October 18, 2024

Fiscal year 2024 ended with a yawning budget gap of $1.9 trillion. Another $1.9 trillion was added to the already record amount of debt outstanding with much more to come. The baseline deficit projections from the Congressional Budget Office do not include any of the tax and spending proposals espoused by either presidential candidate. The nonpartisan Committee for a Responsible Federal Budget (CFRB) has examined the proposals from each candidate and concluded that no matter who is elected the baseline budget deficits and debt outstanding will increase significantly during the next 10 years. It is not a pretty picture. Economists have worried about steadily increasing budget deficits for years. Because nothing bad has happened policy makers in Washington have ignored the problem. Why should they be any more concerned today? The answer is that the Social Security and Medicare Trust Funds will be depleted within a decade. If nothing is done to fix the budget problem the monthly payments to an army of older Americans will get chopped by 21%. If something is done to fix the problem all government spending – including entitlements – will get cut, and taxes will climb. The clock is ticking. Every year of inaction will make the ultimate adjustments even more onerous. The current situation is simply not sustainable.

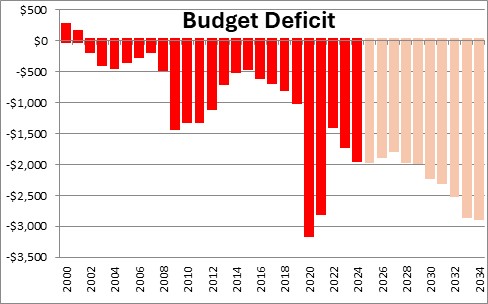

The budget deficit for fiscal 2024 was $1.9 trillion. Outside of the two pandemic deficits in 2020 and 2021 this is the largest budget deficit in nominal terms on record. The deficits are expected to get even larger in the years to come.

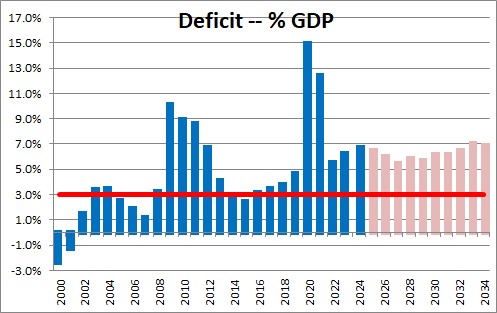

The best way to understand the extent of the problem is to look at the deficit as a percent of GDP. This past year’s deficit was 6.4% of GDP which is only surpassed by the years around World War II, the 2008 financial crisis, and the pandemic. Economists would like budget deficits to average about 3.0% of GDP during the course of a business cycle — significantly less than that during the good times so that when a recession hits or war breaks out the combo of tax cuts and increased spending can help the economy to recover. A deficit of 6.4% of GDP is unprecedented for a good year during peacetime.

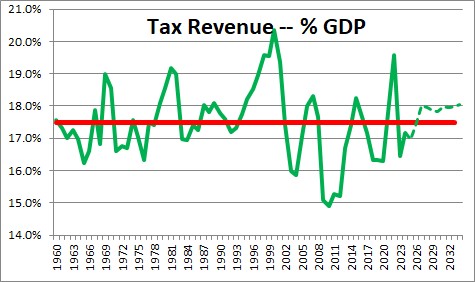

The problem is not on the revenue side. Tax revenues as a percent of GDP were 17.2% of GDP in fiscal 2024 compared to the 50-year average of 17.5%.

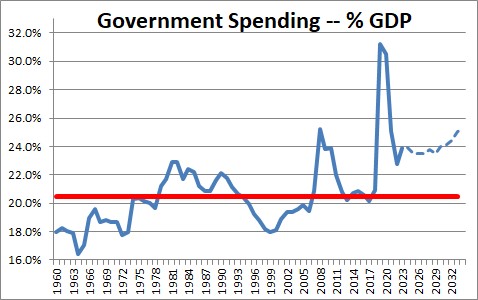

The problem is government spending which came in at 23.9% of GDP compared to its long-term average of 20.5%. It is easy to identify the problem but cutting spending will be challenging.

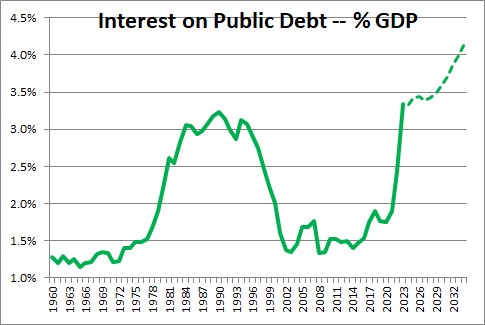

A major source of the growing deficit is interest on the public deficit. At $950 billion this past year it is now the second largest expenditure category after Social Security which costs $1.5 trillion. It exceeds Medicare at $869 billion and defense spending at $826 billion. As a percent of GDP it is the highest since the government began keeping records in 1940, and it is going to climb in the years ahead as the debt outstanding continues to grow.

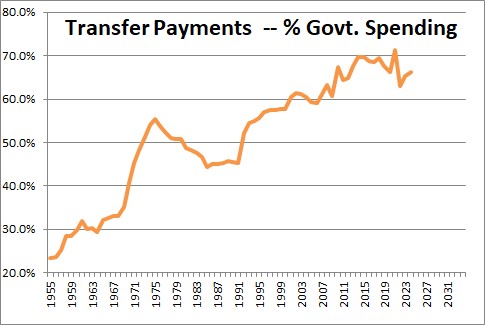

The other problem is that two-thirds of every dollar spent is an “entitlement” which is a monthly income support payment. There are a wide variety of such expenditures but the largest and most widely recognized are Social Security, Medicare, and Medicaid, followed by welfare spending, child support payments, and veteran’s benefits. Politicians love entitlements which increase the income for some voters in their district. For that reason entitlements almost never go down. As a result, they have climbed from 25% of the government spending pie in the mid-1950’s to 66% today. For a politician a vote to cut Social Security payments will soon end their career.

One might think that the growing deficits would be alarming to the two presidential candidates. Not so. The Trump and Harris tax and spending proposals will lead to budget deficits significantly higher than the CBO’s current baseline.

Trump is talking about extending the Tax Cut and Jobs Act tax cuts, eliminating the $10,000 deduction cap on state and local government taxes, exempting tips from taxes, exempting Social Security benefits from taxes, reducing the corporate income tax rate to 15% for domestic producers, a 10% tariff on all imported goods and a 60% tariff on goods from China. The CRFB estimates that these proposal could add $7.5 trillion to the deficit over the next ten years.

Harris wants to extend the Tax Cut and Jobs Act for households earning less than $400,000, expand the child and earned income tax credits, enhance the Affordable Care Act, exempt tips from income tax, raise the minimum wage, increase the corporate tax rate from 21% to 28%, and increase capital gains for households earnings over $1 million and unrealized capital gains for households with more than $100 million in wealth. The CFRB estimates these proposals will boost the deficit by $3.5 trillion.

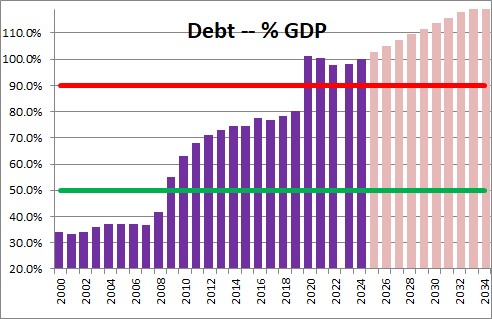

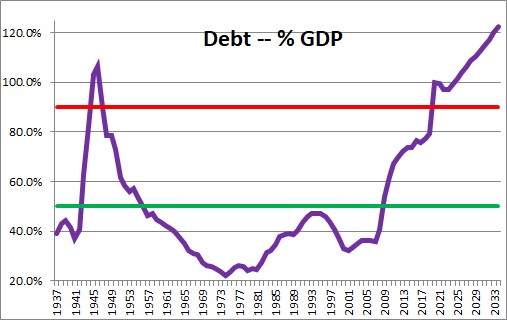

The CBO’s baseline forecast indicates that the government debt to GDP ratio will climb from 100% today to 120% over the next decade. The Trump and Harris proposals would boost that to 130-145%. This outcome is unacceptable.

The record high debt/GDP ratio was 106.2% in 1946, just after the end of World War II. Once the war ended spending fell rapidly and the debt/GDP ratio shrank quickly. That will not happen today. Interest on the debt will keep climbing and it will be difficult for politicians to significantly cut spending when entitlements account for such a large percentage of the total.

It is true that the federal government can always get whatever money it needs by issuing more debt. But at what price? If investors lose confidence in the government’s willingness or ability to responsibly manage its debt, interest rates will climb significantly. If that happens will the private sector be able to get the funding it needs when the government’s appetite is so large and interest rates are so high?

One would like to think that somebody in a position of leadership today would be sounding the alarm. But those voices are currently few and far between and their pleas are being drowned out by louder voices elsewhere.

Our government seems to function best when a crisis is looming. In this case the catalyst for action could be 2033 when the Social Security Trust Fund is depleted and Social Security recipients face a 21% cut in benefits. One would hope that politicians would act sooner to address the problem but we are not optimistic.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me