October 27, 2023

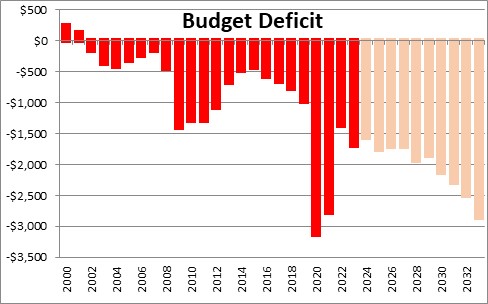

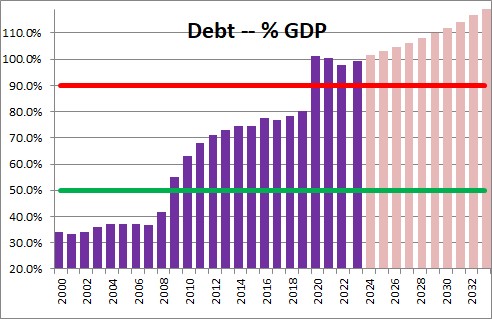

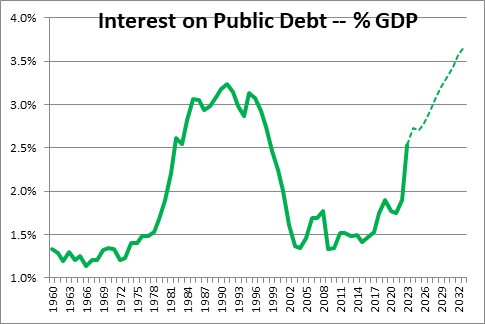

The budget deficit for fiscal 2023 was $1.7 trillion but nobody cared`. Projected budget deficits for the next ten years never get smaller and within five years are expected to exceed $2.5 trillion. As a result, the Treasury will add $20 trillion to outstanding debt in the next decade. Debt in relation to GDP will climb to a record high level. As the amount of debt outstanding climbs, the interest expense will increase commensurately. Today interest represents 2.5% of GDP. It is likely to reach 3.7% by 2033. Looked at in a slightly different way, interest payments today represent 15% of GDP. By 2033 they should climb to 20%. And by 2053 will be 35% of tax revenue. To pay the mounting interest bill other categories of spending must get reduced. This means that tough choices lie ahead. Today, entitlements like Social Security, Medicare, and Medicaid represent about two-thirds of all government spending and would be prime candidates for reduced spending. But politicians never want to cut entitlements. Less money for defense? In today’s increasingly dangerous world that seems foolish . What about education? Infrastructure? The bottom line is that the budget deficit is spiraling out of control and our leaders in Washington need to make a serious effort now to rein in spending. But with divided government likely to continue for some time to come the odds on that actually occurring seem remote.

The budget deficit for fiscal 2023 was $1.7 trillion. The Congressional Budget Office envisions deficits between $1.6 and $2.8 trillion every year for the next ten years. By definition a deficit means that the government spends more money than it receives from taxes and must issue an equivalent amount of debt to pay its bills.

Over the course of the next decade the government is expected to add $20.0 trillion to the amount of debt outstanding. Prior to the recession debt in relation to GDP was 79%. Today it is 100% and by 2033 the CBO expects it to be a record 119%. The previous record high debt/GDP ratio was 106% after World War II. It subsequently fell quickly as defense spending plunged. That is not going to happen today.

One of the government’s many expenses is interest on the public debt. Given the massive increases in debt outstanding that began around the 2008-09 recession, jumped sharply in the wake of the 2020-2021 recession, and are expected to continue climbing for the next decade, interest on the public debt has risen from 1.5% of GDP prior to 2008 to 2.5% today and is expected to climb to 3.7% of GDP by 2033. It has never been higher. The CBO also does a longer-range budget forecast. By 2053 interest payments are expected to be 6.7% of GDP.

But those are just numbers. They seem disquieting, but the seriousness of the problem may not be readily apparent. Let’s think about this in a different way. The government collects taxes from each of us. Every year it spends more than it collects in taxes. It must borrow the difference to pay its bills. Every year the amount of debt outstanding increases which means that interest on that outstanding debt also increases. Today interest represents 15% of all tax revenue. The remaining 85% of tax revenue can be used for spending on everything else. But by 2033 the CBO estimates that interest will be 20% of tax revenue. By 2053 the government will have to allocate 35%, or roughly one-third of its tax revenue, to pay interest. That means that the spending on everything else will drop to 65%. So between 2023 and 2053 the amount of spending on defense, social welfare, infrastructure, research, education and a myriad of other spending categories, will be cut from 85% of GDP to 65%. That is a cut of 20%. It is hard to see where those cuts will come from.

Even closer to home let’s look at the typical consumer’s budget. The Bureau of Labor Statistics tell us that consumers today spend 33% of their income on housing. Let’s suppose that in the next 30 years consumers go on a spending spree, borrow extensively, and interest payments on credit card bills represent another 33% of our income. Only one-third of our income will be available to pay for food, gasoline, medical expenses, insurance, education, and vacations. That is simply not going to happen. Consumers cannot afford such a spending spree.

Neither can the government. As budget deficits soar to $2.0 trillion or more, debt outstanding will climb commensurately. And now, thanks to the Federal Reserve, interest rates have risen dramatically. If the government’s spending spree continues, 30 years from now once the interest payments have been made there will not be enough left money over for everything else. The government cannot afford such a spending spree. Something has to give.

Stephen Slifer

NumberNomics

Charleston, S.C.

For many years we have been told that the current rate of deficit spending can not continue and yet it does. The tipping point never seems to materialize

Hi BIll,

You are right about that, of course. I suspect that the game-changer this time is the d-dates for Medicare and Social Security of 2028 and 2033, respectively. Somebody has to do something before then.

Steve, I agree we need to act for the sake of reducing the interest bill. I believe it can be done through a combination of both spending cuts and new revenue over a 10-year window. Yes, that means raising taxes. When it comes to cuts, we need to have an honest conversation about where our money is going and if it is giving us the return we expect. For example, Defense needs to be discussed without being called a communist. Think about it, we are funding ships that will never go to sea, planes that won’t fly again, bases that might have four aircraft, and training facilities that are unusable during parts of the year during rising sea levels. Why are we holding on to them? We should look at healthcare, which is one of our country’s biggest expenditures without being called socialist. We spend more on healthcare than any other developed nation and are close to the bottom when it comes to outcomes. How many businesses would put up with that? Meanwhile Japan pays the least and has the highest outcomes. Why? Maybe we should ask?

I can remember when the Bowles-Simpson plan came out that looked at a ten-year window – it was reasonable combination of cuts and new revenues. Don’t think we would be having this conversation if Congress had acted on their recommendations. I think to address this concern we need another serious effort modeled on their bipartisanship and common-sense approach . . . . and with a requirement that binds Congresses’ hands from disregarding the recommendations. The answer to your concern is out there, but it all starts with us electing people who are serious about tackling this issue, which, in this day and age, means putting country over personal political ambitions.

Hi Taylor. I love your way of thinking! I loved the Simpson-Bowles plan. A bipartisan committee was never going to reach a consensus — but they did! Absolutely remarkable. But then Obama — who established the commission in the first place decided it cut entitlements too much and scuttled its conclusions. We had a chance to grab the brass ring and fix all these budget issues, and we blew it.

The problem is that the American public does not yet seem prepared to elect those serious people you mention into office. Maybe things will change between now and this time next year. I have often said that our politicians actually seem to get things done in a crisi, but are unable to accomplish much in the absence of a crisis. Not sure if Americans in general or our political leaders in particular have yet reached crisis mode. We can hope.

Thanks for sharing your thoughts Taylor.