November 8, 2024

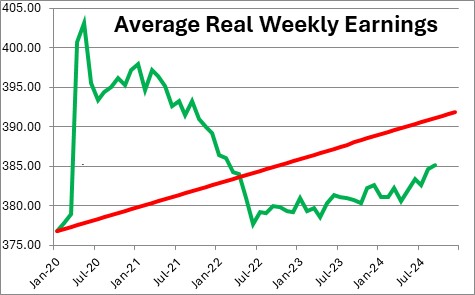

When asked about their level of confidence consumers often highlight inflation as a major concern. When inflation began to rise in mid-2020 Fed Chair Powell told us not to worry because the run-up in prices would be temporary. That led us to believe that prices would eventually decline and return to normal. That did not happen. Prices rose rapidly, and then rose less rapidly. They never declined. As a result, prices for a wide variety of goods and services are far higher today than they were prior to the recession. Given the run-up in inflation our real wages were declining. Our purchasing power had been reduced. And we complained. Loudly, and with justification. But nobody seems to have noticed that those same real wages are now rising rapidly. They are actually higher than they were prior to the recession, although they are not yet as high as they would have been in the absence of a recession. But they are closing that gap with every passing month. If the perception grows that consumers are not as bad off as they were a couple of years ago, consumer confidence should continue to rebound and consumer spending will remain robust. Business confidence should also climb which could boost both hiring and investment spending. Is the prevailing sense of economic doom and gloom about to change?

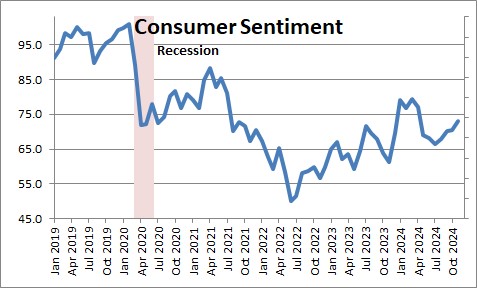

Consumer confidence by any measure has been rising for the past couple of years, but remains far below the level that prevailed prior to the recession. For example, the University of Michigan index was 73.0 in November. It was 100 prior to the recession. When asked consumers continue to cite concerns about inflation.

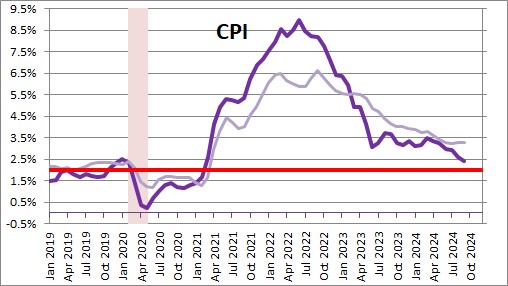

They have not forgotten how dramatically prices rose in 2021 and 2022. The Federal Reserve told us that those price increases would be temporary. In Fed-speak that meant that the 9.0% rate of inflation would be temporary and prices would soon grow at the desired 2.0% pace. In that sense, the surge in inflation was ”temporary”. But consumers interpreted “temporary” to mean that prices rose but would eventually decline to something close to where they started. That never happened.

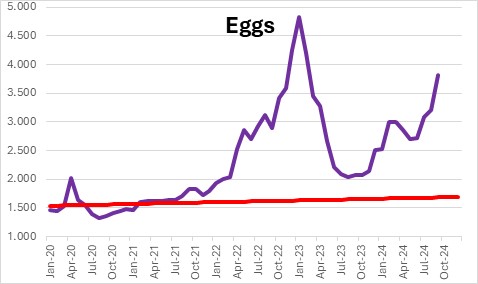

Prices for a wide variety of items have risen dramatically in the past four years. A dozen eggs today cost $3.82. Prior to the recession they were $1.50. That may be an extreme example, but most food items have risen 20-50%. Automobile insurance and repairs have risen 50%. Gas prices have climbed 30%. Home prices and rents have soared. We are reminded of those prices increases every time we go to the grocery store, the gas station, or sit down to pay our monthly bills.

When inflation was rising rapidly our real income was falling. Inflation was destroying our purchasing power. And we haven’t forgotten. But the situation has changed. Weekly earnings are now rising by 4.0%. Inflation has slowed to 2.5%. That means our real earnings are now climbing at about a 1.5% pace. Prior to the recession they were growing by about 1.0%. The monthly increase in weekly earnings began to outpace inflation in mid-2022. As a result, real weekly earnings are now higher than they were at the beginning of the recession ($385.09 vs. $377.74), but they are not as high as they would have been in the absence of a recession and real weekly earnings had continued to grow at their same pre-recession pace (the red line below). But real earnings are closing the gap with each passing month.

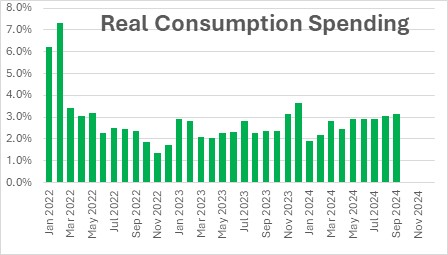

The reduced level of confidence has not deterred consumers from spending. In the past year real consumer spending has risen an impressive 3.1%. A higher level of confidence may not translate into an even faster pace of spending, but it could eliminate much of the sense of economic pessimism that seems to prevail. If consumers feel better, business leaders will feel more confident. Small businesses, in particular, may increase the pace of hiring. They may also be inclined to invest more rapidly if they believe that the economy will continue to climb at a robust pace for the next several years.

Could the prevailing sense of economic doom and gloom soon translate into optimism? Or is that too much to hope for?

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me