April 11, 2025

It is hard not to see the potential dangers from the Trump-initiated trade war. Consumer confidence has plunged. Small business confidence has declined. Investor confidence has collapsed. Those who envision a recession ahead or stagflation can make a very plausible case to support their view. But we suggest the pessimism has come extreme. While a second half recession is a possibility, we continue to expect some moderation in the trade environment in the months ahead which will produce moderate GDP growth and only a slight uptick in inflation between now and yearend. Surprises can work in both directions — even from this president. As always, we will see.

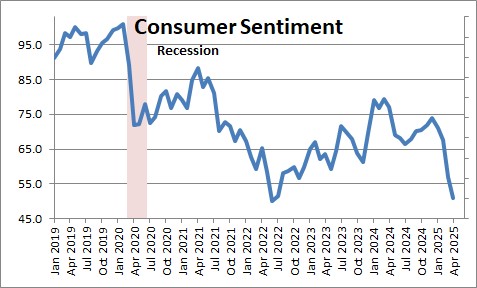

The University of Michigan’s measure of consumer sentiment has plunged. It has fallen 23.2 points in the past four months as consumers express concern about their personal finances, business conditions, unemployment, and inflation. Two-thirds of them expect the unemployment rate to rise in the year ahead which is the highest reading since 2009. No wonder they are worried! Inflation expectations have jumped by four percentage points from 2.8% at the end of last year to 6.7% in April. Inflation expectations have jumped 0.5% or more for four consecutive months and have reached the highest level since November 2022. Despite these negative observations it is worth noting that the last time consumer sentiment was this low was when inflation was at its peak. Consumers became far too fearful. Inflation subsided but consumers have remained depressed for the past three years. Despite their concerns they continued to spend at a steady 2.5-3.0% pace. We suspect consumers are, once again, unduly pessimistic. For example, they expect the inflation rate to rise to 6.7% in the next twelve months. That is not going to happen.

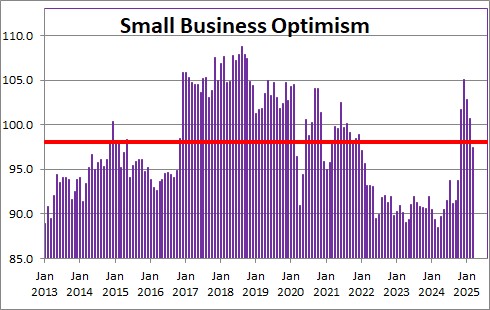

Small business optimism has dropped 7.7 points in the past three months to 97.4 and fallen slightly below the breakeven level of 98.0 for the first time since October. Sixteen percent of owners said that inflation was their single most important problem, unchanged from February. And 30% of respondents plan price hikes in March, up one point from February and the highest reading since March 2024. But — like consumer sentiment — this optimism index has been depressed for three years and the economy has continued to chug along nicely.

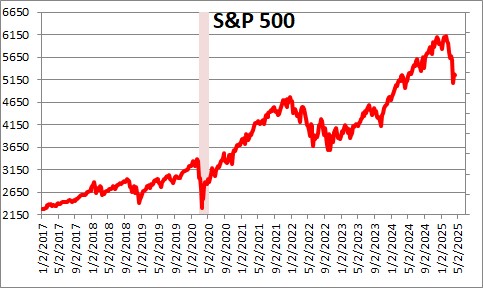

Then there is the stock market. The S&P 500 index has been extremely volatile in the past week and, at one point, fell more than 20% from its February peak which put it into bear market territory. But stock prices are heavily influenced by what investors read in the media and the recent tit-for-tat tariff hikes between countries has created juicy news headlines. Overdone? We think so.

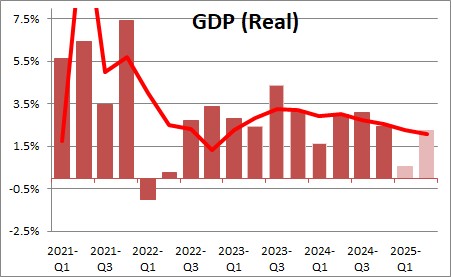

Given this widespread drop in consumer, business, and investor confidence, it is easy to envision the possibility of recession later this year. Some economists are suggesting the economy is already in a recession. We do not share that belief. Typically, a recession is defined as GDP growth falling for two consecutive quarters. We currently anticipate 0.5% GDP growth in the first quarter. That figure will be released on Wednesday, April 30. Our estimate is based on an increase of 0.5% in aggregate hours worked and no change in productivity. But there is a wide range of estimates. The widely respected Atlanta Fed’s GDPNow estimate is for a decline of 2.4%. On the flip side the New York Fed’s GDP Nowcast is for an increase of 2.6%. Most private forecasts are for growth of about 1.0%. It is certainly possible that first quarter GDP is a negative print. But first quarter growth was negatively impacted by severe cold wintery weather conditions in January along with the Los Angeles wildfires. At about that same time the trade deficit turned sharply negative as businesses raced to import goods ahead of the tariffs deadline. Indeed, we suspect that the trade component subtracted 1.5% from GDP growth in the first quarter. The weather, fires, and trade effects should be reversed in the second quarter and beyond. Hence, a decline in GDP in the first quarter should not be viewed as the beginning of a recession.

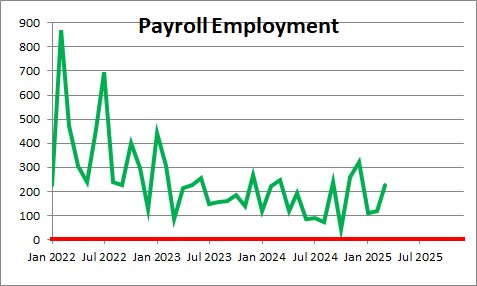

In addition, the labor market has continue to perform well. Typically in a recession jobs decline sharply. That has not occurred. In the past three months the economy has cranked out on average 152 thousand jobs per month.

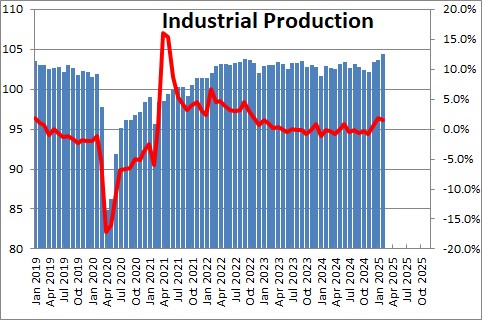

And in a recession industrial production also falls. But production has risen in each of the past three months.

If first quarter GDP growth should decline, the talk will grow that the economy is already in recession. We do not buy it.

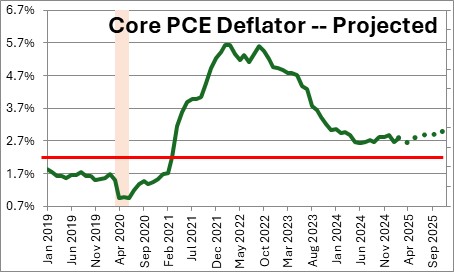

What about the Federal Reserve? Should it consider easing? That will undoubtedly be a topic of discussion at the next FOMC meeting on May 6-7. But the Fed has a couple of real problems. First, its preferred inflation measure, the core personal consumption expenditures deflator is at 2.8% and is likely to edge higher to 3.0% by the end of the year. It is no longer slowly shrinking towards the desired 2.0% pace. An easing in May would basically mean they have thrown their inflation target out the window. That would, in our opinion, completely destroy the Fed’s credibility which was damaged by its reluctance to tighten when the inflation rate rose in 2021 because it mistakenly believed the increase would prove to be temporary.

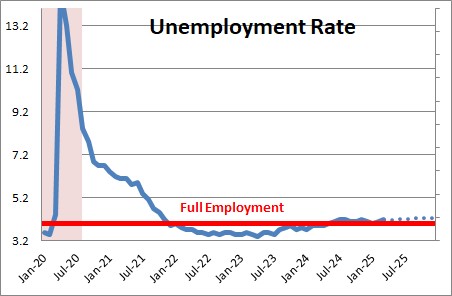

Second, the labor market is performing well. Jobs are being created. The unemployment rate is at 4.2% which is its presumed full employment level.

GDP growth in the first half of the year may be soft, but should still average about 1.5%.

The economy does not need any particular help – at least not yet – and the inflation rate is not cooperating. The Fed is not in a position to fix any of the confidence issues described above. Fed policy is not too tight. The problem is that Trump’s tariffs have created considerable uncertainty and fear. Further, nobody knows what his objective really is. Are tariffs just a temporary bargaining tool? Or does Trump want to eliminate the trade deficit entirely, in which case the tariffs will need to be permanent? Fed easing should occur if the tariffs weaken the economy to the point that the unemployment rate begins to rise.

The situation seems bleak at the moment. It appears that economists and the markets are anticipating a very sizeable, widespread increase in tariffs – which could happen. But given Trump’s quixotic nature he could easily change his mind at any time, claim victory, and move on. It is important to remember that surprises can work in both directions. What if deals are struck and the U.S. and other countries promise to reduce or eliminate tariffs? The current extreme pessimism would be quickly reversed. Stay tuned. The next shock may not necessarily be a negative one.

But long-term damage has already occurred. The Trump bashing of long-term friends and allies will almost certainly make them less willing to support the U.S. not only in trade matters but in foreign relations as well. It is a dangerous world out there. Every country needs friends – including the U.S.

Such a shame. So unnecessary.

Stephen Slifer

NumberNomics

Charleston, S.C.

Stephen,

In the current situation, it is GREAT to hear a reasonable analysis of what is going on. Thank you again for your insightful observations. Full Speed Ahead!

Darrel

Great analysis Steve!

Hope your back is feeling better.