February 28, 2025

Trump has been busy. In his first month in office he imposed tariffs on Canada, Mexico and China, and threatened tariffs on virtually everybody else. Every federal government employee is scrambling to keep their job . He has managed to sour relations with long-term allies while cozying up to Russia. And he has begun his program to deport millions of illegal immigrants. Combine that political angst with a string of weak economic data for January and many consumers have concluded that a lethal combo of slower GDP growth, a higher unemployment rate, and higher inflation lie ahead. We respectfully disagree.

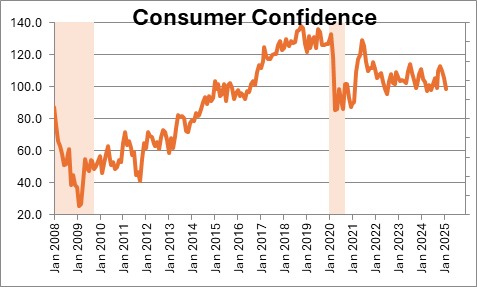

Consumer confidence fell 7.0 points in February and a total of 14.5 points in the past three months. Those declines were highlighted by the press and clearly made consumers nervous. But you did not hear much when confidence surged 13.6 points in September and October? Basically, confidence is where it started prior to the election run-up. It has been bouncing around in a range from 100-110 for the past three years. Those levels are roughly 20 points below the 120-130 level that existed prior to the recession. Consumers have consistently been nervous about something for years.

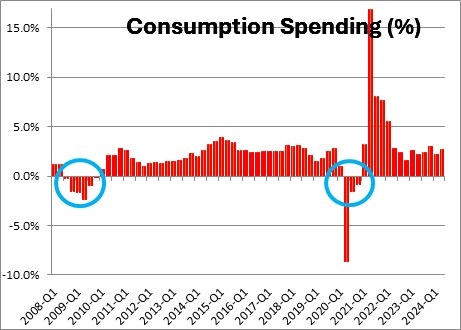

Typically, when consumers became worried they sharply curtail their pace of spending. We saw that happen in 2008 and again in 2020, but consumer expenditures grew 3.7% in the third quarter and 4.2% in the fourth quarter. With the exception of the weather-related drop in January there is no hint of reduced spending.

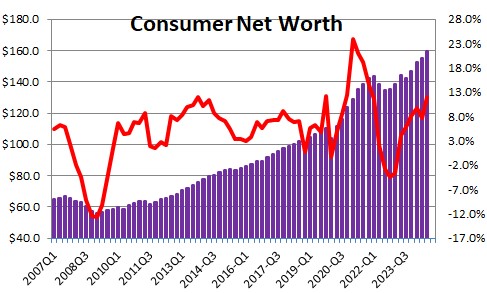

One reason why consumer spending has been so bulletproof is because the combination of skyrocketing home prices and a dramatic increase in the stock market has boosted net worth to a record high level. We all gripe and complain about everything that is going on in Washington, but we continue to dine out often and are perfectly willing to book a cruise for our next exotic adventure.

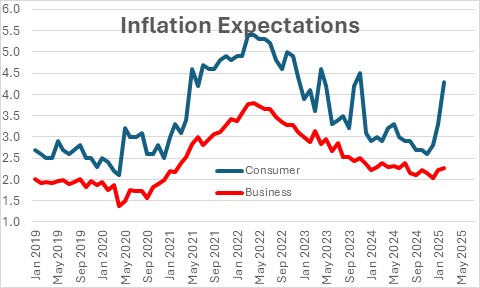

The catalyst for the most recent episode of consumer angst is tariffs and the fear that they could push the inflation rate sharply higher. For example, the University of Michigan’s survey of 1-year inflation expectations jumped by 1.0% in February to 4.3% which is the highest since November 2023. Consumers are fearing the worst. But compare that to the Atlanta Fed’s measure of 1-year inflation expectations for businesses. It rose 0.1% in February to 2.3% which is basically where it has been for the past year. Who is right, consumers or businesses? We will bet on businesses. They have a good handle on what their labor costs will be over the course of the next year and they have forward contracts for purchasing the materials they need for production. In our opinion, consumer views are highly influenced by the press. Bad news always attracts readers, so mainstream media stories almost always highlight a worst case scenario. Not to mention the fact that a dark portrayal of the economy fits nicely with their anti-Trump bias.

The other source of fear for consumers is the layoffs of federal government workers. Musk asked all federal employees to justify their jobs. What is the problem with that? In the private sector every worker is always at risk of losing their job. Government employees are being asked to join the real world.

We do not want to diminish the impact on any individual worker. Getting laid off is a stressful event. How quickly will they be able to find another job? Do they have enough money to tide them over? Will they be forced to relocate? Will their new job provide health care and retirement benefits? Anyone who has been through a layoff can attest to the stress it caused for them and their family.

But everybody also agrees that the federal government sector is bloated. The only way to reduce its size is through layoffs. Politicians on both sides of the aisle have tried for years and failed. One may not like Musk’s slash and burn approach, but layoffs are inevitable and they will reduce the size of the federal workforce. However, we believe that the dimensions of the problem are being grossly overstated. In January payroll employment was 159 million of which 3 million worked for the federal government. That is 2.0% of the total. Trump is not talking about eliminating all federal government employees, he simply wants to shrink its size. If he were to eliminate 10% of the total or 300,000 jobs over the next year that would work out to 25,000 workers per month. Payroll employment is currently increasing by about 150,000 workers each month. Reducing that by 25,000 would cut the monthly gain to 125,000. When one considers that the labor force is climbing by 100,000 per month, even with the layoffs the economy would be producing enough jobs to keep the unemployment rate steady at the 4.0% mark. Keep in mind that many of the 25,000 newly unemployed workers would soon be re-absorbed into the private sector. Our point is that the media is, once again, scaring American consumers. An overhaul of the federal government is long overdue and layoffs will create a huge shift in the makeup of the workforce but the negative impact is grossly overexaggerated.

Economists and the press continue to underestimate the strength and resilience of the American economy.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me