June 12, 2015

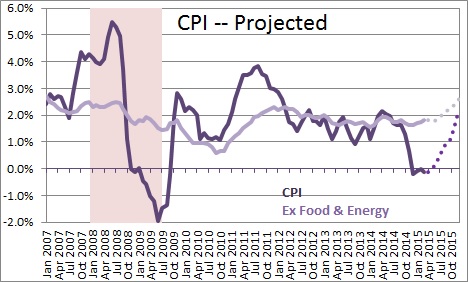

A string of robust economic data combined with an increase in labor costs and a modest pickup in inflation has sent the bond market into a tailspin. Market participants are convinced that the Fed will begin to lift rates in September and that the inflation rate will probably be higher than they thought previously. While we agree that the Fed is on the cusp of a rate hike and the inflation will gradually begin to climb, we believe that the market’s fear is overblown. Falling commodity prices will counter some of the upward pressure on inflation stemming from higher labor costs.

Consumer spending was soft early in the year. However, consumers have now begun to spend some of the additional disposable income created by the sharp drop in gas prices. New home sales have steadily accelerated since the end of last year. Car sales skyrocketed in May. Retail sales surged in that month with across-the-board gains in every category.

At the same time sustained employment gains of 225 thousand per month combined with the highest number of job openings in 15 years has convinced investors that the labor market is tighter than they thought previously. As labor costs rise they fear that excessive labor market firmness is going to push the inflation rate higher.

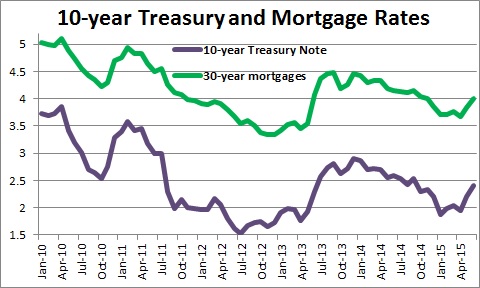

This combination of events has caused long-term interest rates to climb. The yield on the 10-year note which was about 2.0% in January is now 2.4%. The 30-year mortgage rate has climbed from 3.7% to 4.0%. Because long-term interest rates are tied closely to the expected inflation rate, the increase reflects a concern that the long-subdued inflation rate will begin to climb.

While the inflation rate will rise in the months ahead the market’s fear is overblown. We have noted on frequent occasions that rising labor costs are boosting wages and leading to higher prices. The tightness in the housing market is boosting rents. Thus, we expect the so-called core CPI (excluding the volatile food and energy components) to increase 2.6% this year versus a 1.6% increase in 2014.

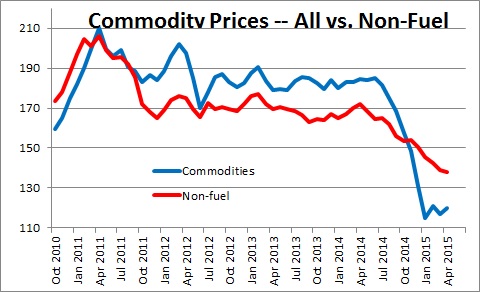

However, lower commodity prices will counter some of the sting and keep inflation in check. Oil prices have plunged since October. Perhaps less well recognized is the prices of all types of commodities have also been falling — agricultural raw materials, industrial metals, precious metals, fertilizers, livestock, seafood, meat, etc.

Why the drop? Commodity traders often joke that the three most important factors influencing commodity prices are China, China, and China. China’s effort to convert from an industrial-based economy to a more a consumer driven model has caused GDP growth to slip from 7.75% the past couple of years to about 6.75%. Because China is the largest consumer of virtually everything that is pumped or mined out of the ground, that slowdown is the primary reason that commodity prices have been falling.

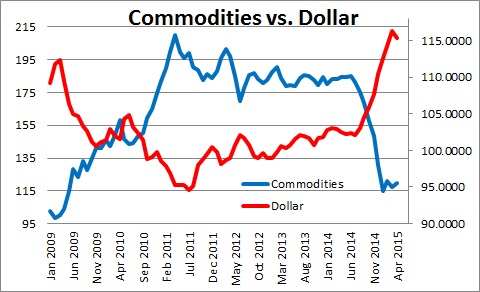

Exacerbating the drop is the dramatic increase in the value of the dollar which has risen 13% in the past year given the fairly robust pace of economic expansion in the U.S. relative to the rest of the world.

It happens that there is a very close inverse relationship between changes in the value of the dollar and changes in commodity prices. A rising dollar creates a problem for developing countries. They are big users of commodities like iron ore and copper which they use to build their country’s infrastructure and to manufacture the goods they sell abroad. Because global trade in commodities is conducted in dollars, developing countries must now spend more for the commodities they want. The stronger the dollar gets, the cheaper commodities are for Americans and the lower the U.S. inflation rate gets.

As long as the U.S. economy expands briskly and U.S. interest rates rise relative to the rest of the world, the dollar will climb and commodity prices will continue to fall. So while rising labor costs are pushing the inflation rate higher, it is unlikely to rise sharply given the partial offset from falling commodity prices. Thus, the recent increase in long-term interest rates is probably overdone. We expect the yield on both the 10-year Treasury note and the 30-year mortgage rate to end the year close to their current levels of 2.4% and 4.0% respectively despite a modest increase in the funds rate later in the year.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me