June 29, 2018

A recent Wall Street Journal article noted how a generation of Americans is entering old age the least prepared in decades. The basic assumption is that baby boomers want to retire at age 65, but soon discover they do not have the financial resources to do so. Fair enough. But let’s ask a more basic question, why do they want to retire at 65 anyway? What is magic about that number? To that group of Americans, I have a suggestion. Work longer.

When Social Security was first passed in 1935 retirement age was 65; life expectancy was 67. You retired, received your gold watch, and died a couple of years later. But over the years retirement age has not changed. It is still about 65 but we are likely to live until 85. Living 20 years on greatly reduced income consisting of Social Security and a pension plan or 401(k) is challenging. The math simply does not work.

But let’s revisit the basic question of why do people want to retire at age 65? It has become a given that we are “supposed to” retire at age 65. But our parents and grandparents chose to work until much closer to their end of their lifetime. What gives baby boomers the audacity to think that they can spend one-quarter of their lifetime sitting on their butt in front of the TV? Is that truly how they envision their retirement? That strikes us as sad, but many people seem obsessed with retiring at 65.

Our guess is that, over time, that perception will change, in some cases by the financial reality that it is not going to happen. But many of these older Americans may wake up to the reality that their retirement dream is not as satisfying as they expected it to be. It is boring.

Most retirees worked 40 years at something. They identified with what they did. They were accountants, attorneys, firemen, teachers, or economists. But upon retirement they are not that anymore. So who exactly will they be for the next 20 years? That is a difficult question to answer. While some may have given thought to that while still working, most have no idea what their retirement years will look like until they get there.

Some may have a burning desire to become an artist, take up the guitar, travel extensively. or “give back” to their community by volunteering at a local non-profit. Those are all perfectly worthwhile choices, but they will not pay the bills.

Why not consider working a bit longer? The health of a 65-year old today is far superior to the health of a 65-year old in 1935. We have the ability to work far longer if we choose to do so.

A primary benefit is that working will keep these older Americans mentally engaged. Equally important it will reduce the monthly drain on their savings.

At a national level there is a chronic shortage of skilled workers. Employers can benefit substantially from keeping older workers around to impart their knowledge and skills to younger workers. Even if not actually on the payroll they can keep working as consultants.

There can be little doubt that retiring baby boomers have been a contributing factor to the recent drop-off in productivity growth. We cannot take a skilled worker with 40 years’ experience, replace them with a 35-year old, and not expect productivity growth to slow.

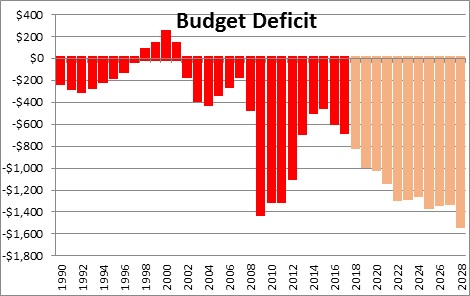

Finally, if older workers begin to work past age 65 it will reduce the drain on the Social Security Trust Fund and extend the date when its assets will be depleted. It will also slow the upward trajectory of the budget deficit. The driving force behind those higher deficits is demographics. As more and more Americans reach age 65, they start to draw Social Security and become eligible for Medicare benefits. If Americans choose to work longer, the deterioration will be less dramatic.

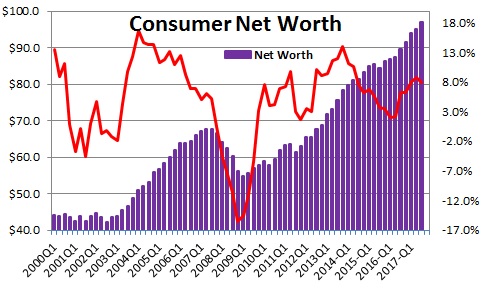

A couple of other points are worth noting. First, the article in the Wall Street Journal looks only at the likelihood of reduced income in retirement. But it ignores the fact that consumer net worth has been steadily on the rise for the past decade. It continues to climb at a steamy 8.0% pace fueled by the combination of rising home prices and by the steady upswing in stock prices to record or near record levels.

Second, given the increase in net worth consumers do not feel the need to save as much from their income as in the past. The savings rate today is 2.8% which is well below its long-term average of 5.5%. Consumers do not need to save as much today as in the past because their net worth is providing a comfortable cushion.

Finally, baby boomers were born between 1946 and 1964. If they choose to retire at age 65 they will retire between 2011 and 2029. That means that they have been retiring for the past seven years and will continue to retire another decade. But, thus far, there have not been the dire consequences predicted by the WSJ. Our guess is that retirement will prove to be less of a challenge for the baby boomers than many expect for two reasons. First, many of them will choose — either from desire or economic necessity – to work longer. Second, many of them have a net worth cushion to supplement their retirement income.

We are not going to suggest that working past age 65 is an option for all, particularly those with health issues, but it is a very rational and desirable choice for many.

Keep working, you may actually enjoy it.

Stephen D. Slifer

NumberNomics

Charleston, S.C

There’s a huge and growing reservoir of Boomer talent standing-ready to volunteer…in church basements, Red Cross, Schools. I want to see the line item in the Governors budget listed as: People Willing To Work for Free… with a large dollar sign. The IRS reports that the average AGI for in-migrating families to SC (63% over age 50) is $70,129. (NC is $63,528.) Our forecast is that the Carolinas will receive at least 468,406 (63% over age 50) new faces in 2018. Likely goes up forever.

Stephen,

I agree with you. I retired at age 72 and hated it, I did some online teaching to fill in the blank time. Then I took a job as professor at Wingate University teaching graduate students working on their doctorates. I LOVE it. I published my first book as of June 30, 2018. It is about technology and its effect on community colleges. I am about 75% finished with my 2nd book on the exponential effect the technologies will have on higher education. I have a publisher for that book. My third one will come out in 2019. My career of community college administration is now allowing me to have a direct impact on higher education in the future of this century.

Quit at age 65? Absolutely not. I am 76 and going strong.

I enjoyed your comments. They are right on track.

Darrel Staat

I agree with your position that it makes sense for people to work longer given how much greater life expectancy is than it was in the past and I believe that is actually happening.

However, the article that you referred to from the WSJ was focused on the failure of many people to save for retirement and the age at retirement was a secondary issue. What was noteworthy is the examples they sited where people in Defined Contribution Plans (401-K) were habitually withdrawing their savings and spending it. People who are unable or unwilling to save were not permitted to raid the cookie jar under a Defined Benefit Plans (a pension) no matter how worthy their needs might be. As such, a significant portion of what they would need in retirement was always protected assuming their employer did not go bankrupt. I think the primary take away from the WSJ article would be that self discipline is as essential now as it ever was.

Hi Walter,

I took the first sentence from the headline of the WSJ article which was noted that there is a whole generation of Americans that are not financially prepared. You are absolutely correct that they noted that people have not been saving enough, and the point you make about the fact that we have been dipping into our 401(k)’s. I could have kept going I suppose, but my word limit for the Business Journal article prevents me from going too long (the article was 952 words; my supposed limit is 700). I guess I focused on the age thing because so many of us are there. I have been harping on this 65 thing for so long I just decided to write about it. I cannot for the life of me figure out why people are so dead set on retiring at 65. Makes no sense to me. Will be 75 next week and plan to keep writing for a long time to come.

Thanks for sharing your thoughts. Talk to you soon. Hope all is well.

Steve

Hi Darrel,

Somehow this article has generated more comments than any I have written in ages. Must be a lot of us in the same boat! I allegedly retired to S.C. at 59 when my daughter got out of high school. Thought I would do the whole retirement thing — running, golf, sailing, etc. But, like you, I found that boring. Tried to “give back” via Rotary. But when you volunteer at these charities you get some sort of boring job that does not seem very fulfilling. The idea of running a non-profit was unacceptable. All about fundraising. Also tried the online teaching. I liked that, but it was a lot of work for virtually no pay. Then the U. of Phoenix decided I had to focus on the theory. I do not bring much to that party. I have had 40 years of real world economics. I loved it and think I can get others to love it as well. Anyway, then along came the recession. Knowing I was an economist people asked me what I thought was going to happen. Enough people asked so I figured that might be a business opportunity. I started writing and running around doing speeches. Perfect! Now I get to do in my retirement something that I love, think I am fairly good at doing, at whatever pace I want. What more could I ask for? I will be 75 next week so I am right behind you and have no plans to quit any time soon. This getting old is kind of fun!

All the best. Keep writing. Talk to you soon. Thanks for sharing.

BTW, I want to read your book. Just found it on Amazon. Will comment once I read it.

Steve

Hi Pat,

Interesting stats for S.C. Sounds like both SC and NC will have lots of relatively well off people arriving soon. Some still working. They bring a lot of experience to whatever job they get here. Others will be retired. The retired ones should have that net worth cushion I talked about. And, hopefully, once they get settled they will start looking around for something to do.

Thanks for your comments.

Steve