November 18, 2011

Earlier this year U.S. consumers got scared – very scared. And why not? Oil prices jumped by 50%. The tsunami in Japan slowed first half GDP growth to a snail’s pace. Europe’s debt woes threatened to spill over into the U.S. Congress appeared incapable of dealing with our own budget problems. The stock market went into a tailspin. Happily, those fears have passed and the economy seems to be on a sounder footing. What happened to all that expected weakness??

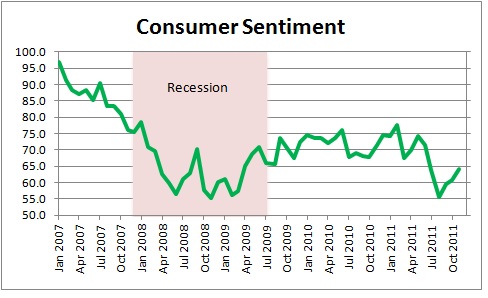

During the summer consumer confidence plunged to a level last seen in the midst of the 2008-2009 recession. Because of its depressed level many economists concluded that the economy was on the cusp of slipping back into recession. But that made no sense. The condition of the U.S. economy in 2011 is not even remotely similar to what it was three years ago.

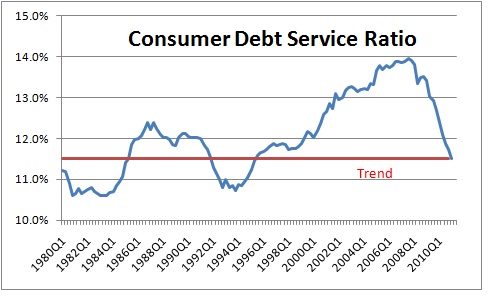

With respect to the consumer, three years ago we were very highly leveraged. In the mid-1990’s times were good and we began to accumulate enormous amounts of debt. Debt climbed far more rapidly than income. As a result, our debt/income ratio climbed dramatically.

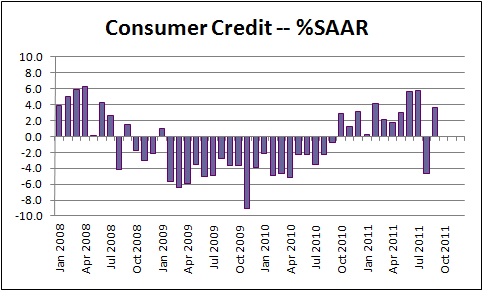

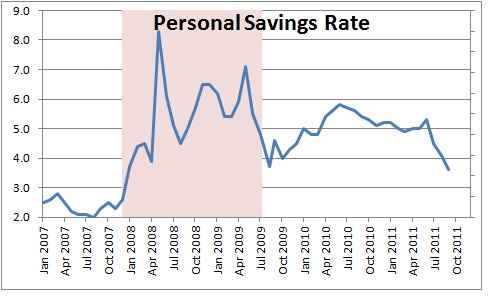

When the Fed raised the funds rate from 1.0% to 5.25% between mid-2004 and mid-2006 that debt burden, particularly for adjustable rate mortgages, became far more costly and problematical. Once Lehman collapsed in September 2008, we suddenly came to the realization that we had way too much debt. We got worried and began to pay down debt with a vengeance.

Every month for nearly two years we paid down debt. If we made $1,000 per week we might, for example, take $100 from every paycheck and use it to pay off debt. Two years later our debt/income ratio has dropped back to a level much more in line with its historical average. This means that in 2011 consumers have a much more manageable “debt burden”. We are so comfortable, in fact, that we actually began to borrow again late last year and the pace of borrowing has accelerated steadily throughout 2011.

If Americans really are comfortable with their debt burden, this means that they no longer have to take $100 from every paycheck and use it to pay down debt. They can save it, or even begin to spend it. That has enormous positive implications for GDP growth in the quarters ahead. Remember, consumer spending accounts for two-thirds of our gross domestic product.

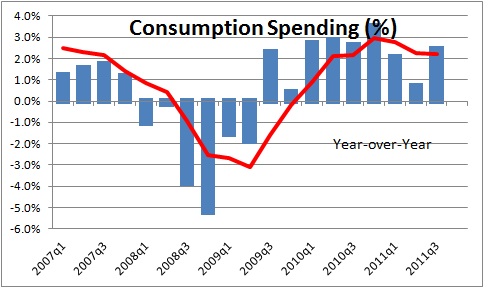

In the third quarter when a series of events shook our confidence, our reduced debt burden allowed us to shrug off this concern and actually boost our pace of spending. Indeed, consumer spending in the third quarter quickened to a 2.4% pace. And while it is still early, consumer spending in the fourth quarter is on at least a 2.5% growth track.

Some suggest that the current pace of spending is unsustainable because consumer income did not grow as quickly as spending and the consumer had to dip into savings. That is true. The savings rate fell to 3.6% in September from a 5.0% rate earlier this year. Going forward one of two things is going to happen. If income does not begin to rise more quickly, then the pace of spending will have to slow. But it is entirely possible that income could begin to grow more rapidly, and that is exactly what we expect. We anticipate a faster pace of job creation on the months ahead. The weekly data on layoffs has been steadily falling. The number of people receiving unemployment benefits has also been declining. Thus, we expect payroll employment to rise by 175 thousand in November which is about double the pace of the past six months. Meanwhile, the unemployment rate should drop by at least 0.1% in November or perhaps 0.2% to 8.8%. Faster job growth means faster growth in income.

If asked, the consumer will tell you that he or she feels terrible. But the reality is that the consumer’s reduced debt burden is allowing them to spend at a respectable – and perhaps accelerating — pace. Can you imagine what they might do if they actually began to feel better? More jobs just might make that happen.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me