February 7, 2025

This past week we learned about wild swings in employment the past three months combined with a steady decline in the workweek which does not seem to make a lot of sense. The Bureau of Labor Statistics said that the wildfires in California and the bitter cold weather that prevailed throughout most of the country in January had no discernible impact on the data. Hard to believe. At the same time consumer sentiment fell sharply in February as consumers worry about a sharp acceleration in inflation this year. Does that imply slower consumer spending in the months ahead? We doubt it. Meanwhile, Trump’s on again, off again tariffs, deportation of illegal immigrants, shrinking the federal government workforce, and soon-to-be announced changes to tax rates, make economic forecasting for 2025 challenging. In the end, we believe that the economy remained robust in January and should continue to expand at a roughly 3.0% pace in 2025. We are not yet prepared to join the chorus of worrywarts who fear that everything that is happening in Washington these days is negative.

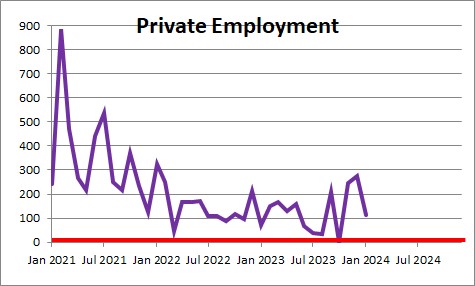

Payroll employment climbed by 143 thousand in January after having risen 307 thousand in December and 261 thousand in November. Why so much slower in January? The wildfires in Southern California and the severe winter weather could easily have contributed to the January slowdown in employment, but the Bureau of Labor Statistics said that was not the case. That is a little bit hard to believe. What we know now is that employment rose sharply in the past three months with an average monthly gain of 237 thousand.

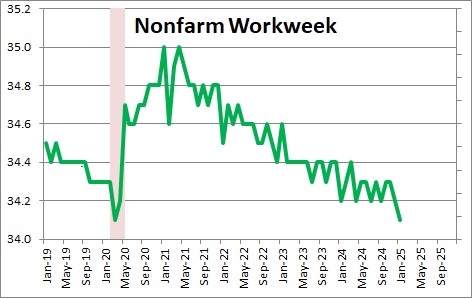

In addition to hiring workers employers can also alter the length of the workweek for their existing workers. The nonfarm workweek declined 0.1 hour in January to 34.1 hours after falling 0.1 hour in December. That is a surprisingly short workweek. It is hard to believe that employment has been so solid while at the same time employers have been significantly shortening the workweek. Something is not making sense.

It is important to remember that employment changes drastically in the November through January period every year with the hiring and subsequent laying off of temporary workers in connection with the Christmas holiday season. And, in this case, potential distortions could have been created by the California wildfires and extreme cold weather. We remain cautious about reading too much into the monthly changes in the employment and hours worked data for these three months.

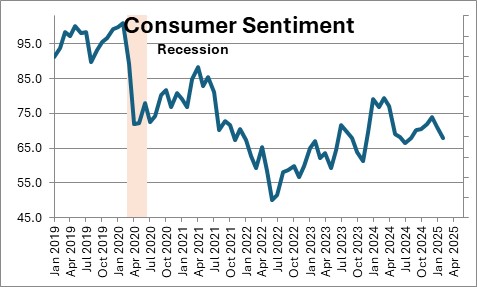

Then there was the sharp drop in consumer sentiment in February. The University of Michigan reported that sentiment declined by 3.3 points to 67.8 as consumers worried that inflation could accelerate sharply in 2025. That is the lowest level for this index since July of last year.

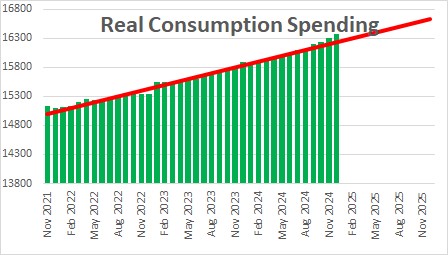

But it is important to note that consumer spending has fallen sharply in the past couple of years but consumer spending has been unaffected. In the past year real consumer spending has risen a solid 3.1%. We doubt that the latest inflation fear will have much of an impact on the pace of consumer spending in the months ahead. Given the ongoing strength in the labor market we believe that spending will rise 2.5-3.0% this year.

Meanwhile, President Trump continues to threaten widespread tariffs. But his announced 25% tariffs on imports from Canada and Mexico were postponed for a month days later. They could be re-imposed later. Or not. It is not clear if the tariffs against those two countries are a bargaining chips to entice Canada and Mexico to do more to curtail the flow of immigrants and illegal drugs into the U.S., or if Trump is trying to reduce the sizeable trade deficits with those two countries.

The deportation of illegal immigrants has begun. Thus far it seems to be focused on convicted criminals who have not left the country. If so, the impact on the labor market will be relatively small. But will all illegal immigrants become targets? If that is the case, the negative impact on the labor force and employment will be much more pronounced.

Musk is shutting down some government agencies. He is offering federal employees the option of leaving voluntarily and getting paid through September or getting fired. While everybody agrees that the federal government is grossly overstaffed, many of Musk’s actions may be ruled illegal. It is not yet clear how this will play out in the months ahead.

We are unwilling to significantly our forecasts for GDP growth, employment, and inflation based on what Trump promised during the election campaign, or what he has done thus far. Campaign promises can we watered down. Announcements can be imposed and then withdrawn.

The one thing that economists, investors, and the American people can count on is uncertainty for the next four years. There will almost certainly be negative aspects of everything Trump tries to change. But ejecting criminal immigrants, shrinking the size of the federal government, imposing tariffs on countries that have been stealing our technology and not playing by the rules, and eliciting better terms of trade from all our trading partners, are all worthy objectives.

We are not yet willing to join the chorus of boo-birds who remain steadfastly opposed to any kind of change.

Stephen Slifer

NumberNomics

Charleston, S.C.

Steve, I agree the data is confusing. Question, for experts like who have spent years interpreting and relying on government-provided data, are you able to tell if what is published by a department in the executive branch has been manipulated or is false? I think we are in unprecedented times where the checks and balances of government have been compromised. If the administration doesn’t want the public to see bad news, can they just change the data to show that all is great? Is there a check on data provided by the Administration?

Hi Taylor.

I saw your note re: the Washington Post article. I do not believe data from the government are being manipulated. The reason is that almost every economic indicator we look at can be checked by other publicly available data. For example, suppose the government says that payroll employment rose by 150 thousand when it really declined by 150 thousand. We do not really know if the 150 thousand increase in payroll employment is correct. But we also see weekly data on layoffs (initial unemployment claims). if payroll employment declined sharply there should be a fairly significant increase in layoffs. We are not seeing anything like that. Initial unemployment claims and the number of people receiving unemployment benefits have been quite steady which suggests the labor market is fairly steady. Then there is the monthly ADP survey of employment. If employment is declining and the government is trying to cover it up, then the ADP survey should show a decline in contrast to the government data. it is not. It is showing gains roughly comparable to payroll employment.

As another example, suppose retail sales was falling and the government was trying to cover it up by showing an increase. We get monthly data on car sales from the automobile manufacturers. If overall sales were declining, car sales should do the same. They are not.

GDP data consists on tidbits of information coming in from consumers, businesses, the census bureau for trade, government statistics for government spending. If there was some sort of conspiracy there are lots of sectors of the government that would have to be in on the game.

The bottom line is that there are lots of private sector data sources that can act as a check on data being published by the government. And think about all the government data we see. It comes from the Labor Department, the Commerce Department, and the Census Bureau, amongst other departments. Some data is reported by the states. They have no incentive to report misleading data. There is simply too much data available from non-government sources, and from so many different government agencies that it would be almost impossible to significantly alter the data.

Confounding some, the economy still seems to be doing fairly well and it is not because the government is trying to pull a fast one. Maybe the economy will weaken in the months ahead, and if it does all data available should move in that direction.

I hope this helps.

Steve