March 28, 2014

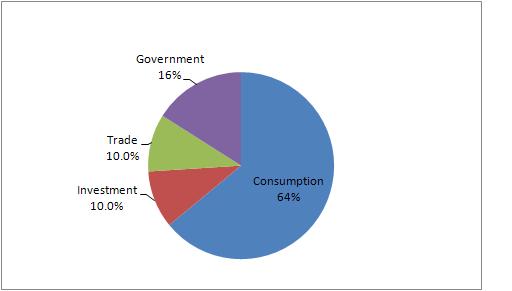

Quite often discussion about the pace of economic activity centers on the consumer. That is probably appropriate since consumer spending accounts for about two-thirds of GDP. However, firms in America make investment decisions that determine the pace of spending in another 15% of the economy. That investment spending increases productivity which enhances corporate profitability. If firms are making money they will hire more workers which will, in turn, increase the ability of the consumer to spend. So how is corporate America feeling these days? Pretty darn good.

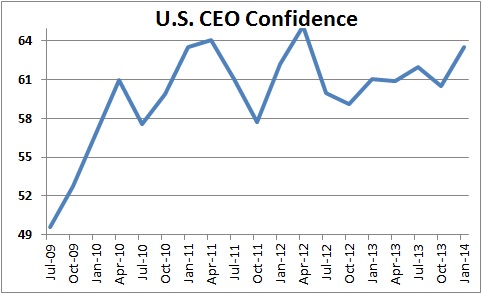

Every quarter the Young Presidents’ Organization (YPO) surveys confidence amongst CEO’s around the globe. In January confidence amongst those CEO’s located in the U.S. (of which there are nearly 1,000) continued to climb. It has been steadily rising since early 2012.

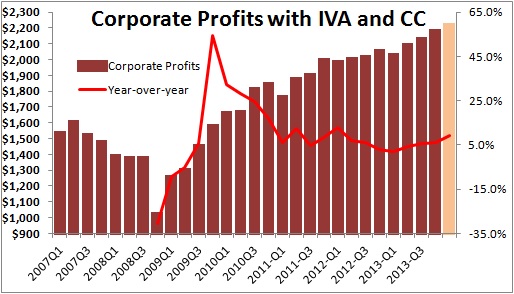

One reason why business confidence is high is because corporate profits continue to climb. The seed for this growth was generated during the recession when firms aggressively cut costs by laying off thousands of workers and replacing them with technology. This substitution of labor for capital has paid handsome dividends for corporate America during the past five years. Almost five years into the expansion profits are climbing at about a 9.5% pace.

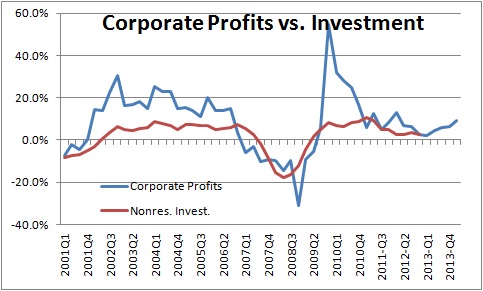

When corporate profits grow rapidly it is perhaps not too surprising that investment spending follows. If business leaders are feeling good and making money they should be inclined to quicken their pace of spending. The current 9.5% growth in profits suggests that investment spending should accelerate during the course of this year to perhaps a double digit rate which is far more impressive than the current 2.6% pace.

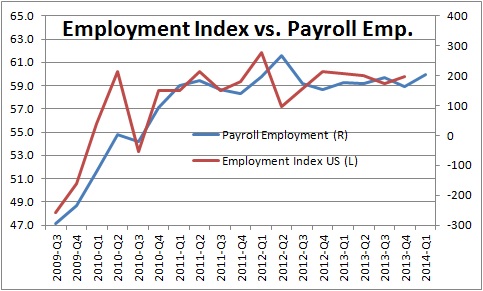

Similarly, if firms are feeling good and making money they will need to hire more bodies. In addition to confidence the YPO asks CEO’s about the prospects for employment during the next 12 months. The U.S. employment index rose modestly in the first quarter. As shown below it tracks the change in payroll employment fairly well. So while payroll employment in January and February was reduced by widespread miserable weather conditions, these corporate leaders appear to believe that there will not be any lingering impact. Indeed, the survey results (taken in early January) suggest that payroll employment going forward should continue to climb by about 200 thousand per month.

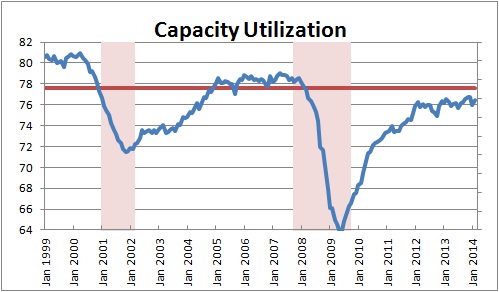

Another factor that influences the pace of investment spending is capacity utilization. If firms are rapidly boosting output at some point they will begin to run into physical constraints. They will simply be unable to boost production enough to satisfy demand. As that occurs they will need to build a new factory, buy additional equipment, or invest in technology that will enable them to use their existing facilities more efficiently. Currently, the utilization rate in the manufacturing sector is 76.4%. Its average over the past 20 years has been 77.6%. If economic activity accelerates during 2014 as we expect more and more firms will quite soon bump into capacity constraints.

Given that corporate leaders feel confident, their firms continue to make money, and factory utilization is reaching a limit, we expect nonresidential investment to accelerate during the course of the year from its current 2.6% pace to 7-10% as the year progresses. That same positive attitude implies that employment will probably climb to 225-250 thousand per month during the course of 2014. These are two of the many reasons why we anticipate GDP growth of about 3.0% this year.

Having said all of this, survey after survey of corporate executives indicates ongoing concern about the political gridlock in Washington. These leaders have said that they would invest and hire more freely if the Administration and Congress were to reform the corporate tax code. They are bothered by the fact that the long-awaited reform of immigration policy has stalled during the past year. And almost to a person they highlight the needlessly complex regulatory environment. While the current investment outlook seems favorable, it would be far more robust if Washington would address any of these issues. Unfortunately, this is an election year and progress on any of these fronts seems unlikely until 2015.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me