November 15, 2024

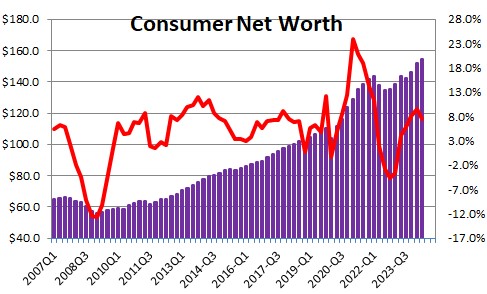

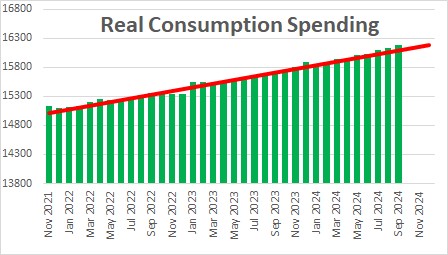

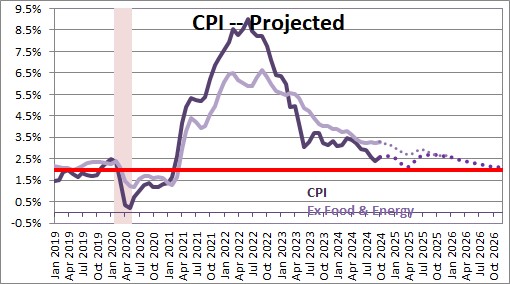

The retail sales data for October combined with upwards revisions to September indicate that the consumer is still willing to spend. That is not a great surprise. Driven by the rapid ascent of the stock market and surging home prices, consumer net worth has risen to a record high level. And with the unemployment rate at 4.1% every worker that wants a job has one. There is little fear of losing one’s job and cutting off the family’s income stream. Against that background it is not surprising that consumers remain willing to spend. What is new is that last year consumers were relying heavily on credit cards to sustain their pace of spending. Now, with real earnings once again on the rise, consumers are able to spend at a brisk pace without excessive credit card borrowing. With inflation likely to remain subdued in the months and quarters ahead and real earnings continuing to climb, consumers will have no need to rely heavily on credit card debt to maintain their lifestyle in 2025.

While it is still early in the fourth quarter, the retail sales data for October suggest that the consumer remains willing to spend. There is no doubt that consumers are well aware that their net worth has jumped to a record high level. Every few days the various stock market indexes register another new record. In 2022 and 2023 home prices rose to levels that most homeowners never expected to see in their lifetime and they continue to climb slowly.

At the same time the unemployment rate is 4.1% which is essentially its full employment threshold. What that means is that everybody who wants a job has one. That does not seem likely to change much in 2025. There is little chance that the breadwinner is going to get laid off any time soon and the family income stream might get interrupted.

Against this background it is not surprising that the consumer remains willing to spend.

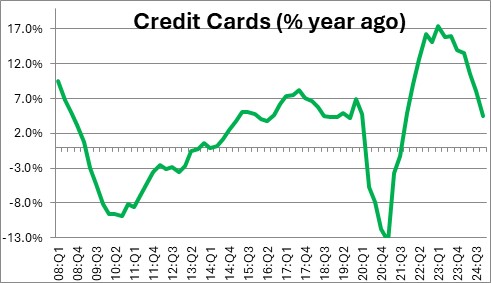

But during late 2021 and 2022 when real income was declining, consumers maintained their lifestyle by relying on credit cards. Credit card debt outstanding began to surge and continued to grow rapidly every quarter until the end of last year. The annualized growth rate peaked at 17.4%. Given that credit card borrowing is extremely expensive with interest rates typically between 20-25%, the rapid run-up in credit card debt was simply not sustainable.

During that period of time consumer purchasing power was being steadily eroded by inflation. A 4.0% increase in nominal earnings quickly translated into a decline in real earnings as inflation soared. Consumers were feeling the pinch. A $100 trip to the grocery store bought only about two bags of groceries whereas a year earlier that same $100 might have bought three bags of groceries. Even though real earnings were declining, consumers wanted to maintain their lifestyle so they began to rely heavily on credit cards to make that happen.

But then the inflation rate began to fall. By the spring of last year nominal earnings were growing more quickly than the inflation rate, and real earnings were once again beginning to climb. In the past year nominal weekly earnings have risen 4.0% while inflation has slowed to 2.9% which means that real earnings have risen 1.1%. That is roughly in line with the growth rate in real earnings that prevailed just prior to the recession. Life is returning to normal.

With the upturn in real earnings consumers have noticeably reduced their reliance on credit cards. For two years credit card debt was climbing at roughly a 17.0% pace. But in the first three quarters of this year credit card debt outstanding has slowed dramatically and for the year as a whole it should rise only about 5.0%. Consumers continue to spend, but now they are able to do so with money from their weekly paycheck rather than ultra-expensive credit card debt. With real disposable income growing at a 3.1% pace and real consumption spending growing at the same 3.1% pace, consumers should easily be able to maintain a robust pace of spending throughout 2025.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me