May 2, 2014

The employment report for April provided convincing evidence that the early year weakness was weather-related and that the economy is rebounding vigorously. Following miniscule growth of 0.1% in the first quarter, second quarter growth should be 4.0% or higher.

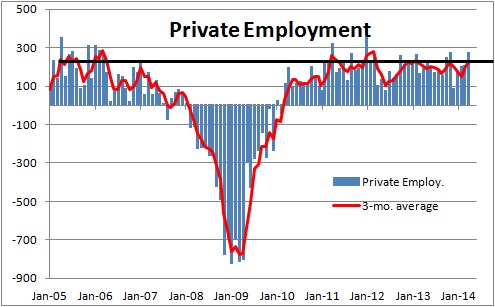

Private employment rose 273 thousand in April with upward revisions to February and March. In the past three months employment on average has risen 225 thousand. That is about as good as it gets. While individual months can surpass the 300 thousand mark a three-month moving average of employment, shown in red below, rarely exceeds 225 thousand. We are there and the economy seems to be gathering momentum.

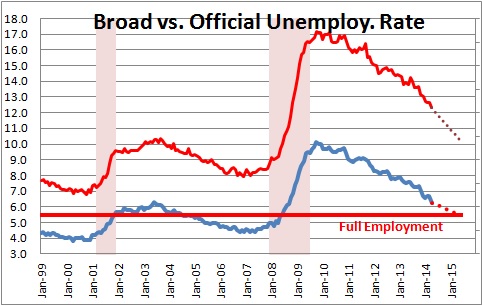

Meanwhile, the unemployment rate fell 0.4% in April to 6.3%. The rapid decline over the past year has been assisted by slower growth in the labor force as the baby boomers begin to retire. Over the past year the labor force has risen by 5 thousand per month (versus about 100 thousand normally) while employment has risen by 166 thousand per month. Any way you slice it the unemployment rate has been falling in large part because the economy is generating jobs.

However, the official unemployment rate is misleading because so many people are unemployed. Many people are holding two or three part time jobs because full time employment is unavailable. Many workers have given up actively looking for a job. The youth unemployment rate is still high. The broadest measure of unemployment which encompasses these underemployed workers fell 0.4% in April to 12.3%.

At 12.3% this measure of unemployment is far higher than the official rate of 6.3%. But it is always higher than the official rate because it encompasses people who are underemployed as well as those who are unemployed. Over the past 20 years it has averaged 80% higher than the official rate.

The Fed believes that the full employment level for the official rate is about 5.5%. At that level, presumably, everyone who wants a job has one. The Fed does not have any specific full employment threshold for the broad measure. But if the historical relationship between the two is a reasonably accurate barometer, than the full employment threshold for this broader measure of unemployment should be about 10.0%.

Given our forecast for GDP growth between now and mid-2015, it is easy to expect the official rate to be 5.5% by the middle of next year and the broad rate to be about 10.0%. Thus, we would argue that by any measure the labor market will have attained full employment by the middle of 2015.

Meanwhile, as the economy gathers momentum and the labor market approaches full employment, it is likely that the inflation rate will gradually work its way higher. In fact, by the middle of 2015 we expect the core CPI to be increasing at a 2.2% rate versus 1.6% currently. The Fed’s preferred inflation gauge is the core personal consumption expenditures deflator which tends to be about 0.5% lower than the CPI so by mid-2015 it should be about 1.7%.

The Fed has given us two criteria that they will use to decide when to raise the funds rate. First, they want to unemployment rate to decline to roughly its full-employment level. Second, they want the inflation rate to approach the targeted level of 2.0%. By June 2015 the official rate will be at the full employment level of 5.5%, and their preferred inflation rate will be 1.7% which is close to their inflation target. Not surprisingly, the Fed expects to raise the funds rate sometime around the middle of next year. Now you know why.

It is worth emphasizing that increases in the funds rate will be slow and gradual. It will take two years for the funds rate to rise from 0.0% today to the 4.0% level where it is generally regarded as “neutral”. The Fed will not hit the brakes until mid-2017 at the earliest — but it will take its foot off the accelerator. For this reason we have said repeatedly that the earliest date we need to worry about a recession is 2018. That is a long time down the road. Enjoy the ride.

Stephen Slifer

NumberNomics

Charleston, SC

Follow Me