August 7, 2011

Standard and Poor’s cut the rating on U.S. Treasury notes and bonds one notch from AAA to AA+. This is the first time since S&P started these ratings in 1941 that U.S. debt has been downgraded. When this happens there are several potential consequences:

- Interest rates paid by the U.S. Treasury on its outstanding debt will increase.

- Rates on other types of securities which are generally priced as a spread over the comparable Treasury rate will go up. This would include corporate notes and bonds, rates paid by state and local governments, and mortgage rates.

- Foreign investors, especially central banks, might choose to buy fewer Treasury securities and more of other AAA-rated sovereign debt.

For now, S&P is the only ratings agency to lower the debt rating for the United States. The other two ratings agencies – Moody’s and Fitch – have kept the U.S. rating at AAA. The first question one might ask is why S&P chose to act. The simple answer is that budget deficits and total debt outstanding for the United States do not look anything like other AAA sovereign borrowers.

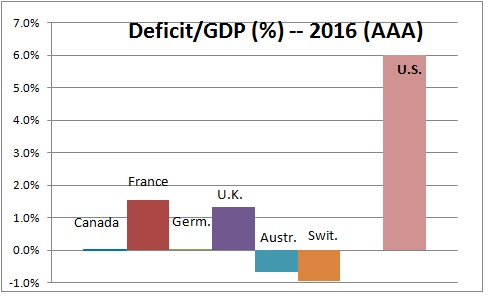

During the course of a business cycle AAA-rated countries budget deficits as a percent of GDP typically average about 3%. They will be higher than that in a recession when government spending is used to help lift the economy out of its slump, but then the deficits are eliminated or turned to surpluses in the good years. But the U.S. has not done that. Presented below are the IMF’s projected budget deficits as a percent of GDP in five years time (2016) for six AAA-rated countries – Canada, France, Germany, U.K. Australia, and Switzerland. Four of the six countries anticipate either a balanced budget or a surplus, the other two have deficits of about 1.5%. The U.S., however, is still expected to have a deficit of 6.0% of GDP five years from now. The U.S. simply does not look at all like the others.

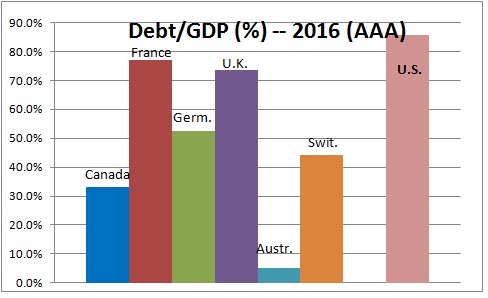

AAA-rated countries also try to keep their total debt outstanding to less than 50% of GDP. These same six countries combined satisfy that requirement, although some like France and the U.K. are on the high side. The U.S. stands at 85%. It is also worth noting that for all six AAA-ranked countries their debt ratio is lower in 2016 than it is currently. Not so for the U.S. Its debt ratio continues to climb from 70% today to 85%. In fact, the debt ratio for the U.S. bears more resemblance to the four European countries that have been having debt difficulties — Portugal, Ireland, Greece, and Spain.

Given all this it is no wonder than Standard and Poor’s chose to downgrade the U.S. The other ratings agencies may choose to follow and, worse yet, this will not be the only downgrade — unless policy makers get our fiscal house in order soon!

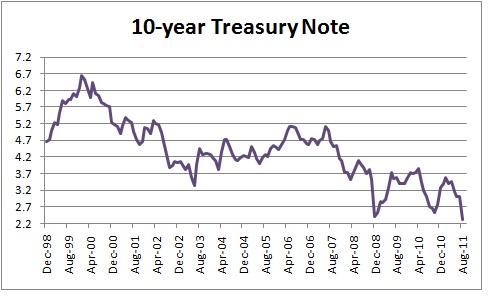

So what about this idea that a downgrade will raise the interest rate paid by the U.S. Treasury? Typically when there is a problem in Europe or Asia investors flee to the safety of U.S. Treasury securities which has always been regarded as risk free because of its AAA rating. But what if there is a possibility that the U.S. might default? Now where do you hide? The answer is, in U.S. Treasury securities. For the past month or so investors have been bombarded with weaker than expected news, a growing fear that the U.S. economy could dip back into recession, policy makers in Washington who seem to be completely incapable of dealing with our debt issue, and a re-surfacing of debt problems in several European countries. But yet interest rates on the U.S. Treasury 10-year note have actually fallen from 3.5% in April to 2.3% today – a decline of 1.2%. If investors are nervous and trying to flee risk, U.S. Treasury securities are still deemed to be the safest game in town.

There has also been concern that foreign investors might choose to stop buying U.S. Treasury securities because of the possibility of default. Foreign investors currently own $4.5 trillion, or 45%, of Treasury debt outstanding. Of that amount, almost half is owned by China ($1.2 trillion), and by Japan ($0.9 trillion). In the past year foreign investors (principally central banks) have bought $0.5 trillion of Treasury securities and thereby financed one-third of this year’s $1.5 trillion budget gap. But what if they decide to pull back and invest elsewhere? Domestic investors would have to step in to fill the gap. In the process interest rates would move presumably higher to attract sufficient capital to finance the additional Treasury debt.

But, once again, foreign investors are just like domestic investors. As we have seen in recent weeks, in times of financial and economic stress the U.S. is still the best-looking of the available alternatives. Furthermore, of the six AAA-rated countries described earlier only France, Germany, and the U.K. have any sizeable amount of domestic debt, and each of those markets is only about 17% the size of the U.S. The reality is that the higher-rated sovereign credits do not have bond markets of sufficient size to satisfy the global appetite. Finally, if the choices today are between France, Germany, and the U.K. as possible alternatives to the U.S., it is hard to imagine that in today’s world with Europe suffering even more acute and immediate debt problems than the U.S., a savvy investor seeking safety would choose a European country over the U.S. China may grumble and demand that as a major holder of Treasury securities that the United States must curb its appetite for debt, but the reality is that the Chinese really do not have too many viable alternatives.

So why is the stock market taking this news so badly? The most likely explanation in our opinion is that it came along at a time when the market was already in a foul mood and so it became the focus of attention and the wall of worry got higher. In the end, what happens to the economy is all about confidence. If the stock market decline causes investors, consumers and business people to lose the faith, the economy will dip back into recession. But that is not out view and we will re-iterate the reasons why we do not think that will happen in a separate commentary. Hang tough. The world has not yet ended!

Stephen Slifer

NumberNomics

Charleston, SC

Trackbacks/Pingbacks