February 26, 2016

Consumer spending is by far the strongest sector of the economy. Thus far consumer credit has been growing at a moderate pace. But if the consumer were to become more willing to borrow, and at the same time banks were more willing to lend, it would create a problem because the economy is close to its full employment threshold. A significant pickup in lending activity at this point in time would quickly boost inflation and force the Fed to tighten at a faster pace than they have described. Thus it is worthwhile to check in periodically on the status of consumer credit.

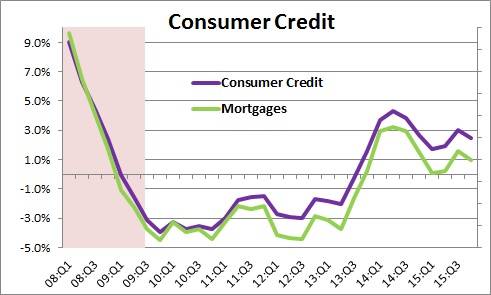

During the course of the past year total consumer credit has been growing at a moderate 2.4% pace which is roughly the same rate of expansion we have seen for the past couple of years.

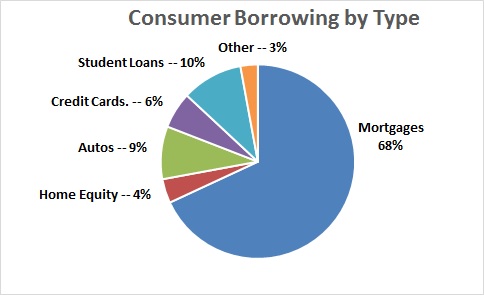

Consumer credit is dominated by mortgage lending which accounts for two-thirds of the total. For that reason, as shown in the chart above, growth in total credit outstanding closely parallels what is happening to growth in mortgages. Over the past year total consumer credit has grown 2.4% while the mortgage category has expanded at a slightly more subdued 1.0% pace.

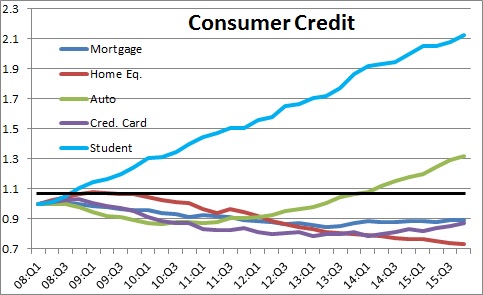

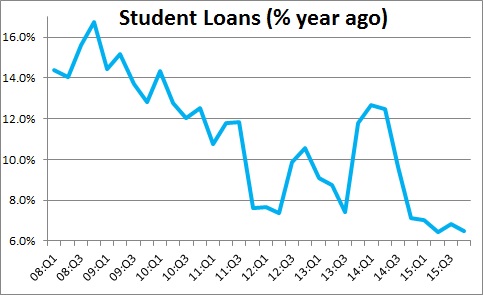

The one category of credit that stands out from all others is student debt. It began to climb rapidly during the recession as graduating high school students could not find jobs, and as unemployed workers returned to school to brush up on the skills they needed for employment. During the past eight years student debt has more than doubled in size to $1.2 trillion while all other types of credit have increased slowly or even declined.

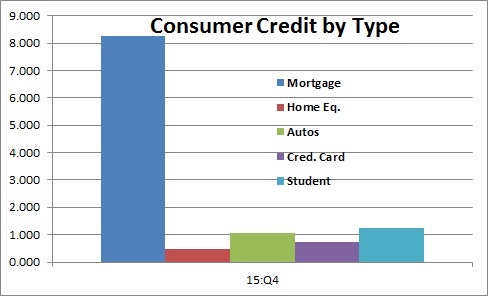

As a result, at $1.2 trillion student loans are now larger than home equity loans, ($0.5 trillion), auto loans ($1.1 trillion), and credit card debt ($0.7 trillion), but pale in comparison to the whopping $8.2 trillion of mortgage debt outstanding.

Having said that, recent data show that the rate of growth in student loans has slowed from a double-digit pace a couple of years ago to a still noteworthy 6.5%. Such a slowdown is perhaps not surprising given that the economy continues to expand at a moderate pace of roughly 2.5% and jobs are more readily available.

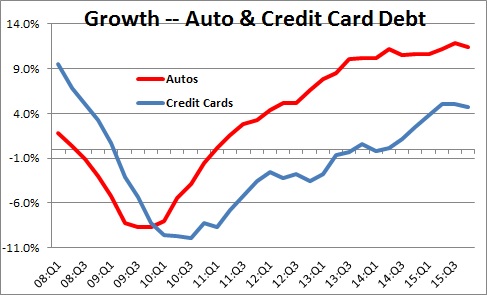

During the course of the past year the fastest rate of expansion amongst the various categories of consumer credit has been auto loans which have climbing at a steamy 11.4% pace. Consumers also seem willing to pull out the plastic as credit card debt has been piling up at a 4.7% clip.

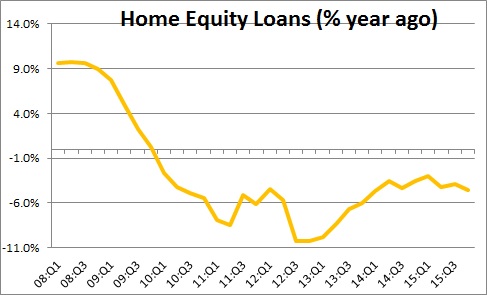

What has not been growing are home equity lines of credit. They have been contracting for the past six years. Homeowners got burned during the recession by having too much debt, home equity debt in particular, as home prices were falling. They continue to pay down home equity lines of credit.

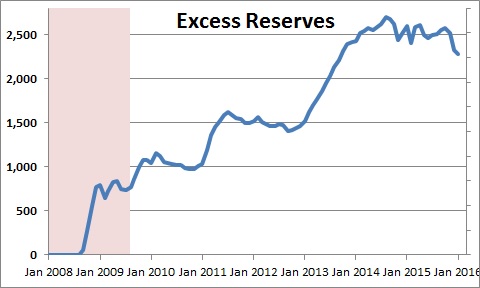

Why do we care about this? The answer is that the Federal Reserve flooded the banking system with reserves during the recession and in the first six years of expansion through its bond buying program. Excess reserves soared from $2.0 billion prior to the recession to $2.5 trillion. That represents the ability of the banking system to make loans to consumers and/or business people. If those groups become willing to borrow at the same time that banks become more willing to lend, there are sufficient funds in the banking system to fuel a highly inflationary spending spree.

Banks have generally been willing to extend credit to businesses for the past several years, but they have been relatively stingy with respect to consumers. If consumers step up the pace of borrowing, the Fed may feel compelled to raise rates more quickly than the slow pace that they have suggested up to this point to curtail the pace of economic activity and, hopefully, head off a pickup in inflation.

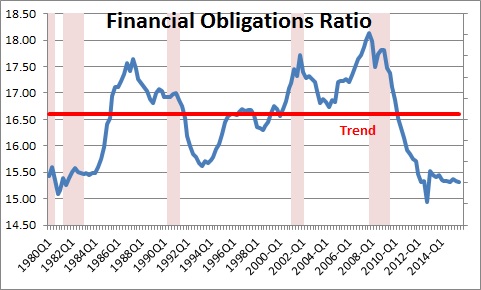

Thus far consumers are not eager to take on additional debt but they certainly have the ability to pick up their pace of spending. That is because consumer financial obligations as a percent of income are the lowest they have been since the early 1980’s. The question is probably not whether, but when, the consumer will begin to spend more rapidly.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me