January 17, 2025

The early data for December showed that the economy continued to roll as 2024 came to an end. Employment rose 246 thousand while the unemployment rate edged down 0.1% to 4.1%. Retail sales rose 0.4% after having climbed sharply in each of the previous three months. Housing starts surged by 15.8% to 1,499 thousand. And even the inflation rate cooperated as the core CPI rose a less-than-expected 0.2% which trimmed the yearly increase to 3.2%. On January 30 we should learn that fourth quarter GDP rose 2.5-3.0% which would match the growth rate registered in the first three quarters of the year. Given the robust ending to 2024 it is likely that first quarter GDP growth will be similar. But can growth continue at that pace without giving rise to an increase in inflation?

In the first two weeks of January the bond market worried that the combination of strong GDP growth, tax cuts, reduced immigration, and tariffs could boost the inflation rate in 2025. As a result, the yield on the 10-year note climbed to 4.79%, the highest rate in more than a year. But the CPI inflation data were reassuring and the rate on the 10-year has already fallen 20 basis points. The bond market always reacts and often overreacts. But, as we see it, the economic backdrop has not changed — GDP growth of almost 3.0% in 2025, the core CPI slipping from 3.2% to 2.9%, the Fed cutting rates twice in 2025 to 3.8%, and bond yields ending the year at 4.1% vs. 4.6% currently. But all of that could change depending upon what Trump chooses to do with respect to tariffs, immigration, and taxes. His inauguration will be Monday, January 20, and shortly thereafter we will get some specifics regarding his plans for each of these topics. As these plans are announced, market volatility will almost certainly increase. But the extent to which the positive economic environment described above changes remains to be seen.

With respect to the economy we anticipate GDP growth of 2.9% in 2025. Consumer spending should continue to be robust with a significant tailwind from the steady increase in net worth driven by the near-record level of stock prices and the steady increase in home prices. Investment spending is sure to climb as all firms try to figure out the extent to which AI can benefit their business and as Trump eliminates many of the onerous regulations with which businesses of all sizes currently have to cope. The housing sector seems poised to rebound as builders increase the supply of homes available for sale and mortgage rates drop to about 6.0%.

While GDP growth of 2.9% may appear to be excessive and likely to contribute to an increase in inflation, we disagree. We believe that given the acceleration in productivity, the economy’s potential growth rate has climbed to about 3.0% in which case 2.9% growth should not be inflationary.

Economists are worried that the tariffs Trump has talked about will be inflationary. Some economists suggest that a 60% tariff on Chinese goods and a 20% tariff on non-Chinese goods could add 0.5% to the inflation rate. That strikes us as plausible, but is probably an extreme case. Trump seems to use the threat of tariffs as a bargaining chip to accomplish some other objective – like reducing illegal immigration from Mexico, or encouraging Canada to spend more on defense. We suspect the upward bias to inflation caused by tariffs will be relatively small, perhaps only about 0.2%, which is likely to get lost in the impact on inflation from other sources.

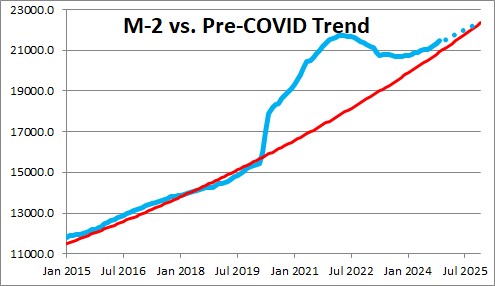

The two biggest positive factors for the inflation outlook are growth in the money supply, and the likely deceleration in rents. By rapidly shrinking its balance sheet and causing M-2 to decline, the Fed eliminated virtually all of the surplus liquidity in the economy that it created in 2020-2022. The money supply has stopped falling and has grown at a 4.5% pace in the past six months. Growth in the money supply should roughly equal the growth rate in nominal GDP. If the economy grows 3.0% and inflation is 2.0%, then nominal GDP growth would be 5.0%. That means that money growth of about 5.0% should be appropriate. Thus, the current 4.5% pace appears non-inflationary to us. Given that the Fed is still slowly shrinking its balance sheet we believe that the inflation rate should graduallyl slip to about the 2.0% mark.

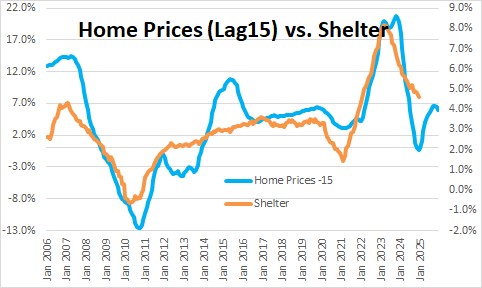

In addition, rents should continue to moderate. The rent component represents one-third of the overall CPI index, and rents follow the change in home prices with a lag of about one year. That means that we already have a fairly good idea of what is likely to happen to the rent component in the upcoming year. If rent growth slows from 4.5% today to 3.5% by the end of this year, that should reduce the core inflation rate by 0.3%. We expect the core CPI to slow from 3.2% currently to 2.9% by yearend. And since the core personal consumption expenditures deflator grows about 0.5% less than the core CPI, that should trim the core PCE deflator growth to 2.4% by the end of this year. That is closing in on the desired 2.0% pace.

Recent data for both economic growth and inflation have been consistent with our relatively optimistic scenario for 2025. But the real test for both lies ahead as Trump outlines his proposed policy changes with respect to tax cuts, immigration, and tariffs. Let the games begin!

Stephen Slifer

NumberNomics’

Charleston, S.C.

Follow Me