the recession which is certain to boost confidence and enhance their willingness to spend.

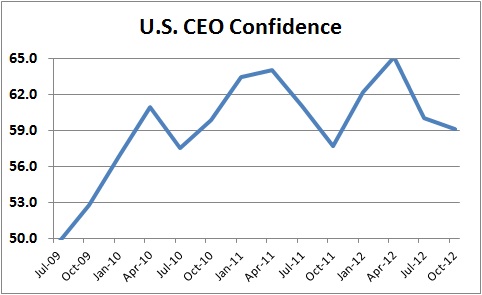

Business people are somewhat more cautious. The Young Presidents Organization survey of CEO confidence taken in early October is in sharp contrast to the behavior of consumer sentiment shown earlier. While not low, CEO confidence has ebbed during the last couple of quarters which seems to reflect their reluctance to hire and invest.

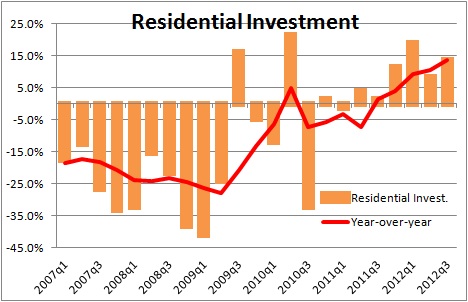

To understand what is going on, one must understand that there are two types of investment spending. Residential investment has been soaring. It has been rising at a 14% pace for the past year. The drop in home prices and record low mortgage rates finally lured potential home buyers into the market. Demand picked up. But housing market conditions were so bad for three years that builders were caught by surprise. As demand exceeded supply, home prices began to climb. Builders rushed to take advantage of the shortage of available housing and higher prices.

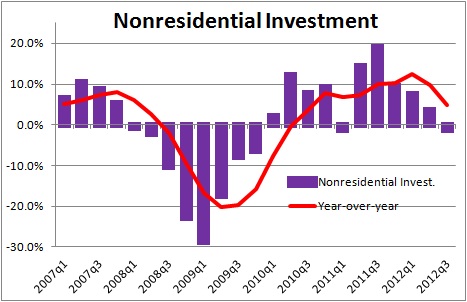

The other type of investment spending is called nonresidential investment. It includes business spending on building new factories, as well as spending on equipment to put on the factory floor and spending on technology. This type of spending has been gradually slowing for a year, and in the third quarter actually declined 1.3%. Presumably, corporate America is worrying about yearend. Nobody expects Congress to sit idly by and do nothing to address the “fiscal cliff” issue. Thus, the likelihood of a recession in 2013 is remote. But as some taxes go up and some government spending gets cut, the government sector is a sure bet to be a drag on growth next year, but no one can know the extent of the slowdown. That uncertainty is making firms cautious about investing in new factories and technology, and making them cautious about hiring additional workers.

If, as we expect, Congress “does something” by yearend and mitigates much of the impact of the fiscal cliff such that GDP growth is reduced by perhaps 1.5% in 2013, consumers and businesses will hopefully feel relieved, confidence will improve, and GDP growth next year will accelerate somewhat despite the drag from the government sector.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me