October 11, 2014

The Federal Reserve is pleased that inflation is closing in on its 2.0% target. But what exactly is inflation? It is the change in prices in the past twelve months. While prices in the past year have risen slowly, they skyrocketed in prior years. As a result, prices on a wide variety of goods and services are 50% higher than they were four years ago. Doing the math, that means that they have essentially risen 12.5% per year each for the past four years. Consumer paychecks did not keep pace. No wonder consumer sentiment is so subdued! The problem is that the Fed flooded the economy with surplus liquidity during the recession and for two years afterwards. Then it was astounded that the inflation rate surged. What in the world did it expect? The Fed has never acknowledged its own policy blunder. It continues to blame the inflation surge on supply shortages. It may be thrilled that prices are once again rising at the desired pace, but American consumers are less pleased. Prices surged but never came down. They just keep climbing. Something seems wrong with that picture.

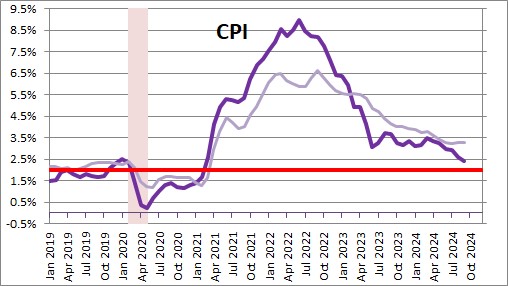

The overall CPI in the past year has risen 2.4%. The downtrend in inflation in the past two years is unmistakable. The Fed’s preferred inflation gauge, the personal consumption expenditures deflator should be at the desired 2.0% mark by spring.

But what about the surge in prices that occurred in 2021 and 2022? The prices that consumers pay today not only reflect the modest increase in 2024, but also the surge in prices that occurred in those earlier years. Prices are cumulative and in many case are 50% higher than they were prior to the recession. Much of the inflation problem was, in our view, created by misguided Fed policy.

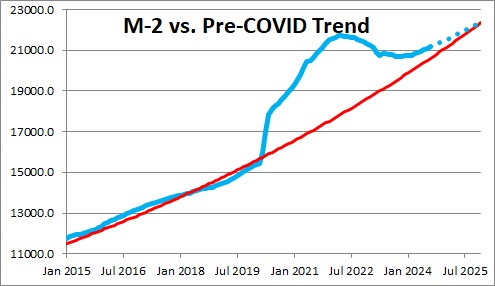

During the recession the Fed purchased several trillion dollars of securities to assist the recovery from the March/April 2020 recession. We have no problem with that initial action. But when the economy roared back to life in the third and fourth quarters of 2020 the Fed should have quickly begun to eliminate some of that surplus liquidity. It did not. Indeed, it continued to add fuel to the fire in the second half of 2020 and all of 2021. It did not begin to withdraw any surplus liquidity until March 2022 which was a year and a half too late. The damage was done. One can only speculate what might have happened to inflation if the Fed had reversed course sooner, but it seems fairly obvious that the inflation runup would have been far less dramatic.

The Fed made a policy mistake and waited too long to reverse course. But what next? It has chosen to reduce the inflation rate from a peak of 9.0% in June 2022 to 2.0%. We think it should seek a partial rollback to counter some of the sting from the price increases that occurred in 2022 and 2023, But that is not going to happen. The problem is that the cumulative price increases in the past four years have made life more difficult for all Americans.

Overall the CPI has risen 22% since the end of the recession or 5.5% per year. But prices for food, transportation, and housing have risen far more sharply.

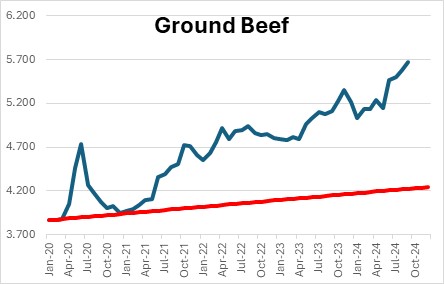

For example, prior to the recession ground beef was $3.86. Today it is $5.67. That is an increase of 47% in four years.

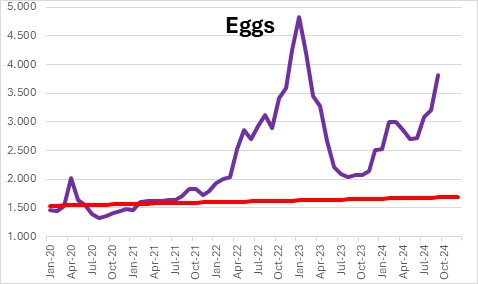

Prior to the recession a dozen eggs cost $1.53. Today they cost $3.82. That is an increase of 149% increase in four years.

Other food items have risen less dramatically. Bread has risen 45%. Milk 26%. Coffee 60%. Beef steaks 41%, Pork chops 28%. Chicken breasts 17%. Almost every food item has risen more rapidly than the 22% increase in the overall CPI.

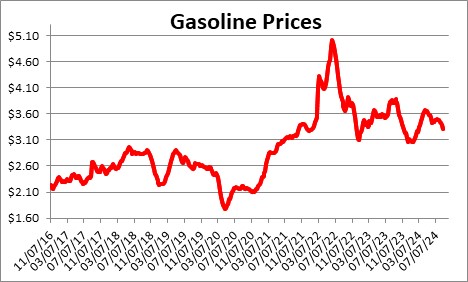

The price increases are not limited to food items. Automobile insurance has risen 51%. Auto repairs 52%. Even gasoline is 39% higher than it was prior to the recession.

Rents have risen 25%.

The items cited above are all necessities. We have to eat, keep the car running to get to work, and pay the rent. The elevated prices in these categories are hard to avoid.

While all consumers face these higher prices the impact is especially problematic for those families on the lower end of the income scale. In many cases these families must choose which bills to pay.

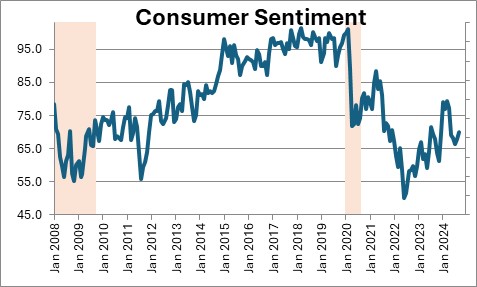

Against this background it is not surprising that consumer sentiment remains depressed. While it has risen in the past year, it remains lower than it was at the low point of the 2020 recession and only slightly higher than at the bottom of the extremely long, deep 2008-2009 recession. The erosion of consumer purchasing power in the past four years explains a great deal of the problem.

Overall the economy is doing fine, every worker has a job, and inflation has once again been tamed. But that does not mean that all is well. Higher income earning families are doing great given the increase in house prices and the record level for the stock market. But lower income earning families are struggling with the cumulative effect on prices in the past four years which has eroded their purchasing power.

Stephen Slifer

NumberNomics

Charleston, S.C.

I agree with everything said, also I am really concerned about the trillions in national dept! How will the government ever fix this runaway train😖

Hi Allen,

It will be a real challenge and I do not see anything happening soon on that front. It may take a crisis — like the Social Security Trust Fund running dry — to force something to happen. Actually, I am writing about that again this week. Should be up at 2:00 EST.