August 21, 2015

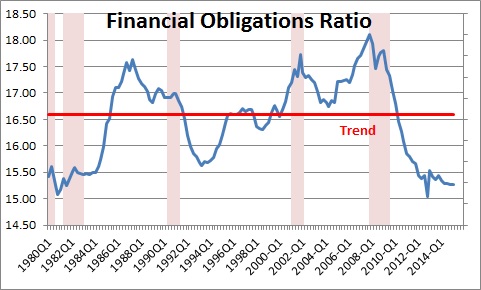

At the beginning of the recession the consumer was heavily indebted and their debt payments in relation to income were at a record high level. For the next several years the consumer paid down considerable amounts of debt, job creation was lifting income, and the debt/income ratio fell precipitously. It is currently at its lowest level since the early 1980’s. With little debt consumers have the ability to pick up their pace of spending if they choose to do so. In the past year consumers have become willing to borrow again, but they remain cautious.

Having said that, the Wall Street Journal recently ran a front page story about the growth in student loans and the extraordinary sums of debt some students are carrying. Furthermore, many of the biggest borrowers plan to take advantage of Federal debt forgiveness programs and have no intention of paying back their student loans. The article creates the impression that consumer borrowing, student loans in particular, are spiraling out of control. While changes clearly need to be made in the student loan program, the problems are still relatively small. A couple of points are worth noting.

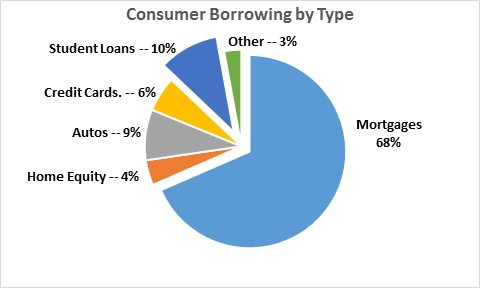

First of all, there are $1.2 trillion of student loans outstanding. While that number seems large, it represents only about 10% of total consumer credit outstanding. The big gorilla has been, and still is, mortgage lending which, combined with home equity lines of credit, accounts for almost three-quarters of all consumer borrowing.

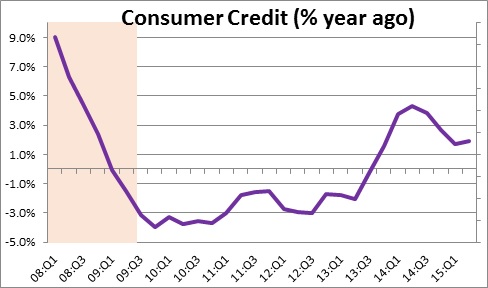

Second, during the recession and the first few years of expansion, student loans were climbing at a 10-15% pace as young adults — unable to find a job — chose to go back to school. However, student loan growth has gradually slowed to a much more manageable 6% pace. Meanwhile, consumers are feeling good and are very willing to purchase cars. Auto loans have accelerated in recent years and are now climbing at an impressive 12% pace.

Automobile and student loans may be the fastest growing categories of consumer borrowing, but the overall picture is one of modest growth. Mortgage lending in the past year (the big gorilla again) has been essentially unchanged. Home equity lines of credit have declined. And credit card debt has risen by 5.0%. Put it all together and total consumer credit has risen at a modest 2.0% pace. Consumers are borrowing, but not excessively so. Keep in mind that real disposable income (which is what is left after inflation and taxes) is climbing at a 3.0% pace. Thus, the debt to income ratios noted earlier are still not climbing.

But what about those student loan borrowers with more than $100,000 of debt outstanding who have no intention of paying it back? First of all, 85% of student loan borrowers have less than $50,000 of debt outstanding. The average borrower has about $30,000 of student loans. However, the Wall Street Journal article focuses on those borrowers with more than $100,000 of student loans. The article points out, correctly, that the number of such borrowers has been rising steadily for a decade. But it does not point out that borrowers with student debt in excess of $100,000 represent only about 4.0% of all such borrowers. For most of them the debt level is so large because they have chosen to go on to grad school – law school and med school in particular. When they graduate the vast majority will be in a position to repay their debt. But, as the article noted, some have borrowed big time with no intention of ever paying back the full amount. They plan to take advantage of a variety of debt forgiveness programs. For example, if they become a teacher, a public defender, take some other public sector job, or work for a nonprofit organization, their student loans can be forgiven after 10 years. For those working in the private sector most of them can have their debt forgiven after 20 years. Clearly, the student loan program needs to be modified. But the notion that student loans are spiraling out of control and becoming the next bubble that is about to burst is grossly misleading.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me