June 2, 2016

The economy seems poised to expand at a 3.0% rate in second quarter after an upward revised 1.2% growth rate in the first quarter. If the second quarter estimate is accurate it means that the economy will have grown at a 2.1% pace in the first half of this year – little different from the 2.0% pace registered in 2016. However, second half growth should quicken to 2.5%. All of this seems likely to happen despite any support from the White House or Congress.

Senate Republicans are prioritizing health care legislation but acknowledge that they may not finish prior to the August recess. The White House claims it is working hard to provide details for the one-page outline of a tax bill that it released in April. It still hopes to have a tax plan enacted by the end of this year. But the legislative calendar gets crowded after the August recess. Congress must grapple with legislation to raise the debt ceiling and then agree on spending levels before the tax bill can be considered. These important pieces of legislation keep getting pushed farther and farther into the future. We still expect legislation on all fronts to ultimately be adopted, but they will most likely be watered down versions in order to pass the Senate with only a simple majority.

One might argue that the longer the delay the less likely that any of this legislation will be adopted. Maybe. But we would suggest that Republicans promised so much during the campaign that failure to deliver will almost certainly result in a significant loss of seats in next year’s mid-term election. Thus, we feel quite certain they will come up with something.

For now the economy is doing OK and there is every reason to expect faster growth in the second half of the year. That outcome will be largely determined by two GDP components – consumer spending and investment. Trade and government spending should change very little.

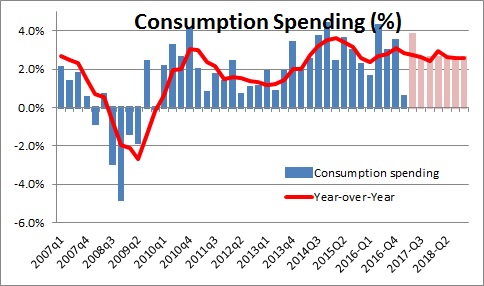

Consumer spending. The underlying fundamentals appear strong. Job gains remain solid despite smaller than expected increases in April and May which seem to reflect employers difficulty in finding an adequate supply of skilled workers in an increasingly tight labor market. The job gains support growth in household income. The record stock market level bolsters consumer wealth. Consumer sentiment is the highest it has been thus far in the cycle. Interest rates remain very low by historical standards. We have every reason to expect household spending to continue to climb at a 2.5% rate both this year and next.

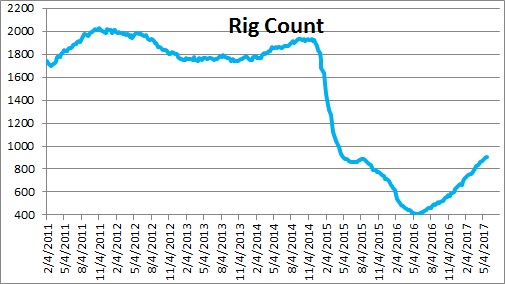

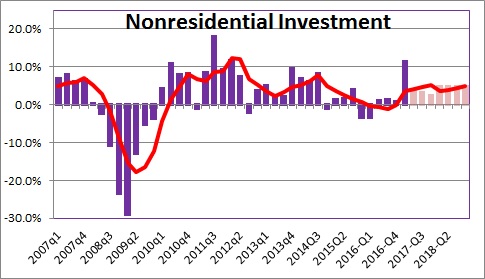

Investment. The protracted period of sluggishness in the oil sector has come to an end. Investment spending came to a halt during the recession as falling oil prices clobbered firms in the oil patch. But oil prices have rebounded to a level that is encouraging some drillers to re-open previously closed wells. The drag on investment spending from the oil sector has come to a halt and even turned into a moderate amount of stimulus.

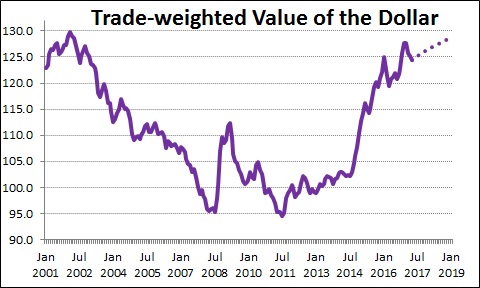

The factory sector was smacked by a 20% increase in the value of the dollar between mid-2014 and October 2016. That made U.S. goods more expensive for foreigners to purchase and sharply curtailed growth in exports. U.S. firms in export industries suffered the consequences. But the dollar has been essentially unchanged since the election so the drag on GDP from reduced exports growth has come to a halt. Furthermore, after a long period of falling employment, factory jobs have been rising by about 10 thousand per month since December of last year.

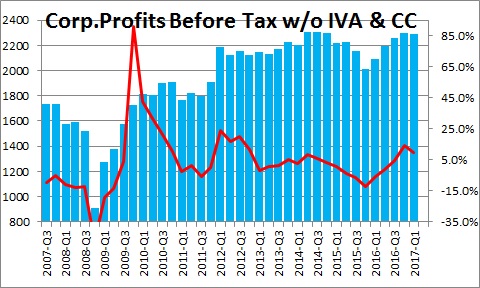

In addition, the stock market has climbed to a record high level as both reported and expected future earnings have been on the rise. The drag on earnings from both the oil and manufacturing sectors has disappeared. Business confidence as measured by the various purchasing managers’ indexes is at a multi-year high. Global GDP growth is showing signs of accelerating. Interest rates remain low. As a result, corporate earnings began to climb in the middle of last year and are likely to rise at a double-digit pace this year,

Against this backdrop it is easy to envision investment spending rising about 5% this year and next compared to no growth in 2016.

Trade and Government Spending. The dollar has been relatively stable for the past six months so the trade component will, at most, subtract 0.1% from GDP growth in 2017. A pickup in defense spending will be partially countered by spending cuts elsewhere so government spending might add 0.1% to growth. Not a lot happening to either of these categories.

Thus, some pickup in GDP growth in the second half of this year is likely. But to sustain a faster pace of spending and boost potential GDP growth from 2.0% currently to the 2.8% pace that we expect by the end of this decade the economy will need help. It desperately needs faster growth in productivity which, in turn, depends upon steady growth in investment. We are banking on the tax cuts Trump talked about during the election campaign, some repatriation of corporate earnings, and, hopefully, better health care. We continue to believe that such legislation will be forthcoming, but the clock is ticking.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me