April 22, 2011

Over the past couple of weeks we have gotten additional tidbits of information that help to refine our first quarter GDP estimate. It now appears that our anticipated 4.0% growth rate is too high; 3.0% is probably a better estimate. This initial look at first quarter GDP growth will be released on Thursday. The question is, does this slower-than-expected growth in the early part of 2011 indicate that the economy is simply on a slower growth track than we have been projecting? Or is this sluggish growth in the first quarter merely the result of temporary factors that might have negatively impacted growth early in the year but are unlikely to retard the pace of expansion in subsequent quarters?

This is the question that economists have to deal with every single quarter. One of the biggest mistakes an economist can make is to become wedded to a particular point of view. To simply conclude that temporary factors reduced growth in quarter one, but will have no impact whatsoever on growth in subsequent quarters, is generally not the wisest course of action. If growth falls short in a particular quarter an economist cannot say with 100% certainty that forecasts for subsequent quarters will be unaffected. Unfortunately, we are wrong all the time. The question is one of degree. Are we just slightly off? Or is our projected path for the economy totally off base? Occasionally, we can point to specific factors that might have caused growth to deviate from the expected path – strikes, weather-related events like snowstorms and hurricanes, and inventory changes quickly come to mind. But, more often than not, the economic situation is not quite so clear-cut.

Keep in mind that this early read on GDP growth for any quarter is incomplete. It is based on three months of data on consumer spending, but on just two months of data for most of the other GDP components. Furthermore, some of the figures on which this so-called “advance” report is based – such as retail sales, inventories, and trade – can be subject to large revisions. These revisions typically will be about 0.5%, but have on occasions been as much as 1.0%. So, what you see initially may, or may not, be the final outcome. As always, stay tuned.

While we are still a week away from getting that early look at first quarter growth but, from where we sit, we are probably not going to revise our yearly forecast down by very much if growth in the first quarter falls short of our projection. We may rethink this once we see the data, but, for now, a big downward revision seems unlikely. Here’s why.

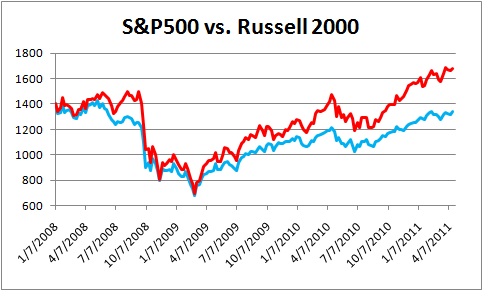

We had an enormous amount of bad news in the first quarter – snowstorms adversely affected sales in much of the country in January, gasoline prices skyrocketed as tensions in the Middle East erupted, and Japan was forced to deal with a record earthquake, the subsequent tsunami, and a nuclear accident caused by the combination of the two. Given that amount of bad news, the stock market should have taken a significant hit. But it has not. The S&P 500 index (shown in blue below) has largely shrugged off this bad news. That is a clear indication that the economy has some sound underpinnings at this stage of the cycle.

One might argue that the performance of the S&P 500 indicates that big companies are doing well, but perhaps smaller companies are lagging. Not true. The Russell 2000 index which measures the performance of 2,000 smaller companies is even more robust. The red line on the chart above has been indexed to match the level of the S&P on January 7, 2008. In fact, these smaller firms have actually outperformed their larger counterparts in the past three years by an astounding 25%. The S&P is still 5% lower than where it was going into the recession. But the Russell index is 20% higher than its starting point and is currently at a record high level.

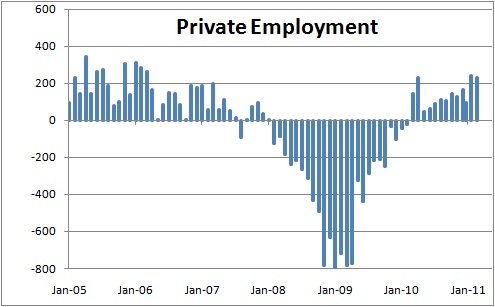

The other factor that is hugely important is jobs creation. As we have moved throughout the first quarter, the number of jobs being created has grown steadily and now appears to be consistently in a range from 200-225 thousand per month which is impressive. The creation of jobs produces income. If income grows we, as consumers, have more money in our pocket to spend. Also, the more people that are working, the more goods and services they produce, which is what GDP is all about.

One other point to note. Given the impressive performance of small companies over the past couple of years, it is possible that the Bureau of Labor Statistics is underestimating the number of new jobs being created. In its payroll survey BLS collects data asks large firms to report how many workers are on their payrolls. However, it does not have the resources to collect similar information from smaller firms. Thus, each month it must make an estimate of the number of jobs created by these smaller firms based on historical data. The household survey, from which the unemployment rate is calculated, includes such workers. From the time that the unemployment rate began to fall in December of last year through March, employment as measured by the household survey increased 965 thousand. In contrast, the payroll survey indicated that just 630 new jobs had been created. That may not sound like much, but over the course of a four-month period that works out to additional job creation of 81 thousand per month. Thus, it is possible that the current pace of job creation is closer to 300 thousand per month than 220 thousand.

As always, we will dutifully analyze the first quarter GDP statistics when they become available on Thursday but, knowing what we do at the moment, it is unlikely that there will be a substantial downward revision to our GDP growth expectation for the year. Having said that, there will probably be some downward adjustment as an acknowledgement of the (presumably) weaker-than-expected GDP growth in the first quarter.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me