February 14, 2025

The available data available for January are so distorted that it is impossible to get a good reading on the performance of the economy or inflation in the early part of the year. The CPI data for January were higher than expected and made investors nervous. We suggest that seasonal adjustment issues and a dramatic increase in egg prices have distorted the data. Retail sales plunged far more than expected in January presumably because of bitterly cold weather in much of the country. As a result, the January inflation and sales data are largely useless. Economists and investors are even more confused now. The one thing that is certain is that the Fed is going to do nothing for the foreseeable future and will wait to see what happens once the fog lifts.

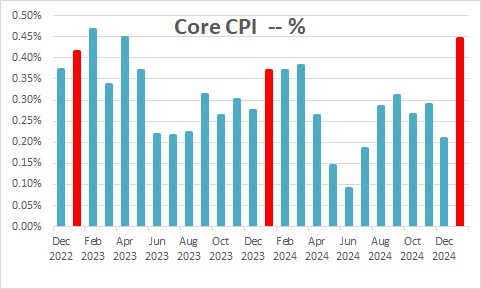

The CPI rose 0.5% in January and the core CPI climbed 0.4%. Both numbers were slightly higher than expected. That was an unfriendly inflation outcome. But is this the beginning of a significantly higher-than-expected inflation rate for the year as a whole? Probably not for a couple of reasons.

First, it appears that more companies are choosing to raise prices at the beginning of each year. As a result, in each of the past several years the monthly changes in the core CPI in the January-March period were the biggest of the year. The spring and summer months were the smallest. The CPI, like virtually every other economic indicator, is adjusted for normal seasonal movements. But if the seasonal patterns are changing, it takes the seasonal adjustment process about five years to fully incorporate the new pattern. If that is the case, the larger-than-expected increase in January is the result of technical issue and not a harbinger of a faster inflation rate ahead.

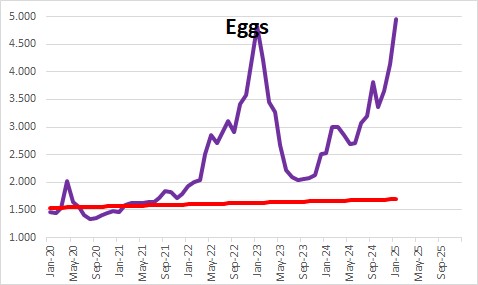

Second, the avian flu caused egg prices to jump 20% in January to $5.00 per dozen and to double in the past year. When the virus is found the entire flock is killed to curtail the spread of the disease, and these massive egg farms have millions of birds. That puts a serious dent in the egg supply. However, that is a one-off factor which will eventually be reversed. Having said all that, the 0.4% increase in the core CPI for January was bigger than what we expected and makes us nervous.

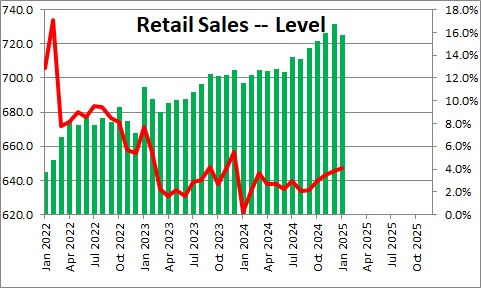

Then we learned that retail sales fell 0.9% in January. That follows sizeable gains in each of the previous four months. Economists were aware that bad weather would adversely affect the January data and had expected no change in sales for that month. A decline of 0.9% was far weaker than anticipated. But do not read much into that outcome. A few grains of salt are in order. We know, for example, that January was the coldest January in the past 20 years. That bitter cold weather was combined with snow and ice storms that blanketed much of the U.S. (Snow and ice shut down my hometown of Charleston, S.C. for three days) Then there were the fires in southern California that raged from January 7th through the end of the month. Los Angeles is second largest metropolitan area in the country. Almost certainly the fires dampened sales in that area for the month.

While we do not believe that the soft sales data January indicate any change in the trend of consumer spending and GDP, the loss of sales in January has caused us to reduce our first quarter GDP growth rate from 3.0% to 2.5%. If consumers need a new car but are unable to buy it in January, they may well find their way to a dealership and make the purchase in February. But if a family typically eats out once a month, they do not go to a restaurant twice in the next month to make up for it. Some sales are lost permanently. Our projected first quarter GDP growth rate is somewhat slower than we expected previously.

The sizeable increase in the CPI does not indicate any significant change in the trend rate of inflation even though it was higher than expected. As described above, it could be attributable to the seasonal adjustment process and will be offset in subsequent months. But nobody can be 100% certain that is the case. The avian flu will eventually end and egg prices will drop, but will the virus mutate and become difficult to control? Will it spread to domestic poultry flocks? Nobody knows. As a result, egg prices are likely to remain elevated for some time to come. Accordingly, we have raised our forecast for the core CPI in 2025 from 2.9% to 3.3%. Given that the core personal consumption expenditures deflator tends to increase about 0.5% slower than the core CPI, we expect the core PCE deflator to increase 2.8% in 2025 compared to the Fed’s targeted rate of 2.0%. That is enough to keep Fed policy on hold through midyear. Whether the Fed will be able to ease in the second half of the year remains to be seen.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me