February 26, 2021

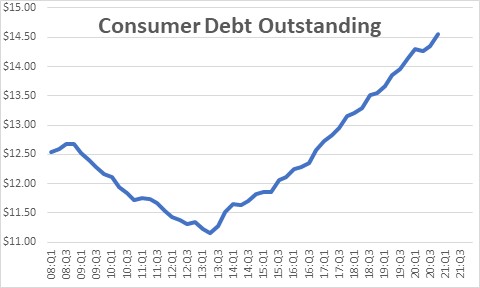

The Federal Reserve Bank of New York recently released its quarterly report on consumer debt which rose by $206 billion in the fourth quarter to a record high level of $14.56 trillion, driven in part by a steep increase in mortgage originations. That sounds ominous. It is not.

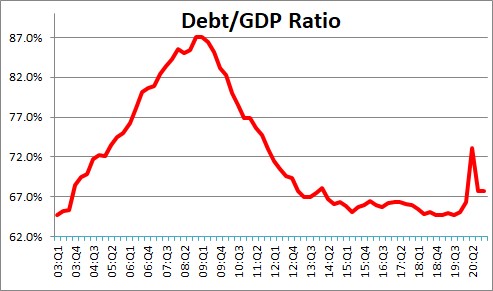

While the level of consumer debt is important, the real question is whether the consumer can afford it. One way to determine that is to look at the relationship between consumer debt and nominal GDP (which is a measure of income). That percentage today is 68%. It jumped when the economy plunged into recession in the second quarter of last year, but the dramatic rebound in growth in the second half of the year has caused this ratio to return to where it had been for the previous seven years. With consumer income climbing rapidly and interest rates at record low levels, consumers can easily handle the existing level of debt.

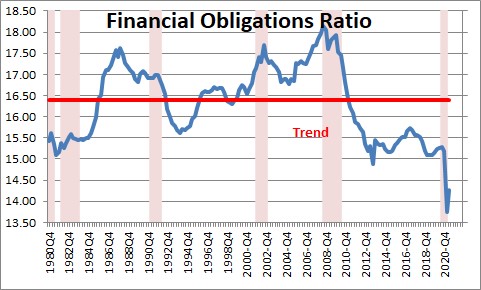

The Board of Governors of the Fed has a slightly different measure known as the consumer’s financial obligations ratio which looks at monthly payments on all types of consumer debt — mortgages, consumer installment debt, automobile lease payments, rent, homeowners’ insurance, and property taxes — in relation to income. This measure plunged last year as interest rates declined and consumer income surged thanks to the $1,200 tax refund checks, and remains far below its average over the past 40 years of 16.6%.

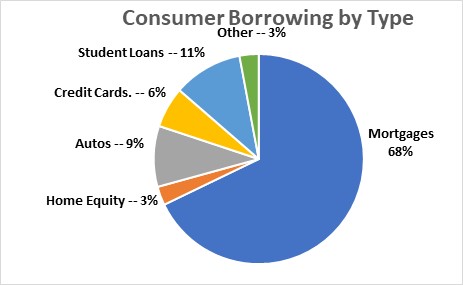

Of the various types of consumer debt, the big gorilla is mortgage debt which accounts for 68% of the total. Not surprisingly, in any given quarter the change in total debt will be largely determined by what happens to mortgages. In the fourth quarter mortgage debt outstanding increased by $182 billion while total debt climbed by $206 billion. That means that in the fourth quarter mortgages accounted for almost 90% of the increase in the total– far more than its normal share of the total.

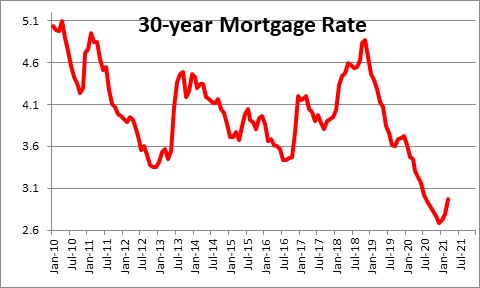

Why the growth in mortgage debt? Potential home buyers were rushing to take advantage of record low 2.7% mortgage rates.

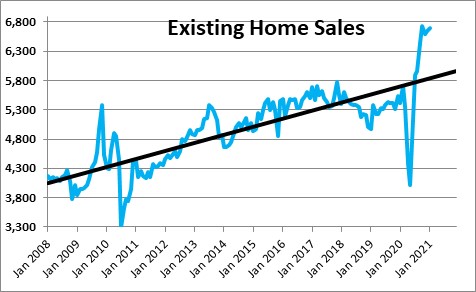

As mortgage rates declined, home sales skyrocketed in the second half of the year. Not only were rates at record low levels, but the fiscal stimulus program passed in March 2020 included a $1,200 tax refund check for virtually every taxpayer which encouraged potential homebuyers to take the plunge. Many took the opportunity to move out of their expensive rental apartment in big cities to more affordable housing in the suburbs.

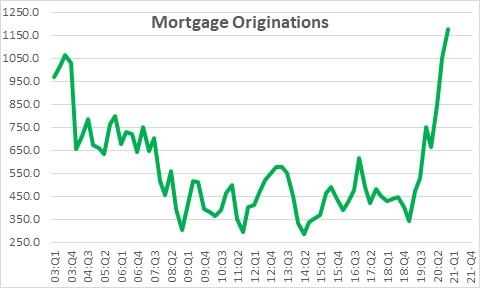

Current homeowners were also rushing to re-finance and take advantage of historically low mortgage rates. The New York Fed survey shows that mortgage originations, which include both newly originated mortgage as well as refinances, were at a record $1.2 trillion in the fourth quarter and surpassed the volume seen during the historic refinance boom in 2003.

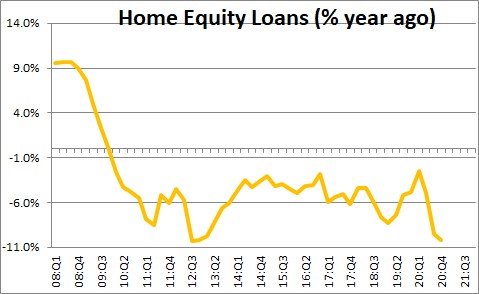

Home equity lines of credit fell $12 billion in the fourth quarter. But this type of borrowing has been falling steadily ever since the end of the so-called “Great Recession” in 2009. Given the extent to which home prices fell during that recession, homeowners have chosen to pull back sharply on their outstanding lines of credit.

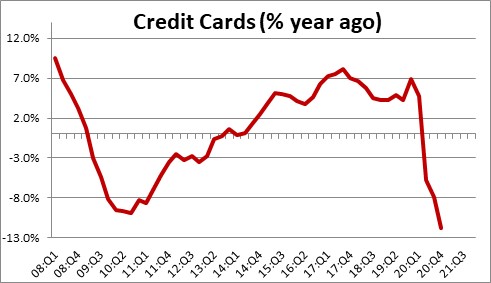

Elsewhere, credit card balances outstanding increased $12 billion in the fourth quarter, but they were $108 billion or almost 12% lower than they were at the end of 2019. Perhaps consumers took advantage of the $1,200 tax refund windfall to pay off some very expensive credit card debt.

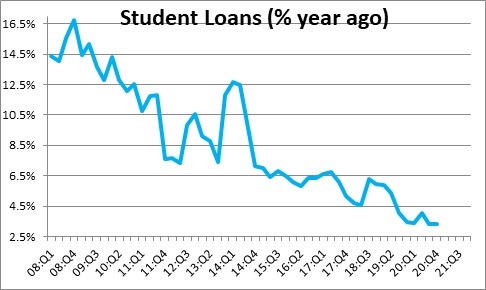

Student loans rose $10 billion in the fourth quarter. Following the 2008-09 recession student loans climbed at a double-digit pace for several years as students, unable to find a job, remained in school. But because the economy has improved since that time most of them have found jobs. At the same time the cost of a college education has escalated. As a result, student loan growth this past year has continued to slow to 3.3%.

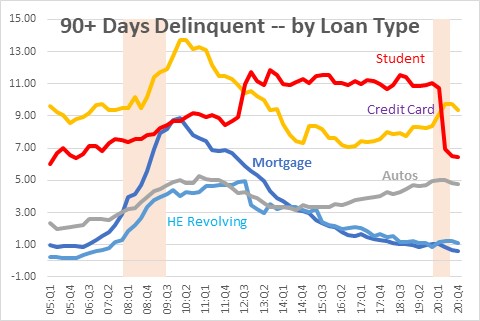

As consumer income continued to climb supplemented by the $1,200 tax refunds, delinquency rates have fallen for all categories of borrowing. The decline was most noticeable for student loans (the red line below) where delinquency rates plunged during the course of the year. This seems to reflect an upswing in forbearances which were provided by the CARES Act or voluntarily offered by lenders.

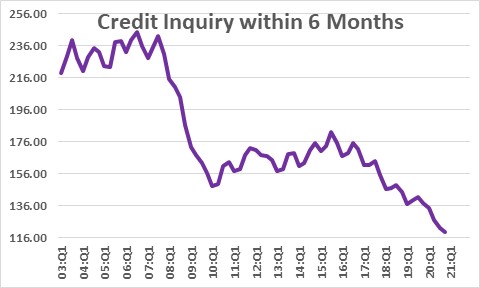

The New York Fed also reports the number of credit inquiries in the past six months which it interprets as an indicator of the consumer’s demand for credit. It continued to slide in the fourth quarter and is now the lowest seen in the 19-year history of the data.

As we see it, the consumer continues to be cautious about taking on additional credit. To the extent that credit is climbing, it is largely attributable to rapid growth in the mortgage component which reflects consumers taking advantage of historically low interest rates. As a result, consumer debt in relation to income remains well in check and monthly payments are easily affordable given the low level of interest rates. There are no signs that consumers are having difficulty keeping up with their monthly payments, and where payment problems have arisen, banks have been willing to offer forbearance to those troubled borrowers.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me