May 24, 2019

In a recent speech Fed Chair Powell highlighted the recent rapid growth of corporate debt. Not surprisingly, that concern captured headlines in the press. Less noted was his conclusion that such debt was not out of line given a long-lasting expansion, and – unlike 10 years ago — the banking system is well positioned to withstand any business sector downturn. Powell views the risk of rising corporate debt as moderate. He and his colleagues at the Federal Reserve are doing exactly what they should be doing — looking under every rock for any potential problem that could threaten the now decade old expansion.

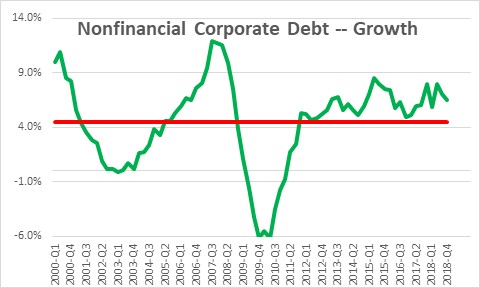

Corporate debt has grown rapidly in recent years. Its growth rate averaged 4.5% during the past 20 years, but in recent years growth it has accelerated to between 6.5-8.0%

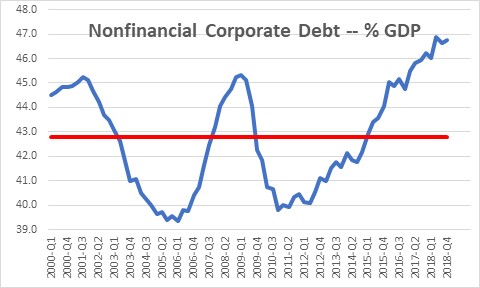

Consumers constantly monitor debt in relation to income. They can take on additional debt as their income grows, but they must make sure that debt does not become excessive.

We can measure the exact same concept for the corporate world by looking at corporate debt as a percent of GDP. That percentage has risen steadily and some now view its current level as alarming. However, with interest rates still at very low levels the cost of servicing that level of debt is historically low. Thus, the relatively high amount of debt is not yet bothersome, but if the Fed were to raise interest rates sharply that could change. Fortunately, higher rates do not appear to be in the cards any time soon.

The concern about corporate debt stems largely from what are known as collateralized loan obligations or CLO’s. The terminology may sound familiar. A decade ago the problem came from collateralized mortgage obligations or CMO’s. At that time financial firms were packaging a large number of mortgage loans, turning them into a debt security, giving that security an investment grade rating because the risk was supposedly “diversified” amongst a large number of borrowers, and then selling those securities to investors. We know how that turned out.

A CLO is essentially the same thing, but the underlying debt in this case is not a mortgage but a corporate loan. These loans typically have a low credit rating and are often issued in connection with a leveraged buyout where a private equity firm takes control of an existing company. CMO’s became a problem when the Fed sharply increased short-term interest rates in 2005 and 2006 which put pressure on homeowners who had chosen a variable rate mortgage. As rates rose and variable rate mortgages repriced upwards, less credit worthy homeowners were increasingly unable to afford the higher mortgage payments, and eventually defaulted on the loan. If interest rates should once again begin to climb, CLO’s carry the same risk for less credit worthy corporate borrowers.

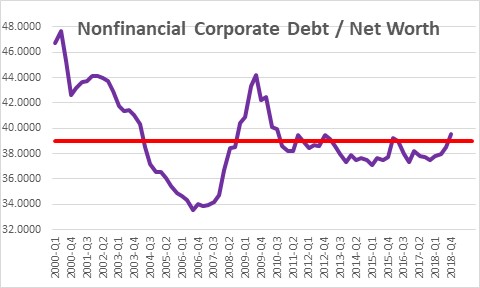

In addition to monitoring debt in relation to income one can also monitor the level of debt relative to net worth. This is a measure of debt in relation to assets, and its current level is not nearly as alarming. As stock prices rise a firm’s net worth increases, and it is better able to safely carry an elevated level of debt.

While the rising level of corporate debt can be viewed in a number of different ways, some more problematic than others, Powell’s conclusion is that “business debt has clearly reached a level that should give businesses and investors reason to pause and reflect.” An unexpected downturn could cause significant problems for overly indebted firms. Powell views the recent growth in corporate debt as a moderate risk. Quite clearly, if the Fed is watching this development, we should do the same.

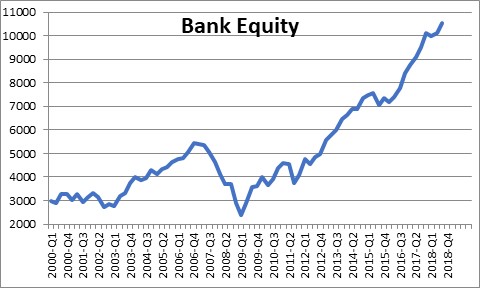

The other point worth noting is that the financial system today is far better able to deal with any potential business sector losses than it was a decade ago. Bank capital has risen significantly since the recession. Banks hold substantial amounts of highly liquid assets.

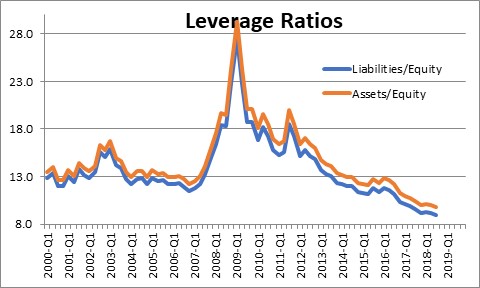

Banks are far less leveraged today than they were previously.

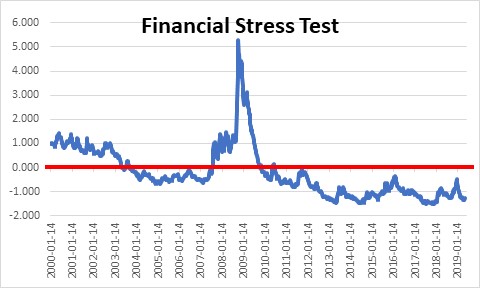

And the Fed’s “stress test” is below zero which means that there is a below-average level of financial market stress. In short, the financial system is well positioned to deal with any problems that are likely to occur during the next downturn.

Fed Chair Powell appropriately flagged a growing level of corporate debt. While he does not view the rapidly growing level of corporate debt as a problem, it is a situation that needs to be monitored closely in the months and quarters ahead. By noting this potential problem he has alerted business leaders to an emerging problem which could well encourage them to rein in some of the recent rapid growth in debt.

The even better news is that the likely catalyst for the next downtown – a sharp increase in short-term interest rates – is not yet on the horizon.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me