October 5, 2012

The employment report for September was clearly encouraging. The unemployment rate fell 0.3%, the workweek increased 0.1 hour, and payroll employment rose 114 thousand. All of this suggests that the economy is gathering momentum despite the fact that the fiscal cliff is looming.

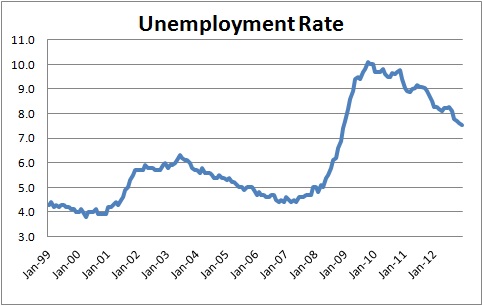

The unemployment rate fell 0.3% in September to 7.8% after having declined 0.2% in August. Two consecutive declines suggest this recent drop is not an aberration but something more substantial.

Typically, sharp declines in the unemployment rate occur when workers drop out of the labor force and quit looking for a job. That was not the case in September. In fact, the labor force climbed 418 thousand while firms hired 873 thousand new workers. That is the biggest increase in household employment in a decade. As a result, the number of unemployed workers fell by 456 thousand. Indeed, in the past two months – August and September — the ranks of the unemployed have fallen by an impressive 706 thousand.

The more legitimate complaint may be that many of those new jobs are part time positions rather than full time employment. As long as the outlook for the economy remains murky that will continue to be the case. Currently firms are worried about the fiscal cliff at yearend and the possibility that the economy could fall into recession early next year. As long as there is even a remote chance of that happening firms are going to be reluctant to hire.

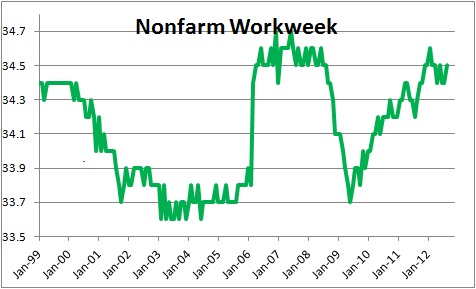

The nonfarm workweek rose 0.1 hour in September to 34.5 hours which seems to reflect the same concern about the fiscal cliff. The increase in the workweek in September indicates a need to boost production but an unwillingness to hire more bodies. Nevertheless, it is important to recognize that a 0.1 hour increase in the workweek is very powerful. It has the same impact on the economy as hiring 388 thousand workers. To put that in slightly different terms, if firms had elected not to lengthen the workweek, they would have needed to hire 500 thousand workers in September to boost output by an equivalent amount.

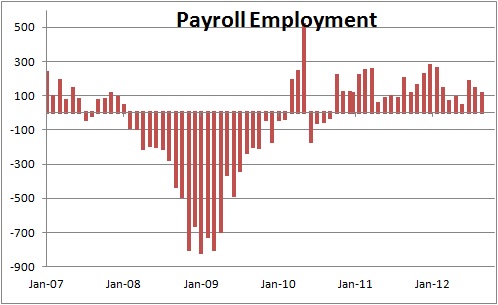

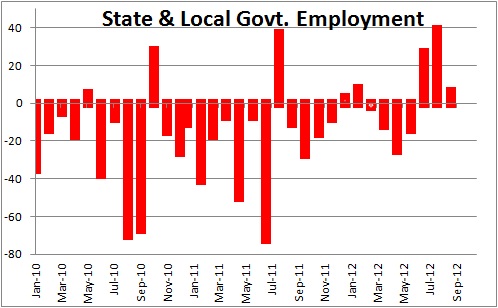

Payroll employment for September rose 114 thousand which is not very impressive. However, payroll employment in July revised upwards by 40 thousand from an increase of 141 thousand to a gain of 181 thousand. And in August the employment gain revised upwards from +96 thousand to +142 thousand. Because the upward revisions stemmed from additional state and local government hiring rather than the private sector, it is easy to dismiss them. But be careful.

Virtually every state and municipality has sharply curtailed spending in the past couple of years as tax revenues declined. But in recent months, tax receipts have accelerated and these government entities now appear to have the luxury of boosting employment slightly. As shown below, state and local government hiring fell 20 thousand a month from January 2010 through the middle of this year. If going forward we can anticipate monthly employment gains of 15 thousand that shift from a decline to an increase boosts payroll employment by 35 thousand.

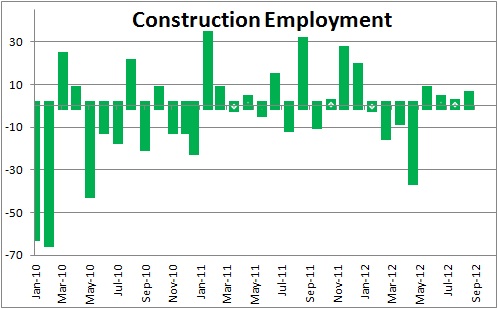

The same analysis applies to construction employment. The housing sector has turned upwards. To build those new homes and apartments builders need more workers. Construction employment has recently shifted from a decline of 15 thousand per month to an increase of 5 thousand. During 2013 it is easy to envision monthly employment gains of 20 thousand.

The point of this is that the employment report for September was reasonably constructive. If, as virtually everyone expects following the election, Congress takes action to mitigate the impact of the fiscal cliff the economy should do relatively well in 2013. As we see it, neither party has an incentive to “do nothing”. If the economy slips into recession in 2013, the American public is going to blame both Republicans and Democrats. They all lose. Second, one half of the cuts in government spending are supposed to come from defense. That is unacceptable. Thus, if Congress reduces the negative impact of the fiscal cliff on GDP growth next year from 5.0% to about 1.5%, economic activity should still accelerate to about 2.5% as uncertainty is reduced. Simultaneously, a budget agreement will reduce future budget deficits and debt outstanding. Not bad!

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me