November 14, 2014

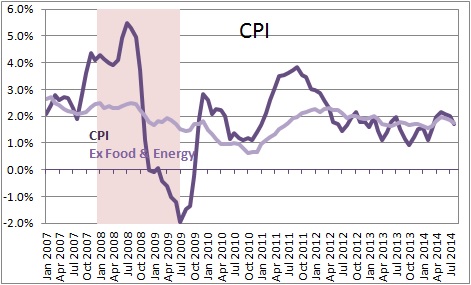

There always seems to be something to worry about. The latest fear is deflation. But rest easy, that is not going to happen. By the middle of next year the inflation rate should return to the Fed’s 2.0% target, and by yearend it is likely to be above target at 2.8%. How can that be? Three reasons.

1. An increase in the price of gasoline.

2. The rising cost of shelter.

3. Higher wages.

Gasoline. The latest deflation worry has been triggered by the recent rapid decline in oil prices. Gasoline prices have fallen 21% since June. Clearly, increased oil output in the United States has contributed to the drop. The Saudi’s then chose not to cut production which would have pushed prices higher. Instead, in an overt attempt to further depress prices and force some shale producers in the U.S. out of business, they kept the spigot open.

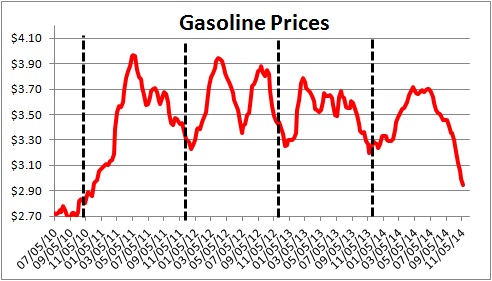

But it is important to understand that gasoline prices have a very strong seasonal component which is tied to the summer driving season when demand for gas is at its peak. Gasoline prices always rise in the first half of the year and fall in the second half. This volatility in gasoline prices is evident in the chart below. The dashed black line is drawn in the middle of November for each of the past four years. After hitting bottom sometime around mid-November prices subsequently rose 45% in the early part of 2011, 21% in 2012, 17% in 2013, and 14% in 2014. Given that consistent behavior it is a good bet that by June of next year gasoline prices will be back to about $3.60. As gasoline prices reverse direction the fear of deflation will subside.

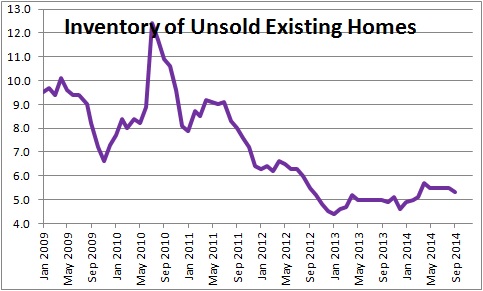

Shelter. The most important category that will contribute to a higher inflation rate next year is shelter. Housing is in short supply. The available supply of homes available for sale is 5.3 months. Realtors suggest that demand and supply are roughly in balance when the inventory is about 6.0 months. Thus, there is currently a shortage of available homes for sale.

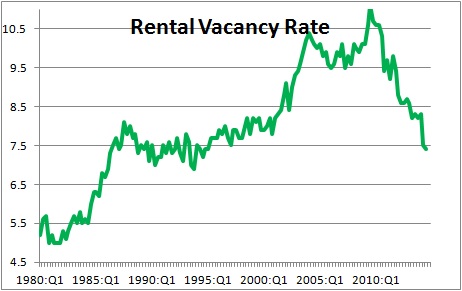

The shortage of available rental properties is even more acute. The vacancy rate for rentals is 7.4% which is the lowest in 20 years.

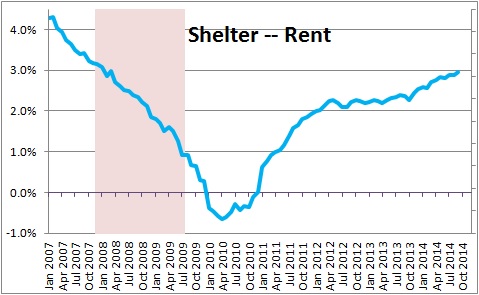

As a result of this shortage of available housing, home prices and rents have both been on the rise. As a result, the shelter component of the CPI which accounts for roughly one-third of the entire index has steadily accelerated. It has climbed from 2.2% in 2012 to 2.4% in 2013, and 3.0% in the most recent 12-month period. Unlike many other components of the CPI this series is not particularly volatile. The rising cost of shelter is here to stay.

Wages. As the labor market steadily tightens wage pressures are sure to increase. Given that wages represent about two-third of a firm’s overall cost, it is likely that a pickup in wages will ultimately be passed through to consumers in the form of higher prices.

Wage pressures were virtually non-existent in the first five years of this expansion. Hourly earnings rose at a fairly steady 2.0% pace which is only slightly faster than inflation. That will soon change.

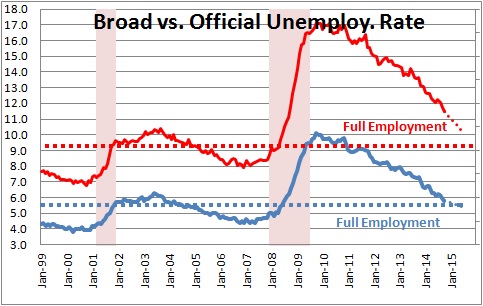

As the labor market continues to tighten all measures of unemployment should be close to their full-employment threshold by the middle of next year.

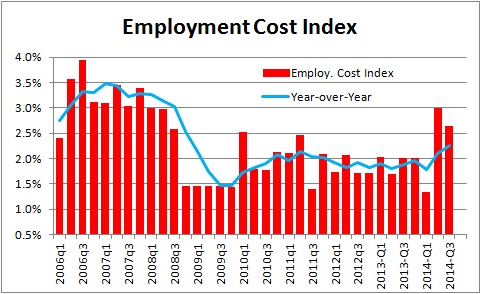

Because firms will find it increasingly difficult to find the workers they need from the ranks of either unemployed or underemployed workers, they will be forced to offer higher wages and/or benefits to poach the necessary workers from other firms. Indeed, some measures of wages have already begun to climb. The employment cost index had been rising steadily at a 1.8% pace for several years, but suddenly in the second and third quarters of this year labor costs have climbed to a somewhat more troublesome 2.8% pace. Both wages and benefits contributed to the pickup. As the labor market tightens further in the months ahead, it is hard to envision these higher costs diminishing. If wages rise, it is only a matter of time before firms try to counter these higher costs via increases in prices.

Putting these pieces together we find it easy to envision the CPI picking up from 1.7% today to 2.0% by midyear and to 2.8% by December of next year. While the fear today may be deflation, that is not likely to last long.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me