February 12, 2016

The stock market rout has been relentless. The S&P has fallen 13% from its early November peak. Why? Some investors fear that growth in China is substantially slower than the official numbers suggest. Others are bothered by the dramatic decline in oil prices which has clobbered the oil sector. And some investors may now recognize that GDP growth going forward is not going to be 3.5% but, more likely, about 2.0%.

GDP growth in China has slowed but the fear is worse than the reality. First of all, in April of last year the IMF projected 2015 GDP growth for China of 6.7%. Growth turned out to be 6.8%. Nothing happened late in the year to justify the market’s fear that GDP growth in China was slowing dramatically. Second, on-line retail giant Alibaba recorded a record $14.3 billion of sales on November 11. That is more than double e-commerce sales in the U.S. for Thanksgiving, Black Friday, and Cyber Monday combined. The Chinese consumer seems to be alive and well. We believe the fear has been triggered by the 46% drop in Chinese stock prices since June of last year. While clearly dramatic, the Shanghai Composite Index rose 135% in the previous nine months. Its current level is still 25% higher than where it was 18 months ago. That is inconsistent with an economy that on the brink of collapse.

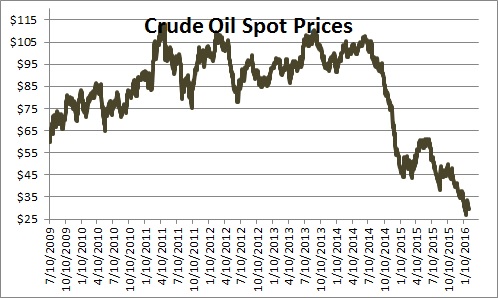

The price of crude oil has fallen 75% from $107 per barrel in June 2014 to $26.50 currently. The dramatic decline has clobbered oil companies everywhere. However, falling oil prices provide considerable stimulus to the U.S. economy. Consumers benefit from falling gasoline prices as do companies in the transportation industry like truckers and airlines. Manufacturing firms in plastics and chemicals are clear winners. So is the agricultural industry. The market’s fear that falling oil prices could lead to a recession are unwarranted.

Some investors may now recognize that going forward the economy is not going to grow at a 3.5% pace but, more likely, expand by 2.0%. If that is the case then stock prices, which reflect expected corporate earnings, were unrealistically high.

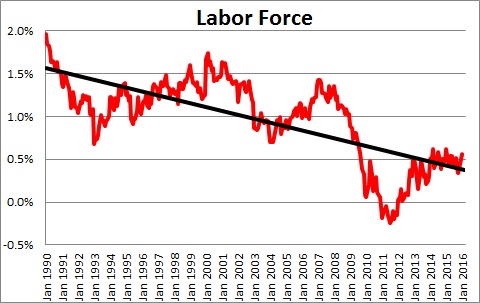

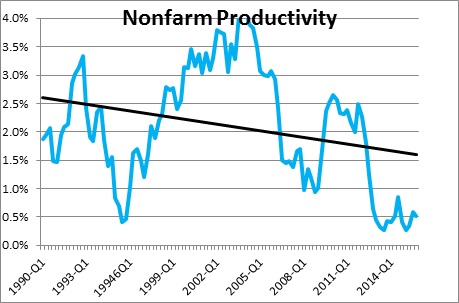

The economy’s speed limit is determined by how many people are working and how productive they are. Given those two pieces of information we can estimate how many goods they can produce – i.e., GDP. In the 1990’s the labor force was climbing at a 1.5% pace and productivity was chugging along at 2.0%. Thus, 20 years ago the economy could grow at a 3.5% pace and we expected that pace to continue. Unfortunately, our economic speed limit has slowed because growth in both the labor force and productivity have slipped and a 2.0% pace now seems more likely.

In the 1990’s the labor force was growing steadily at a 1.5% pace. Today its growth rate has slowed to 0.5%. Why? Primarily because the baby boomers are retiring. Boomers were born between 1946 and 1964. If they retire at 65 they will retire between 2011 and 2029. Thus, growth in the labor force has slowed by a percentage point to 0.5% and will continue to climb at a subdued pace for the next 15 years.

Productivity has also slowed but its route to reduced growth has been uneven. It surges, drops off, and then repeats the process. In the 1990’s it was growing at a 2.0% pace; today is growing by 0.5%. Economists are not sure why. Some suggest that employers are waiting for “the next big thing”. Others think it is because productivity in the service sector is being understated. And still others blame the stifling regulatory environment or the upcoming election. Nobody expects productivity growth to remain at 0.5%, but how quickly will it grow in the years ahead? We have penciled in a 1.5% pace.

With 0.5% growth in the labor force and 1.5% growth in productivity, our economic speed limit today is 2.0%. It is no longer 3.5%. Stock market investors need to ratchet downwards their earnings expectations. Corporate earnings and the stock market grow at a pace roughly in line with nominal GDP. In the 1990’s we had about 3.5% GDP growth and 2.5% inflation, or nominal GDP growth of 6.0%. Today we are talking about 2.0% GDP growth and 2.0% inflation (the Fed’s target) or nominal GDP growth of 4.0%. Thus, corporate earnings and the stock market are not going to grow as rapidly in the future as they have in the past.

If the market’s fears about China are overblown, falling oil prices are a positive – not negative — factor for the economy, and earnings expectations are being adjusted downwards to reflect the expectation of slower growth in earnings, then the recent drop in stock prices is largely a stock market event and is unlikely to portend any significant drop-off in the pace of economic activity. We continue to anticipate 2.4% GDP growth in 2016.

Stephen Slifer

NumberNomics

Charleston, SC

Stephen, after reading and listening to the recent doom sayers, your interpretation of events in the economic world is a breath of fresh air to review. The perspective you see makes sense. Thank you for your fine work. I really do appreciate it.

Take Care.

Darrel