December 20, 2022

Recent Fed policy has been confusing to say the least. In September the focus was on the unemployment rate and the Fed eased aggressively. Two months later the focus shifted back to inflation and the Fed seemed nervous. The Fed basically told us that it intended to cut rates in December but there was little economic justification for doing so. The economy is chugging along at a 3.0% pace and the core personal consumption expenditures deflator is 2.8%, well above the Fed’s targeted 2.0% pace. It is hard to justify easing given that economic environment, but it did so anyway.

We would like to address three issues. Has politics entered the Fed’s decision-making process? Why has nobody at the Federal Reserve even considered the possibility that the economy’s speed limit may have risen from 1.8% to something higher? And what does the Fed think is a “neutral” level for the funds rate? At the moment it says it is 3.0%, but Its view has been steadily climbing. In our opinion, the Fed is struggling to understand what is going on.

Politics or Policy. The Fed claims to be apolitical. But twice in the past four years its actions have seemed more political than policy based. While extremely deep, the 2020 COVID recession lasted only two months — March and April 2020. The economy came roaring back and GDP recovered everything it lost by the end of that year. Inflation began to climb in mid-2020 and by early 2021 it was roaring. The Fed was convinced that the run-up in inflation was going to be temporary. It did not recognize its error and finally begin to tighten until March 2022. It was at least 1-1/2 years too late. Why? Was it totally convinced that the entire inflation problem was caused by supply shortages? Or did politics come into play? With the mid-term election coming in November 2022, did Chair Powell and his colleagues deliberately try to keep rates low and the economy humming by choosing not to raise rates even though the robust pace of economic activity and rapidly rising inflation indicated clearly that the time had come? We would like to believe that the Fed’s motives were pure, but it was such a colossal policy error that we wonder if politics entered the equation.

In the past several months we have come to wonder, once again, if politics have come into play in determining monetary policy. Back in September the Fed was worried that the labor market was weakening. The unemployment rate had climbed to 4.3%. It was sufficiently worried that it opted to cut the funds rate by 0.5% on September 18 and penciled in four rate cuts in 2025. The bond market rallied vigorously and the yield on the 10-year note fell to 3.7%. The Fed seemed far more worried about the economy than anybody else. Was the expressed concern about potential weakening in the labor market a legitimate fear? Or did politics come into play with an election just six weeks hence? With the election now out of the way, the Fed is suddenly worried about inflation and it penciled in just two rate cuts in 2025. Bond yields suddenly soared to 4.6%. Was Fed policy in recent months based solely on economics? Or did politics play a role? Given these two relatively recent examples we wonder if the Fed is as apolitical as it thinks.

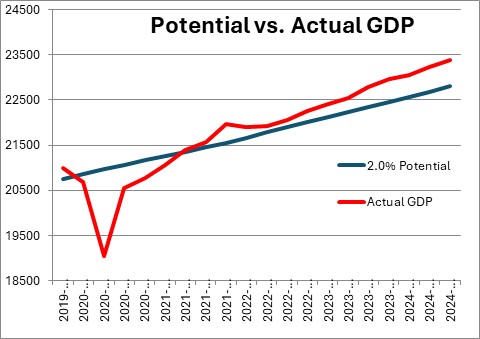

Potential GDP Growth. The Fed continues to believe that potential GDP growth in the United States is 1.8%. But in the past nine quarters GDP growth has averaged 3.0%. Throughout that entire period the level of actual GDP has exceeded potential. In that situation the inflation rate should have risen. Instead it has fallen from 7.1% to 2.7%. Shouldn’t someone at the Federal Reserve consider the possibility that the world has changed and that potential GDP growth is no longer 1.8% but has climbed perhaps to the 3.0% mark? We think so. But according to the so-called dot plots only one brave soul out of 19 FOMC members has suggested that potential GDP could be as high as 2.5%. The rest are all clustered together within 0.1% of the 1.8% mark. The Fed is driven by its models which do not seem to deal well with a rapid change in the economic landscape.

Neutral funds rate. The neutral level for the funds rate is unobservable Nobody knows exactly what it is at any given point in time. And it is not fixed. It can change over time. Economists have developed models to estimate it but, in the end, it is largely a guess. For years the Fed thought that a neutral level for the funds rate was 2.5%. With GDP growth averaging 3.0% for the past couple of years and showing no sign of slowing, the Fed has raised its estimate of the neutral funds rate to 3.0%. It is going to go higher. At the end of 2023 only two FOMC members thought the neutral rate was 3.5% or higher. Today there are six. It is likely that the Fed will soon raise its estimate of the neutral rate to 3.5%. We suggest it is 3.8%. If that is the case, there are only two or perhaps three more 0.25% rate cuts still in the pipeline. Why is the Fed using them now?

With the Fed having made a major policy mistake in 2020-2021, and offering very convoluted explanations for its action in recent months, we suggest that the Fed is confused and losing its credibility. That is not a good thing.

Stephen Slifer

NumberNomics

Charleston, S.C.

Follow Me