May 2, 2025

The imposition of tariffs is causing massive distortions in the data. First quarter GDP declined 0.3%, but to get goods into the country prior to the imposition of tariffs in early April imports surged, subtracted a massive amount from GDP growth in that quarter, and masked an otherwise solid economic performance. But the jump in imports in the first quarter will lead to reduced imports in the months ahead and thereby boost GDP growth. For what it is worth, we anticipate a solid 2.5% GDP growth rate for the second quarter. Also this week we received a surprisingly robust report on the labor market. Payroll employment continued to climb by 177 thousand in April and the unemployment rate remained at the full employment level of 4.2%. On the inflation front the core personal consumption expenditures deflator has risen 2.6% in the past year but is likely to increase at slightly faster rate than that for the year as a whole. The markets have concluded that growth will slow appreciably in the second half of the year and the Fed will cut rates three times between now and December. We disagree and look for no change in the funds rate by yearend.

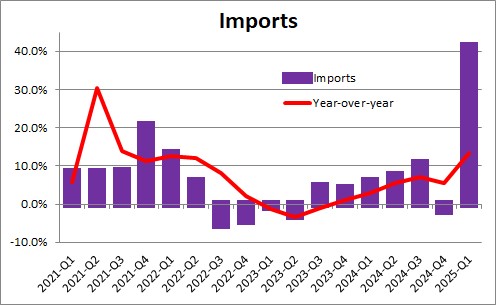

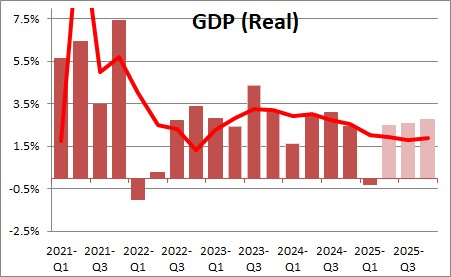

The initial estimate of first quarter GDP was a decline of 0.3% which was a lot softer reading than the 0.5% increase that had been expected. But that GDP estimate was seriously distorted by the way firms responded to the tariffs. There was a great rush to get goods into the country prior to the imposition of tariffs in early April. As a result, imports surged 41.3% in the first quarter and the trade component subtracted a mind-boggling 4.8% from GDP growth in that quarter. But firms did not really need all those imported goods in the first quarter so some of them ended up in inventories. Indeed, inventories jumped and added 2.2% to GDP growth in the quarter. If one adjusts for those two partially offsetting distortions, first quarter GDP would have been 2.3%. In other words, if businesses did not have to cope with the looming tariffs we would have seen a respectable growth rate for the first quarter. But, alas, they did have to significantly alter their behavior to adjust to the tariffs and, as a result, GDP declined 0.3%.

But there is another part to this story. Firms looked ahead and tried to determine how many goods they might need to import during the next several months and got as many of them as possible into the country before the tariffs hit. That means that in coming months imports will be significantly lower than they ordinarily would be. As imports decline the trade component will do the exact opposite of what it did in the first quarter. It will shrink and thereby add to GDP growth. For that reason, we currently estimate second quarter GDP growth of 2.5%.

The point is that first quarter GDP did not decline because consumers pulled back on spending (+1.8%) or businesses cut back on investment spending (+9.8%). It occurred because the government imposed tariffs and businesses had to adjust to this new world as best they could by importing goods into the country in advance of when they actually needed them. That translated into the slight decline in GDP in the first quarter. But in the months ahead businesses will need to import fewer goods into the country than normal because the goods are already here. As imports decline in the spring second quarter GDP growth should get a significant boost.

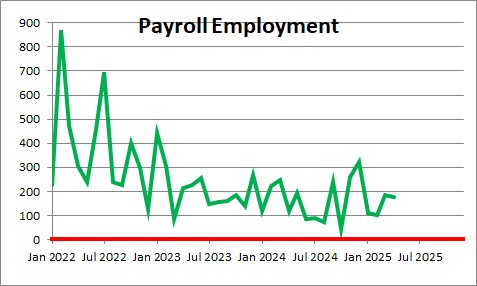

Most economists expect the economy to weaken substantially as the year progresses and tariffs eventually take their toll. That may occur to some extent, we suspect their fear is exaggerated. One of the places where the softness may show up first is in the labor market. But the April employment data showed a solid 177 thousand increase in payroll employment. The workweek is virtually identical to where it was prior to the recession. There is little evidence through April that the feared slowdown is at hand.

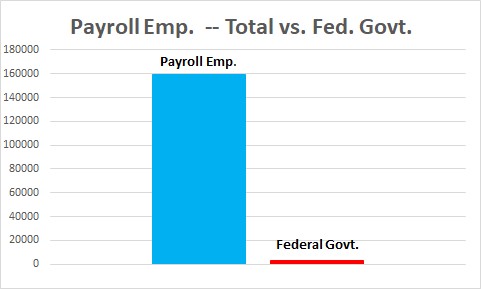

One worry is that federal government layoffs will significantly reduce employment. But federal government employment is only 2% of total employment. Federal employment peaked in January and in the past three months has fallen by a total of 26 thousand or about 9 thousand per month. This gets a lot of headlines in the press and heart-wrenching stories from employees who have been laid off, but in the bigger spectrum this is unlikely to significantly impact the labor market.

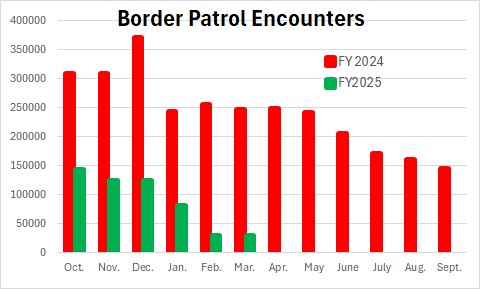

The other fear is that the lack of immigration into the U.S. and the deportation of illegal immigrants will significantly reduce employment. But illegal immigration into the U.S. has largely come to a halt and yet employment growth continues to chug along. Once again, we believe that the fear is proving to be worse than the reality.

With respect to the Fed it will, like everybody else, easily look through the 0.3% GDP decline in the first quarter and envision a relatively robust pace of growth for the second quarter. The unemployment rate remains at its full employment level so the Fed cannot argue that it is easing because it fears a soft labor market. And inflation remains above target and appears to be getting farther away from the 2.0% objective rather than closer. Against that background, a Fed easing move seems inappropriate. For the market expectations of three rate cuts between now and yearend to be correct, a lot more economic weakness will have to emerge in the second half of the year. We believe the Fed will keep the funds rate steady at 4.3% between now and yearend.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me