March 22, 2024

The Federal Reserve has indicated that it is likely to cut the fed funds rate three times in 2024 which would reduce the funds rate from its current level of 5.5% to 4.75% by yearend. But those three rate reductions are the tip of the iceberg. The Fed will continue in easing mode throughout 2025 and 2026. How far might the funds rate fall? The Fed will be searching for a “neutral” level for the funds rate which means that it will be trying to find a level of the funds rate that will neither stimulate nor retard the pace of economic activity.

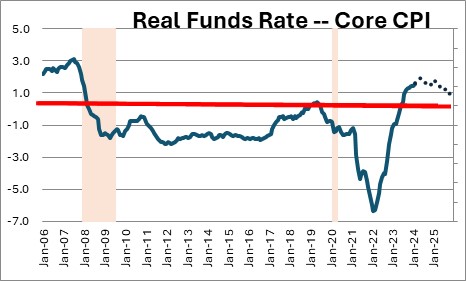

Currently, the Federal Reserve believes that once the inflation rate reaches its targeted pace of 2.0%, a neutral funds rate would be 2.5%. In other words the Fed believes the neutral “real” funds rate is 0.5% (2.5% funds rate – 2.0% inflation). Today the funds rate is 5.5%, the core CPI inflation rate is at 3.8%. Hence, the real funds rate is 1.7%. Fed policy is in restrictive mode, as it should be, because the inflation rate at 3.8% remains far above the Fed’s 2.0% target.

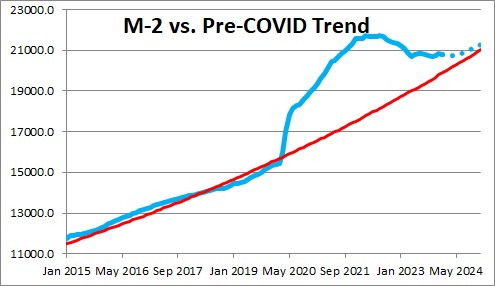

We have noted on numerous occasions that we are convinced the inflation rate will continue to slow gradually as the Fed shrinks is portfolio and eliminates the surplus liquidity that it created in the wake of the 2020 pandemic-induced recession. This piece is important because a slowing inflation rate will give the Fed the ability to cut rates.

By the end of 2024 we expect the core CPI to slip from 3.8% currently to 3.3%. If the Fed, as expected, cuts the funds rate three times to 4.75%, the real funds rate at the end of 2024 would still be 1.5% (4.75% funds rate – 3.3% inflation) versus 1.7% currently.

Continuing this exercise into 2025 we expect the core CPI to slow further to 2.6%. If the Fed cuts the funds rate farther to 3.5%, the real funds rate at the end of 2025 would be 0.9%. As the inflation rate nears the desired 2.0% pace, the real funds rate would begin to approach its “neutral” level of 0.5%.

In 2026 if the inflation rate continues to subside to its targeted 2.0% pace the Fed would likely reduce the funds rate to the 2.5% mark. In that case, the funds rate would finally reach what the Fed thinks is a “neutral” real level of 0.5% sometime during that year.

The point of all this is that whatever rate reductions the Fed has in mind for 2024 are just the beginning of what is likely to be a protracted period of easing that should last for another couple of years.

If the Fed remains in easing mode for that period of time the economy is going to continue to grow. The recession ended in April 2020. By the end of 2026 this business cycle will have lasted 80 months – with no end in sight. The average length of the eight business cycles since 1961 is 78 months. The longest expansion on record was the one that began in June 2009 (at the end of the so-called “Great Recession”) which lasted through February 2020 — 128 months. That expansion ended not because of Fed tightening. It got short-circuited by the pandemic. A gradual easing policy by the Fed for the next couple of years should keep the current expansion on track for years to come.

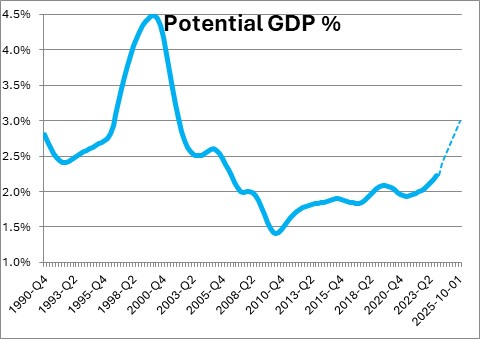

Consider, too, the fact that productivity growth has surged in the past year. Given that AI is being adopted rapidly, productivity growth is likely to remain rapid for years to come. If that is the case the economy’s potential growth rate (effectively its economic speed limit) should climb from 2.0% today to 3.0% or even higher.

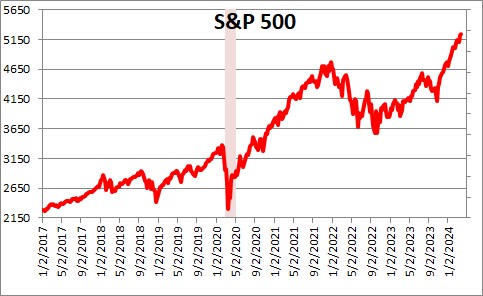

The combination of falling interest rates for another couple of years combined with the possibility of faster-then-expected GDP growth has pushed stock prices to record high levels which, to many investors, seems unwarranted. We are not so sure. We think the stock market has this right. Even if the stock market hits the inevitable speed bump in the form of a “correction” at some point, the trend in our view will remain upwards.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me