March 13, 2025

Americans have never experienced the chaotic policy-making that has come from Washington in the past two months. The on-again off-again tariffs, massive layoffs of federal government workers and the roundup of illegal immigrants, have made consumers, small businesses, and investors understandably nervous. But will consumer spending soon begin to shrink? Will there be a slowdown? A recession? We believe the most likely scenario is somewhat slower growth and steady inflation. Confidence has declined but, thus far, there are few hints that spending or jobs growth have been affected. The economy came into the year with a head of steam as GDP growth averaged 2.5% in the past year. It would take a huge jolt to push it into recession.

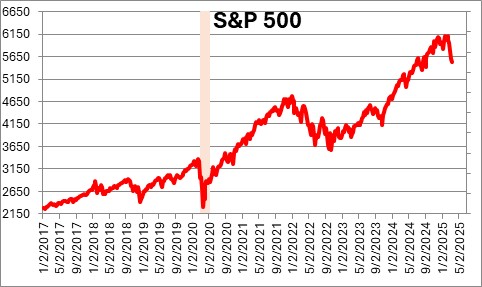

The most obvious sign of falling confidence is the stock market. The S&P 500 index has fallen 10.0% in the past month. That constitutes a correction. Clearly, investors are nervous. But almost everyone believed that a stock market correction was long overdue. Is there more to come?

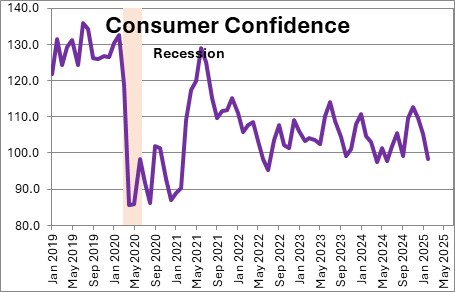

Consumer confidence has fallen 14.5 points in the past three months from 112.8 in November to 98.3 in February. That sounds dramatic. But consumer confidence has been in a range from 100-110 for the past three years as inflation soared. Despite the recent drop it still seems to be range-bound.

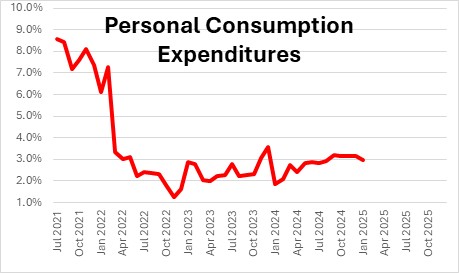

Throughout that entire three-year period when confidence was in the doldrums, consumer spending was rock solid with growth consistently in a range from 2.5-3.0%. When asked we indicate clearly that we are nervous, but we do not follow through with reduced spending. Is that about to change?

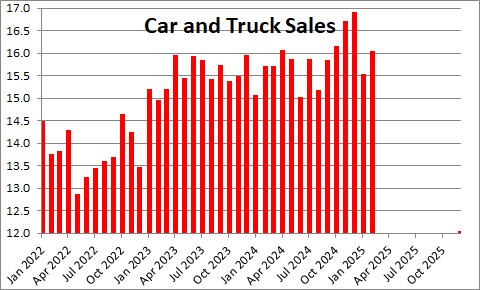

The spending data above are through January. We will get February data on retail sales on Monday and consumer spending at the end of the month. The only thing we know at this point is that new car sales rose 3.2% in February after a big decline (presumably weather-related) in January. The 16.0 million pace of car sales in January is very much in line with where it was in the second half of last year and actually stronger than it was in the first half of 2024. As a result, we anticipate a moderate 0.6% increase in retail sales in February. Despite a sharp drop in confidence consumers continue to spend.

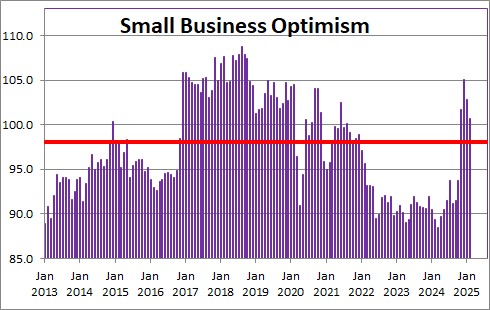

Small businesses are also nervous. Small business confidence fell 4.3 points in the first two months of this year from 105.1 to 100.7. Chief Economist Bill Dunkelberg noted that the uncertainty index rose four points to 104 in February which is the second highest reading ever. That sounds terrible. But small business confidence has consistently been 10 points lower at about 90 for the past three years and the economy did fine. In fact, small business confidence in the past four months has been above the so-called break-even level of 98 which is the first time that has happened December 2021. What is so troublesome about the recent dip?

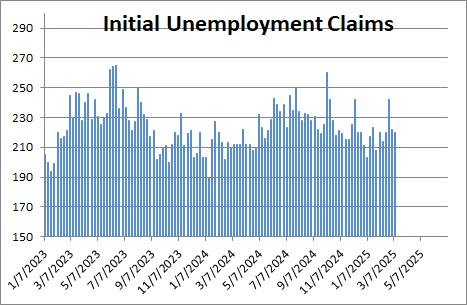

One might also look at the labor market. Thousands of federal government workers have already been laid off. We know that payroll employment rose 151 thousand in February, but that was too early to capture any of the newly unemployed federal government workers. Weekly initial unemployment claims are an early indicator of upcoming changes in employment. In the week of March 8 claims were 220 thousand which is where they have been since the spring of last year. It is also important to remember that there are only 3 million federal government workers which is 2.0% of the entire workforce. A 10% cut would mean that 300 thousand workers lose their jobs. If those job cuts are spread over the course of a year, that would reduce jobs growth by 25 thousand per month from 151 thousand jobs per month currently to 125 thousand. That is somewhat weaker to be sure, but hardly cause for undue concern.

Our point is that right now everybody is nervous – investors, consumers, business people. How could we not be? Given the chaotic nature of policy changes originating in Washington nobody can be sure what’s next. Trump changes his mind on a daily basis. That is nerve-wracking. But, while nervous, have we as consumers changed any of our spending habits? Has anyone postponed that overseas vacation trip this summer? Has anybody decided not to buy a house or a car this year? Has anybody chosen to dine out less frequently now than they did last year? None of that has happened yet. But it could.

Economists understand the sequence of events for a normal recession. The economy overheats, the Fed starts to raise rates, goes too far, the economy falls into recession. But the economy today is performing well. It is not overheating. It is at full employment. Inflation is gradually subsiding. And the Fed is not tightening. This is not the normal script for a recession. The proper policy prescription is do nothing. Don’t mess it up.

But yet every sector of the economy is being brutalized by seemingly bad policy decisions from the Trump administration. We applaud his intent. We suspect that most Americans would agree that the federal government is too big, that it is a good thing to eject illegal immigrants guilty of a crime, and that it is acceptable to apply tariffs to countries that are not playing by the rules. But we have been dealing with these problems for years but nothing has changed. Incremental changes do not seem to work. Trump’s policies are outrageous, capricious, and possibly illegal. They have alienated friends and foes alike. But things are happening in Washington. In our opinion, too much, too soon. A somewhat slower, more predictable pace would be helpful. But that is not going to happen.

For now the economy is doing fine. Consumers continue to spend. Even a slower GDP growth rate in the first quarter of 1.5% caused in large part by the combination of miserable weather in January and a tariff-inspired surge in imports in that same month. Firms continue to hire. Inflation is stable and likely to slow somewhat further as the year progresses. And the Fed is prepared to help if necessary. The problem today is not inflation, the unemployment rate, or imbalanced trade. It is policy-induced decisions made in Washington which make credible, longer-range forecasts almost impossible. Nobody knows what is coming next. But we believe in the often-underestimated strength and resilience of the U.S. economy. Hang in there.

Stephen Slifer

NumberNomics

Charleston, S.C.

Hi Steve,

What are your thoughts regarding the $ 36.7 trillion dollar debt problem. Ray Dalio recently stated that a day of reckoning is coming if we continue to spend – just like maximizing out your credit cards. People may not like to hear this, but the federal government is inefficient, poorly run and full of government employees that contribute nothing to the economy other than cost. There is no accountability in Washington. Jamie Dimon said the same thing a few weeks ago. What about the $ 1.2 billion trade deficit $

Sam

Hi Sam,

I have not written specifically about the budget problem since October of last year. The reason is that the story has not changed — the deficits are way too big and unsustainable. Here is a link to what I wrote back in October:

https://numbernomics.com/another-huge-budget-deficit-but-who-cares/

Interestingly, just today the Congressional Budget Office released their long-term budget deficit forecasts (which covers the next 30 years). It projects that debt held by the public becomes 156% by 2055.

https://www.cbo.gov/system/files/2025-03/61187-Long-Term-Outlook-2025.pdf

But despite this, neither the President nor Congress seem to care.