January 23, 2015

There is a general perception that GDP growth in Europe is stalling and that Europe is about to slip into a deflationary spiral. For example, this past week the IMF recently downgraded its assessment for 2015 GDP growth in Europe from 1.4% to 1.2%. Also this past week, citing the recent decline in the headline inflation rate for Europe and a fear that deflationary pressures are becoming more entrenched, the European Central Bank announced an extensive bond buying program to stimulate the pace of economic activity and head off deflation. But how real are these worries?

The IMF downgraded its economic outlook for Europe from an expected 1.4% growth rate in 2015 to 1.2%. But it is important to keep in mind that GDP growth in Europe for 2014 was 0.8%. Thus, even after this revision GDP growth is still expected to accelerate this year – but not quite as much as had been expected previously.

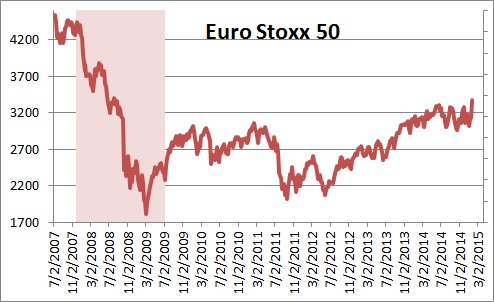

It is hard to get too worried about growth in Europe. The European stock markets are certainly not registering any alarm. The German DAX is at a record high level. The UK’s FTSE Index is close to a record high level. The Euro Stoxx 50 is at its highest level since the recession ended in June 2009. While ECB policy makers may be concerned, European investors do not seem worried.

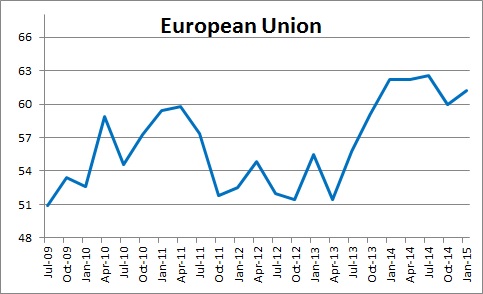

Similarly, a recent survey of CEO confidence in Europe was also unfazed. Sentiment amongst these corporate leaders remained close to the highest level thus far in the expansion. Like investors, corporate leaders do not seem worried.

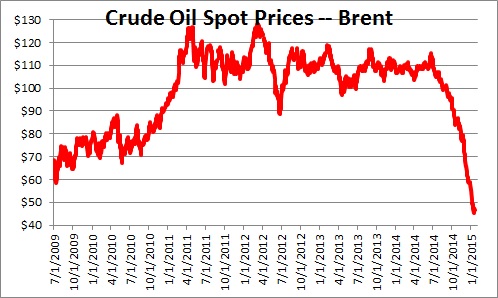

It is important to keep in mind that the sharp drop in oil prices since July of last year is providing considerable stimulus to almost every major country in the world. Why? Because those countries are net importers of oil. Consumers in those countries now pay half as much to fill their car with gas as they did last summer. They will pay less this winter to heat their homes with fuel oil. The savings can be spent on other goods and services which will boost the pace of economic activity. And since Germany, France, Italy, and the United Kingdom are part of the G-7 and therefore four of the largest economies in the world, it is clear that falling oil prices will provide considerable stimulus to the European economy in 2015.

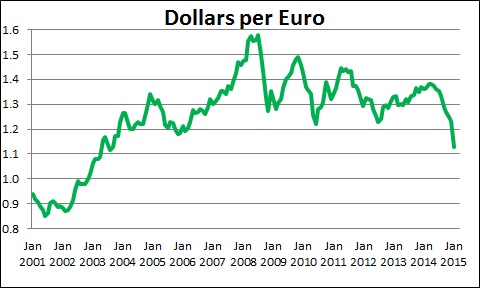

At the same time the Euro has weakened 20% since the spring of last year from $1.38 to $1.12. This means that European goods are now cheaper for U.S. consumers to buy. The Euro has also weakened against the Japanese yet. This decline in the value of the Euro will provide further stimulus to the European economy in 2015.

Given that investors are confident, CEO’s remain enthusiastic, oil prices have collapsed, and the currency has weakened appreciably, it is difficult to understand all the hand-wringing about growth prospects for the European economy in 2015.

The fears of deflation are similarly exaggerated. It is true that falling oil prices have pushed Europe’s headline inflation rate into negative territory to -0.2%. But it is exclusively a function of the drop in oil prices. The core inflation rate seems quite stable at 0.7%. If oil prices continue to slide there could eventually be spillover effects into the core inflation rate, but that seems unlikely. Most energy experts suggest that oil prices will rise somewhat next year. For example the U.S. Energy Information Administration expects the price of Brent crude to rise from $47 per barrel currently to $54.58 this year. For that to happen, oil prices need to hit bottom soon and begin to climb. Thus, the chances of a continuing slide in oil prices and a deflationary environment emerging in Europe seems remote. Furthermore, if that fear of deflation is as widespread as the ECB seems to think, why are the European stock markets doing so well? Why are CEO’s so confident? That wouldn’t be happening if they were worried about falling prices.

We expect U.S. GDP growth to accelerate to 3.4%, this year. One risk to that forecast would be any significant weakening of GDP growth in Europe. But recent events including the drop in oil prices, the weakening of the currency and additional stimulus by the central bank make the worry about a slowdown in GDP growth in Europe this year extremely remote.

Stephen Slifer

NumberNomics

Charleston, SC

Stephen, your comments on the European economy are most interesting. Most pundits seem to see some kind of disaster in the making over there. I appreciate your good sense explanation of the situation, as usual.

I am happy the “media hype” is not part of your remarks. Keep up the good work.